As ad-supported streaming continues to become a mainstay, new survey data from Hub Entertainment Research finds Discovery+ and HBO Max are leading the pack for consumers in terms of viewers’ satisfaction with the number of ads shown and engagement with commercials.

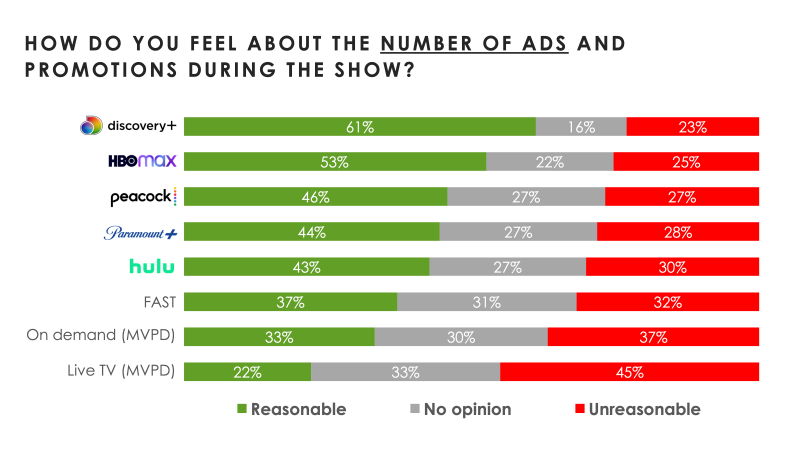

For the report Hub surveyed about 3,000 consumers who watch at least one hour of TV per week. According to the findings, Warner Bros. Discovery’s Discovery+ ranked first, with most subscribers reporting they felt the number of ads they saw during a show was “reasonable” at 61%. HBO Max, also owned by WBD, came in second with 53% who felt the number of ads was acceptable. Hub noted their results were nearly 3x higher than those who felt the number of ads on a live TV MVPD service were satisfactory (22%) They were also the only two services for which a quarter or less of subscribers felt the number of ads was “unreasonable”.

In addition to feeling less inundated by ads, subscribers of the two AVOD tiers also appear to be engaging more with commercials. For each platform, 37% of viewers said they gave ads their nearly “complete attention.” That compares to next-highest ranked Hulu, where less than a quarter (23%) of viewers said ads garnered almost full attention, followed by Paramount+ at 19% and Peacock at 12%.

FAST services and live TV from an MVPD were last on the list with 11% and 7% of viewers, respectively, saying ads from those providers services got their full attention.

Discovery+ also had the best results in terms of those who don’t engage with commercials at all, with only 15% of its subscribers saying ads got no attention – compared to next-best HBO Max at 26%. Nearly 40% of Peacock AVOD viewers said they don’t watch ads shown during a show at all.

Hub Entertainment’s survey also gave some indicators of how to better engage viewers with ads, as a more enjoyable ad experience is closely tied to ad attention. The survey found that respondents who enjoy their overall viewing experience, including ad load, break length and other factors, paid attention to most ads more often than those who were less satisfied with their overall experience.

Top factors that consumers said would make them more likely to pay attention to an ad include shorter ad breaks (43%), ads that reward viewers for watching (42%), shorter lengths for individual ads (41%) and a single commercial during an ad break (41%).

The survey also found that most TV viewers continue to report a preference for watching ads as a trade-off for paying less.

As of December 2022, 57% of survey respondents said they’d choose to watch ads if it would save them between $4-$5 per month for a streaming service. It’s a similar figure to the 58% that said they’d pick a cheaper version with ads in June 2021, with Hub noting a preference for less expensive ad-supported tiers has remained relatively stable over the past year.

“The industry seems to have finally solved the mystery of how to get consumers to accept ads in TV—and it was as simple as offering a less onerous ad experience and paired with a price break to boot.” said Peter Fondulas, principal at Hub, in a statement. “Now that Netflix and Disney+ have jumped on the ad-supported bandwagon, the question is whether and when the remaining ad-free only holdouts will join in.”

HBO Max and Discovery+ have leading positions for ad experience and attention, and the two are poised to combine into a single streaming service expected to debut in spring of 2023. While Warner Bros. Discovery hasn’t officially announced a name for the combined service, “Max” has been reported as the most likely contender.

WBD sees the unscripted library of Discovery+ and high-quality productions of HBO Max content as complementary. In preparation for the launch WBD has already started shifting some Discovery+ content to HBO Max, such as Magnolia Networks’ “Fixer Upper: The Castle,” for example.

It plans to pull the best product features of each service under one umbrella, and has been experimenting to test and address deficiencies in the existing platforms.

“These early greenshoots bolster our strategic thesis that the two content offerings work well together and when combined should drive greater engagement, lower churn and higher customer lifetime value,” WBD chief David Zaslav said during third-quarter earnings.

News also recently broke that “West World” and other shows have been pulled from HBO Max as WBD pursues its own larger cost-cutting initiatives.

However, TVREV co-founder and analyst Alan Wolk, in a recent column on Fierce Video pointed out that the shows aren’t disappearing into the abyss, but rather being repurposed and sold to air on various FAST services. It’s a move Wolk said will help WBD generate revenue on syndication while saving money on residuals.

“Which makes a whole lot of sense given that, without carriage and retrans fees, the profit margin from streaming is not going to be anywhere near the profit margin from linear,” wrote Wolk.

Shifting content to FASTs is happening as those services continue to attract viewers. Hub Entertainment’s survey found 65% of consumers say they used at least one FAST service in Q4 such as Pluto TV, Peacock’s free version, The Roku Channel, Tubi, or Freevee, among others.

The usage of FASTs has continued to climb over time, with Q4 2022 marking a 10 percentage-point gain compared to Q2 2021 when FAST usage stood at 55%.

And more original content could help drive further growth, per Hub, as 47% of current FAST users said they’d be more likely to use a service if they heard it was creating original exclusive content, while 30% of non-FAST users said the same.

According to Hub, original content created for FASTs that had the most recall among survey respondents included The Roku Channel’s “Weird: The Al Yankovic Story” and Freevee’s “Leverage: Redemption.”