The free ad-supported streaming TV (FAST) space is quickly growing and a new report from analysts at research firm TVREV projects that by 2025 ad spend on FASTs will surpass that of cable, broadcast or SVOD services.

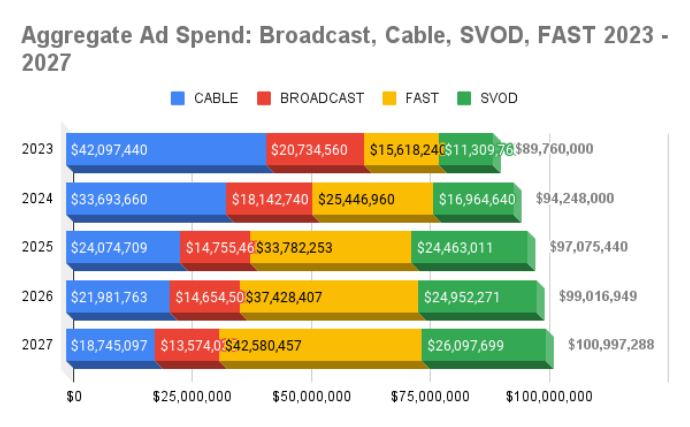

TVREV’s "FASTs Are the New Cable Part 2: Advertising" report, authored by analyst Alan Wolk and Mike Shields, expects ad spend on streaming overall to surpass that of linear (i.e. cable and broadcast) in 2025, and account for a whopping 68% of ad spend by 2027, or $69 billion of $101 billion.

And FASTs appear poised to capture a sizable share, based on current growth rates. Specifically, the research firm anticipates $33.7 billion, or 35% of total ad spend, will go towards FASTs in 2025. That marks a significant shift from 2023 when FAST represent 17% of ad spend.

By 2027 that figure will grow further to $42.6 billion, or 42% of total TV ad spend, reflecting a 25% point increase for FAST’s share over the five-year span. Comparatively, by 2027 TVREV forecasts SVOD will increase its current 13% share to account for a 26% of ad spend (or $26.1 billion), while cable’s current command of nearly 50% will decline to 19% (or $18.7 billion), and broadcast’s 23% share will drop to 13% (or $13.6 billion) at the end of the forecast period.

One caveat the authors pointed out is the unknown around sports rights, which if shifted to SVOD services, would see that medium capture a much larger portion of the streaming ad spend pool.

While more streaming platforms are moving into the ad-supported space (including Disney+ and Netflix), FASTs are completely free services that can offer either or both live linear channels and ad-supported on-demand content. Players in the FAST space include media-owned FASTs such as Fox’s Tubi, Paramount’s Pluto TV, NBCUniversal’s Peacock (free version), and Comcast and Charter’s Xumo, as well as TV interface providers including Samsung TV Plus, Vizio WatchFree+, LG Channels, and aggregators such as The Roku Channel, and Amazon’s Freevee, as well as independent publisher like Crackle Plus.

TVREV’s in-depth report on advertising in the FAST space anticipates brands and advertisers will see FASTs as a replacement to cable and SVODs as a replacement to broadcast “and so the FAST/SVOD split will continue along the same lines… more or less.”

Report authors Wolk and Shields also expect FASTs to capture a significant share of local broadcast dollars, noting local advertisers will want to take advantage of lower CPMs and precise targeting that goes beyond geotargeting.

“FAST services today are where cable was 40 years ago,” said Wolk in a statement. “There’s not only more inventory available on the FASTs than on subscription services, but they’re also a great reach vehicle. The most-desirable and hardest-to-reach consumers are spending most of their time on streaming, and the FASTs will be how brands can best reach them.”

However, while FASTs are poised to grab a higher proportion of ad spending, the report also lays out many challenges that remain in the still evolving ecosystem.

“CTV is growing rapidly, and brands are excited about the possibilities, but it’s still messy in several ways,” said Shields in a statement. “There are a number of unresolved issues, ranging from measurement, to a lack of transparency, along with a fear of recession. So we won’t see a whole lot of huge spending shifts until a few basic fundamentals are established.”

Overall lack of standardization key challenge

Standardization, or lack thereof, is a key hindrance to advertising dollars shifting to FAST, with TVREV saying it “impacts just about every aspect of the streaming ecosystem” across planning, measurement, transparency and privacy.

“It’s important to note that every single person we spoke to for this report cited the overall lack of standardization as the biggest issue they see facing FAST advertising right now,” wrote Wolk and Shields.

A fragmented ecosystem plays into that as buying advertising across various FAST services and their respective layers, with the report noting a certain series might be available on multiple FAST platforms but won’t appear as the same linear channel across them.

“In fact, there is no 'same linear channel' across all of them,” the authors noted, pointing out that FAST services each have their own flavor of linear channels.

“This is great for viewers but no so great for ad buyers. Because while a linear buyer can decide to buy NBCU’s USA Network and USA across every major cable, telco and satellite provider, there is nothing remotely similar to the FASTs,” TVREV explained, adding it makes unified buying across different FASTs significantly more difficult.

The report also digs into the lack of transparency about where ads run, against what shows, and when – something advertisers have been used to on linear but struggle to find on FASTs. The lack of transparency is something Omnicom Media Group executive Kelly Metz highlighted last year during a panel session at Advertising Week, saying the agency needs the same levels it’s used to for linear and isn’t getting it.

“The beauty of traditional linear television was we knew where we were running, it was on a schedule, we could see the programs, we understood exactly what we were buying on behalf of our advertisers,” Metz said in October. “And therefore, it was a very trusted, brand-safe environment.”

According to TVREV, programmatic buying also creates a challenge for advertisers to know where ads run.

“Given the importance of context, this is a huge sticking point between agencies and certain FAST services, especially given how completely transparent linear TV has always been,” the authors concluded.

And per the report, part of the lack of transparency has to do with tech issues, including a lack of universal ID that travels with content, alongside legal concerns tied to regulation of data collection and privacy.

Another issue driving a lack of transparency, according to TVREV, is that metadata isn’t uniform around programming on CTV as each programmer keeps their own taxonomy. Without readily available metadata, it’s difficult to know where ads have run or be able to use the metadata for targeting and reporting on a global basis, the report notes.

TVREV pointed to one potential solution to that issue, in IRIS.TV’s IRIS_ID, which is a universal content ID attached to every video input into the company’s video data platform.

“Given the massive level of fragmentation in the CTV space, having a standardized content ID like the IRIS_ID will allow brands to more easily buy FAST and other streaming inventory at scale, to utilize larger contextual data sets, to easily align their commercials with more relevant content, and then to verify and measure those ad buys,” the analysts wrote, while noting growing acceptance of universal content IDs is helping to boost the level of transparency in streaming.

One finding detailed further in the report is that contextual advertising can help address a bevy of the current issues facing streaming TV advertising.

Ultimately, Wolk and Shields see FASTs evolving to become a vehicle for advertisers to reach audiences they otherwise wouldn’t and “to target viewers on programming they can’t find anywhere else.”