The promise of buying a product straight from your television, or any other video screen, has been around since before the modern internet. Bill Gates addressed this possibility in his best-selling book The Road Ahead in 1995. That you could “buy Jennifer Aniston’s sweater” from your television became the exemplar of hype when proposed in 2000 and its potential remains unrealized.

With the Super Bowl, the State of the Union, and Balloon-gate dominating the press for the last two weeks, two shoppable video ad initiatives were buried in the recent news cycle.

Roku & DoorDash

Roku and DoorDash announced a multi-year program where merchants can integrate click-to-order offers within ads on the Roku platform. Viewers engaging these ads receive a promotional text offer that links to DoorDash app, where they can redeem the offer. For example, Wendy’s is showing shoppable ads on Roku that offer DoorDash users $5 discounts on orders of $15 or more. As well, first-time buyers receive six months of free deliveries from DashPash, a $60 value.

This very aggressive offer shows how serious the two companies are about shoppable video ads. And it’s a win for all parties involved. Roku sells ads against the videos it features, DoorDash profits by collecting fees on sales, and merchants enjoy increased sales.

Roku announced a similar partnership with Walmart in 2022, with Walmart providing fulfillment and Roku grabbing the eyeballs of the retailer’s 70+ million accounts. Walmart claimed the effort would “crack the code” of shoppability by “shortening the distance from discovery and inspiration to purchase.” Lofty rhetoric for a retailer, but reasonably accurate.

NBCUniversal’s Peacock & Walmart

Two days after the Roku-DoorDash announcement, NBCU announced shoppable ads will be added to Peacock in 2023. The effort extends the network’s “Must Shop TV” and its “Checkout” platforms by directly integrating with the video service.

This is not NBCU’s first foray into shoppable TV ads. The company has tried to capitalize on the popularity of Bravo’s Real Housewives and like-minded reality shows by introducing a branded shopping area for show enthusiasts. This “virtual bazaar” fits in well with its larger strategy of “One-Platform Commerce” announced in 2020.

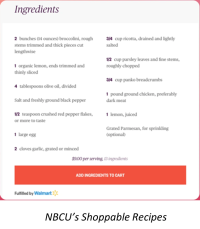

In January 2023, NBCU and Walmart added “shoppable recipes” to the network’s Today show, allowing viewers to scan an on-screen QR code to receive a text link that opens the recipe and enables an online shopping cart. Next month, the functionality will be offered on Today All Day on Peacock.

That Walmart is the retail partner for both Roku and NBCU is telling. Amazon’s Prime Video competes with Peacock in SVOD and its Fire TV hardware competes with Roku, making Walmart an attractive choice for nationwide fulfillment.

Other Action

Not one to sit on the sidelines, in December Amazon launched a Prime app branded “Inspire,” where users select their interests (e.g., camping, gardening) and receive a feed of photos and videos that match them. The products featured within are tagged for easy online shopping and purchasing. It has a social element, as well, allowing users to share reviews and text other app users. The feature is currently available on a limited basis, with nationwide deployment ongoing during 2023. Additionally, it’s available only via the Amazon shopping app, not through a browser.

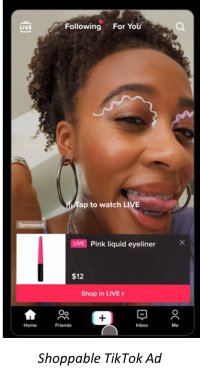

Both Amazon and Walmart take the threat of TikTok and its increased efforts to capitalize e-commerce seriously, and both have multiple bets in this area. As for TikTok, it dipped its toes in the US e-commerce market in November 2022, testing shoppable video ads on users’ “For You” page. Owner ByteDance’s Chinese version of TikTok, Doyin, is currently testing food deliveries through its app. If it succeeds, it’s reasonable to assume it will eventually end up on TikTok.

As with its peers, TikTok was impacted by the decrease in the value of digital ad dollars, and strongly believes that directly engaging its viewers in commerce is the next stage of company growth. Add to this its successful 2021 effort to get “TikTok TV” app onto more smart TVs, and you have a formula for success. (Partners include Samsung, Vizio, and LG—three of the top five smart TV brands.) It remains to be seen what effect federal efforts to ban TikTok will have, but the company is making big plans for shoppable TV ads regardless.

In 2020, Meta increased its foray into shopping for both Facebook and Instagram. That the bulk of Meta’s revenue comes from ads for products purchased somewhere else (thereby missing out on the “Apple” tax) was undoubtedly a driver for Zuckerberg. However, by October 2022, Meta began to scale back its shoppable features, even removing Instagram’s Shop Tab, making it harder for users to purchase products. Thus, it’s future in shoppable video ads is unknown.

Final Thoughts

Actualizing the potential of shoppable video advertising rests largely with Gen Z. Growing up as digital natives, they see little difference between traditional television, social media, streaming video, etc. These are just different ways of using a screen, each with its own purpose. This demographic is accustomed to “click and subscribe” products and services and will carry these habits forward as they age. Retailers, platforms, networks, and the makers of “stuff” will all need to keep a keen eye on this group and adjust their strategies accordingly.

Twenty years ago, very few prominent companies were involved in shoppable video ads and the infrastructure was insufficient to support online shopping, purchasing, and fulfillment. That is no longer the case. This time, if shoppable video ads fail to resonate with consumers, it won’t be because of corporate inertia, but because consumers are not interested in the model.

Doug Montgomery is a senior analyst covering content strategies and monetization at Aluma Insights. A 20+ year veteran of the entertainment and retail business, his years at Warner Bros. were spent analyzing the shift from VHS to DVD and finally to streaming. Montgomery’s team of global analysts helped the company’s key partners manage these changes and provide the best experiences for all stakeholders.

Doug is former Chairman of the Japan America Society of Southern California, a 115-year-old Non-Profit operating in California. During his time as Chairman, he founded and produced the successful Global Stage Hollywood film festival. Doug earned an MBA from The University of Southern California (Dean’s list) and a Bachelor of Commerce from The University of Alberta. In March, Doug will be doing a series of short webinars discussing the competitive environment and sharing new featuring original consumer research on the topic. More shortly.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce Video staff. They do not represent the opinions of Fierce Video.