Sunday night’s Super Bowl game featured a stacked lineup of advertisers, including several for streaming and media companies. According to EDO, the entertainment category came out strong, occupying three of the top five spots in the measurement firm’s eighth annual Super Bowl ad ranking.

EDO scored over 100 national Super Bowl LVII ads, measuring incremental online engagement for a brand or product immediately following the airing. Each ad was indexed to the median performing in-game Super Bowl spot, which has an engagement index of 100. Co-branded airings were scored twice to capture the ad’s impact on each advertising brand.

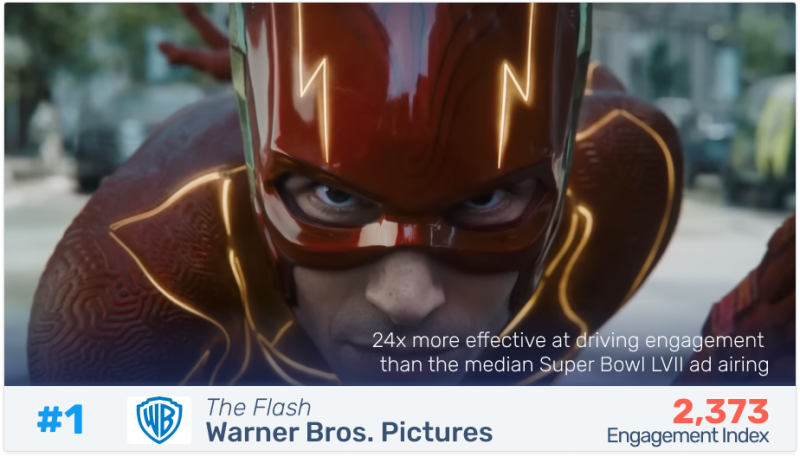

Warner Bros. Pictures landed the number one spot by showcasing a teaser for its upcoming “The Flash” feature film. The 45-second clip scored an engagement index of 2373, meaning it outperformed the median Super Bowl ad by 24x. It also marked the first time in 17 years that a Warner Bros. movie has been featured at a Super Bowl, EDO noted.

Disney came in third with a score of 1248, airing a 90-second ad featuring scenes from movies like “Cinderella,” “Peter Pan” and “Coco.” Recently, Disney tapped EDO to measure the impact of ad campaigns across Disney’s streaming footprint, starting with Hulu.

Fifth place went to Live Nation (engagement index = 743), which used a 15-second slot to promote upcoming shows for the band U2. Other top-performing ads included an advertisement for Blue Moon beer (677), Fox’s promotion of the United States Football League (624) and an ad for Peacock original “Poker Face” (496).

EDO’s complete ranking of Super Bowl ads can be found here.

In a statement, EDO President and CEO Kevin Krim touted the Super Bowl continues to drive engagement for advertisers, outpacing engagement levels of other live events and sports programs on linear.

“Since 2019, the Super Bowl has been 307% more likely to engage viewers than the average primetime broadcast program,” he said. “The second highest performing program of the past three years, the NBA All-Star Game, has been only 126% more effective than primetime broadcast in generating consumer engagement.”

Fox, which held this year’s broadcasting rights for the Super Bowl, stated last week ad slots for the game have sold out and it’s expecting a gross advertising revenue of around $600 million.

Despite the hype surrounding Super Bowl ads, EDO noted at least 20 fewer brands preannounced national Super Bowl ad campaigns this season. Economic uncertainty was flagged as the likely reason for the reduced showing of new advertisers, with EDO pointing out “perhaps only big, stable brands with big budgets could play ball as a launch pad or boost for new campaigns.”

Though the Super Bowl is helping boost linear TV, overall viewership is still veering towards streaming. This year, around one-third of consumers said they plan to watch the Super Bowl through a streaming service, per a survey from Adtaxi.

But a large-scale event like the Super Bowl can often cause streams to lag. Phenix, which specializes in video delivery, compared latency across six streaming platforms that covered the game. FuboTV had the highest measured lag with a 76+ second stream delay, with Hulu, NFL+ and YouTube TV also recording significant lag time.