According to TVision’s newest CTV Advertising report, viewer time spent on ad-supported CTV increased 55% from 2020 to the end of 2022. With viewers increasingly open to ad-supported connected TV viewing, and apps like Netflix and Disney+ emphasizing ad-supported tiers, we can expect that CTV advertising will continue to take more and more of marketers’ budgets.

But as investments grow, CTV advertising’s inherent challenges become more pressing for media buyers and sellers. Just how valuable is a CTV impression? The industry requires more information and greater transparency to accurately answer this question. For example, advertisers need clarity on where exactly their ads are running, how engaged the audience is, and how the various placements compare within the CTV ecosystem. An even more basic, yet very important question is, how many people does a single impression truly reach? That’s the question we’ll dive into now.

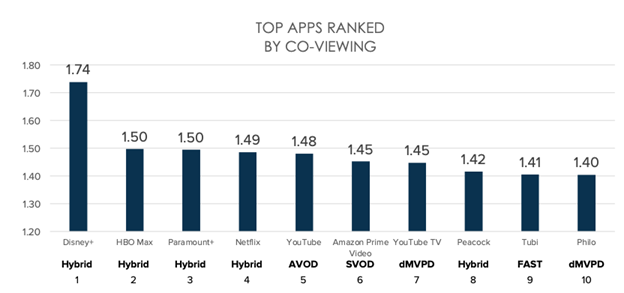

Unlike digital media, which is often a solitary viewing experience, CTV content is largely consumed on the big screen - in that way it mirrors a linear TV viewing experience. But the industry is still mis-counting impressions when it applies the commonly accepted co-viewing factor of 1.2 across all CTV impressions. In fact, CTV averages 1.44 viewers per viewing household (VPVH). That said, general averages may not be sufficient for calculating accurate co-viewing rates. When we look more closely at the drivers of co-viewing behavior, we see that co-viewing varies dramatically across apps, content, household composition, and time of day.

For instance, apps with a lot of family-friendly inventory tend to deliver higher co-viewing rates. Disney+ in particular has a positive story to tell advertisers - on average their impressions will reach 1.74 VPVH, meaning viewers almost never watch Disney+ alone. It should be noted that viewers are racing to Disney+ ad-supported tier faster than others. Disney+ recently announced more than 36% of their new subscriptions in February 2023 were for the ad-supported tier. Antennae reports that as of February already 3% of all Disney+ subscriptions were ad supported, outpacing Netflix.

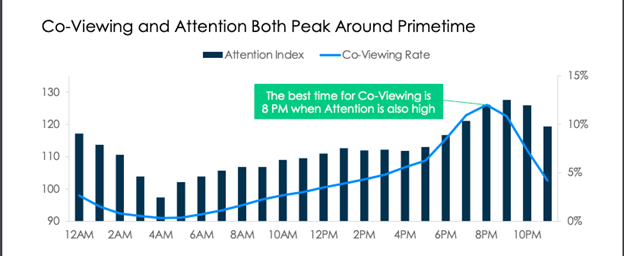

Co-viewing, like attention, also varies throughout the day. For example, viewers are more likely to watch TV together during Primetime than early morning. CTV advertisers - especially those buying programmatically - often do not have insight into where their ads run, but they should be able to more easily control when they run. This is important, because our data shows that Primetime and evening hours are likely to deliver better value for marketers. During these dayparts, not only does the number of people in the room increase, but attention does as well.

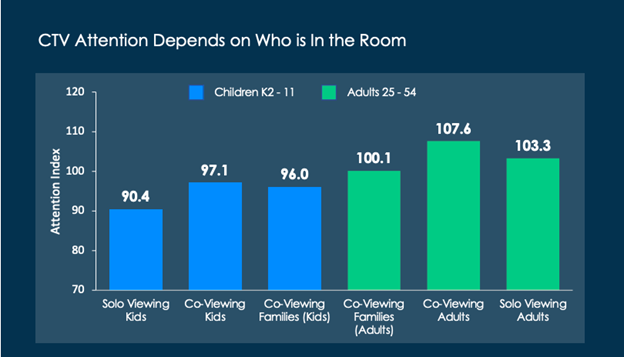

In fact, co-viewing is a main driver of viewer engagement. As you can see in this chart, when adult viewers watch TV with another adult, they are more likely to be engaged and attentive. This is an additional multiplier on the value of a high-co-viewed placement.

Advertisers can maximize budgets with co-viewing data

Better CTV audience measurement can also uncover hidden efficiencies for advertisers. If advertisers factor accurate co-viewing rates into their advertising campaigns they are able to purchase fewer impressions to achieve their goals. For example, TVision’s data shows that if an advertiser’s goal was to achieve 10 million impressions on a major FAST app, they would actually only need to purchase 6.6 million impressions. That’s because this FAST App has one of the highest co-viewing rates we see. When advertisers factor co-viewing into their planning, they can re-allocate budget to achieve even more reach.

Transparent and holistic CTV measurement across all apps helps both media buyers and sellers more accurately evaluate the impact of their CTV impressions.

Yan is the CEO and Co-founder of TVision, the only company which measures how people really watch TV and CTV via a passive in home panel. TVision helps brands, their agencies, TV networks, and OTT platforms better understand how people really watch CTV so they can make more effective media decisions.

Yan founded TVision while earning his MBA at MIT. Prior to TVision, Yan started and managed Yo-ren, a leading digital marketing agency in China, and also worked at McKinsey in Tokyo. He has an MBA from the Massachusetts Institute of Technology (MIT), and a Bachelor of Industrial Engineering from the Tokyo Institute of Technology. He is an in-demand speaker, having appeared on stage at numerous industry events including Advertising Week, TV of Tomorrow, TV Week, as well as IAB, ANA and ARF events. Yan grew up in both Japan and China and currently resides with his family in New York.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce Video staff. They do not represent the opinions of Fierce Video.