If it feels like you are spending more of your TV time on ad-supported CTV, you are not alone.

In fact, data from our single-source, in-home panel shows that viewers’ time spent with ad-supported CTV increased by 55% in the second half of 2022. While advertisers are shifting more budgets to CTV, those budgets are not yet in line with viewer time spent. According to eMarketer advertisers will spend only 6.3% of their total ad budgets on CTV this year, compared to 20% on TV overall.

So, given the strong continued growth in CTV viewership and media opportunities, why are CTV advertising budgets lagging?

While CTV advertising brings forward the best of digital media in terms of nuanced audience targeting and programmatic delivery, the available metrics for measuring CTV can sometimes feel more archaic than legacy TV standards. A big part of the problem is the lack of transparency inherent in CTV walled gardens. Walled gardens’ black box approach to measurement makes it extremely challenging for marketers to get a holistic view of CTV performance.

For instance, one of the most important goals for CTV advertisers is incremental reach. CTV is the most effective way to reach non-linear TV viewing audiences. But while marketers may know this to be true, the challenge is that lack of transparency makes it nearly impossible to independently identify and measure an apps incremental reach.

The first hurdle is siloed reporting. CTV walled gardens have little incentive to enable apples-to-apples comparisons with other platforms. While some of the walled gardens provide insight into incremental reach, they are basically grading their own homework - they lack the neutrality afforded by third party measurement. Without trusted, common reporting, how do advertisers know which apps to invest in and where to find the most unique viewers?

With our single-source panel, TVision is able to provide standardized metrics across all apps--including walled gardens. We can see viewer behavior across the entire TV landscape and determine each app’s incremental reach, as well as accurate audience demographics. Let’s take a look at a few concrete examples where person-level data can better inform CTV media decisions.

Tops apps for incremental reach

Since Netflix first arrived on-line and began capturing share, advertisers have worried about how much of the TV viewing audience was inaccessible as viewers migrated to SVODs. Now as Netflix and Disney+ begin to embrace ad-supported subscription tiers, advertisers are eager to connect with viewers who they feared were out of reach.

The good and the bad news for advertisers is that CTV is a very fractured landscape, with people accessing content through multiple apps. In fact, our data shows that on average households watch an average of 7.3 apps per month. Brands likely have been able to reach most of Netflix and Disney+ audiences through other apps, but careful media planning could help to unlock new audiences.

By comparing the overlapping reach of Netflix and Disney+’s with other top AVOD apps, you can get a sense of the opportunity. For instance, only 41% of Netflix’s audience overlaps with Roku, and only 48% of Disney+ viewers overlap with Peacock. Advertisers on these apps can more effectively extend their reach by adding Netflix or Disney+ to their plans.

Which apps overlap with YouTube?

YouTube is the behemoth in the room when it comes to ad-supported CTV apps. According to our State of CTV report, YouTube accounts for more Share of Time Spent Viewing (16%) than any other app. Advertisers are already investing heavily in this audience. But, as one of the quintessential CTV walled gardens, it is difficult for marketers to determine if their YouTube audience overlaps with other viewers in their CTV campaigns.

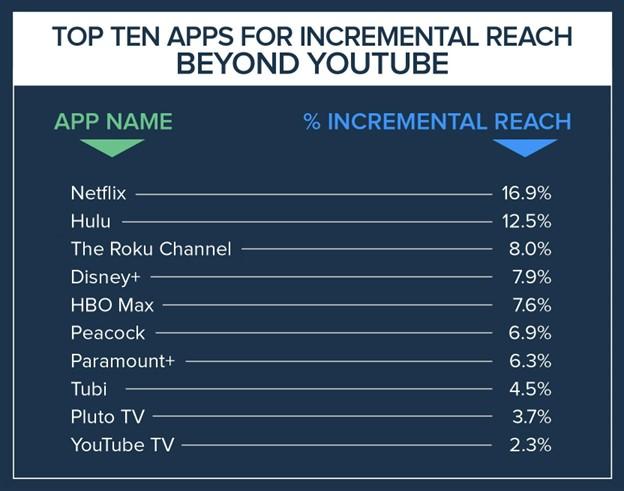

In this chart, we show the top ten ad-supported apps where marketers can expect to receive incremental reach beyond YouTube. Interestingly, free-ad supported apps like The Roku Channel, Tubi, and Pluto TV made a strong showing alongside apps with much larger reach that offer both premium subscription and ad-supported tiers.

Improving CTV advertising requires more transparent measurement

It’s easy to understand why advertisers have trepidation in allocating budget more evenly to CTV. The industry needs to standardize on person-level measurement metrics so that advertisers can achieve digital-level quality in terms of who they are reaching with their ads.

At TVision we’re committed to bringing more transparency to the CTV landscape. Over the next several months I will reveal more CTV insights and present solutions for addressing the CTV measurement challenge.

Yan is the CEO and Co-founder of TVision, the only company which measures how people really watch TV and CTV via a passive in home panel. TVision helps brands, their agencies, TV networks, and OTT platforms better understand how people really watch CTV so they can make more effective media decisions.

Yan founded TVision while earning his MBA at MIT. Prior to TVision, Yan started and managed Yo-ren, a leading digital marketing agency in China, and also worked at McKinsey in Tokyo. He has an MBA from the Massachusetts Institute of Technology (MIT), and a Bachelor of Industrial Engineering from the Tokyo Institute of Technology. He is an in-demand speaker, having appeared on stage at numerous industry events including Advertising Week, TV of Tomorrow, TV Week, as well as IAB, ANA and ARF events. Yan grew up in both Japan and China and currently resides with his family in New York.