Cable One CFO Kevin Coyle said his operator’s 47% margin in the fourth quarter is the highest in the cable industry.

Speaking alongside Cable One CEO Julie Laulis at the Raymond James Institutional Investors Conference, Coyle continued to hammer home the Phoenix-based midsized cable operator’s top talking point the last half decade—that chickening out on the video business in favor of residential broadband and business services is a winning strategy.

More and more, the results are backing up the strategy. Margins were just 35% in 2012 when Cable One started marginalizing its video business.

“Residential high-speed data and business services have four to five times the margin of video,” Coyle said.

RELATED: Cable One ditches promos amid new churn-busting marketing strategy

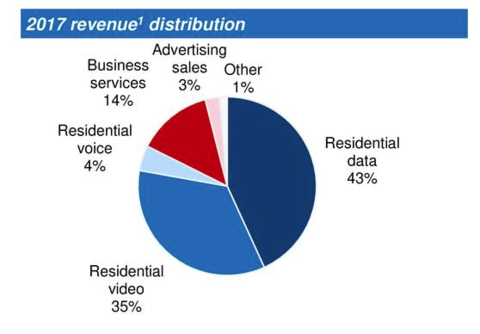

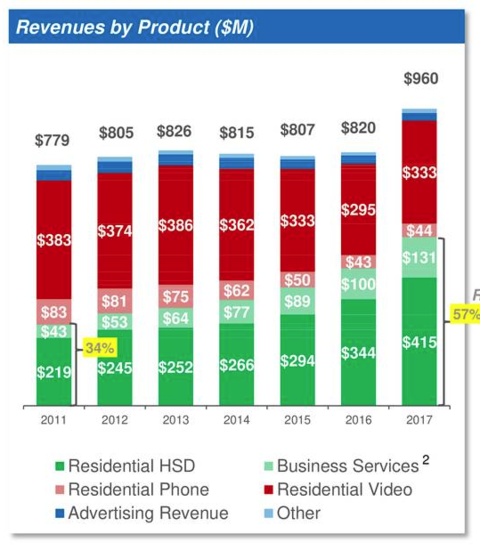

According to a Coyle and Laulis’ Raymond James presentation, residential broadband and business services combined to generate 57% of Cable One’s $960 million in revenue in 2017, while accounted for 34.6%. (Seeking Alpha has Cable One’s entire Raymond James deck here.)

Back in 2011, video accounted for 49.1% of Cable One’s $779 million in total revenue, while residential broadband and business services combined for just 34%.

Video revenue for Cable One declined from $383 million in 2011 to $333 million last year, with the operator making minimal investment in programming and user experience upgrades.

Notably, Coyle and Laulis also presented a chart showing Cable One’s concentration in rural markets, where wireline broadband competition is light. Seventy-seven percent of the operator’s customers are in Arizona, Idaho, Illinois, Missouri, Montana and Oklahoma.

As Cable One has become the poster child for a now popular cable industry strategy of marginalizing pay TV for the sake of overall margins, media/telecom investment analysts—most notably MoffettNathanson’s Craig Moffett—are watching carefully.

For his part, Moffett sees holes in the strategy.

In short, Moffett says, Cable One’s paltry 1.5% growth rate of its residential broadband customer base in 2017, despite having limited competition for wireline internet services, shows that as operators keep increasing speeds and prices, subscriber growth will suffer more than anticipated.

Cable One faces “the most limited broadband competition of any publicly traded operator, and they have the lowest starting penetration,” Moffett said in a note to investors last week, shortly after the company’s Q4 earnings call. “Should they not be growing broadband the fastest of anyone? If price elasticity is greater than anyone thinks, how long is the runway, not just for Cable One, but for any operator choosing a strategy of price increases rather than unit growth?”