Cord cutting actually improved a little. No operator showed signs of significantly diminished broadband growth. 5G is still largely in the test phase for anyone. And most companies, save for Charter, hit their numbers.

But somehow, the “cable flu,” as one analyst calls the cable industry’s steep downward trajectory of fortune on Wall Street, got even worse after these latest rounds of quarterly earnings reports.

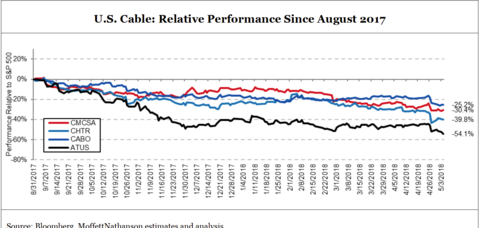

“In a span of a few short months, cable has fallen badly out of favor,” MoffettNathan analyst Craig Moffett wrote in a note to investors this week. “We don’t need to rehash the litany of horribles about video, broadband and M&A here. Suffice it to say that there is no cable company out there that hasn’t been painted with a black brush. Since the end of last August, Comcast announced Sky and is down 30.4%. Charter missed numbers and is down 39.8%. Altice USA mostly hit its numbers … and yet has fallen furthest of call, down a remarkable 44%.”

Over the past few days, there’s been at least some relief.

RELATED: From Comcast to Altice: Tracking Q1 2018 earnings in the pay TV industry

One company bucked the trend a little. With revenue surging 28.1% in the first quarter, Cable One saw its stock price shoot up over 8% in the 24 hours after its earnings report Wednesday morning. Prior to that, Cable One’s share price had cratered nearly 15% since mid-March, with the Phoenix, Arizona-based midsized operator catching the bug right along with everyone else.

Altice USA, which also reported Wednesday, hit all its marks and saw its share price rebound by nearly 10% as of mid-day trading Thursday.

But the broader outlook still isn’t great. For cable, the first-quarter earnings season will best be remembered by a report from Charter that was deemed “solid, if not perfect,” by New Street Research analyst Jonathan Chaplin.

But the imperfect seemed to be all investors saw, with Charter shares falling 12% in the aftermath of its April 27 earnings call.

The reactionary response was to blame cord cutting. Charter exceeding pay TV subscriber losses quite a bit, losing 122,000 customers in the quarter (vs. 89,000 in the first quarter of 2017).

But cord cutting doesn’t explain the larger investor sentiment. It didn’t actually accelerate for the broader pay TV sector in the first quarter. In cable, some companies like Altice USA actually lost less customers than they did in the first quarter last year. And the rate of decline for linear pay TV services was 3.4%, flat with the fourth quarter.

So if it isn’t the cord cutting, it has to be concerns over saturation of the wireline broadband marketplace.

Again, the numbers aren’t great, but they certainly don’t suggest an industry in free-fall.

Comcast reported the addition of 379,000 high-speed internet users in the first quarter, off not that much from the 430,000 it added in the first three months of 2017.

Charter added 362,000 HSI customers, off from 458,000 in the first quarter of 2017. Most cable companies like Mediacom (not publicly traded, but reports earnings anyway under creditor conditions) reported being largely flat with their year-ago broadband growth numbers.

And there might be more price elasticity in the residential internet market than analysts suspect. Cable One, for example, grew HSI revenue 10.7% year over year (performance from the New Wave acquisition factored out) despite increasing broadband customers only by 1% year over year. Cable One price increases in the first quarter included a $2.50 modem rental fee increase.

Do investors fear 5G wireless offerings are going to be eventually submitted for cable broadband en masse in American homes? One investment analyst asked Comcast Cable CEO Dave Watson that question during Comcast’s first-quarter call, and the cable exec had a pretty good answer.

“We are testing our own results in terms of what this can do,” Watson said. “And we still feel that I think it could be a good opportunity for a mobile network provider to enhance their mobile applications and mobile service … We are going to test opportunities with 5G. But we are not going to stand still. We are going to continue to enhance our network capabilities.”

RELATED: Pay TV operators get hammered by OTT-wary investors, but cord cutting didn’t accelerate in Q1

For his part, Moffett sees the problem as pay TV operators not doing what companies in their (advanced) life stage should be doing—returning cash to investors.

“As the growth of the cable (and satellite) business slows, and as capital intensity falls (and margins rise), this will be, or at least should be, a period of rapid free cash flow (FCF) release for pay TV distributors,” the analyst said in an April 30 note to investors.”

Those reasons, Moffett added, vary: Comcast is plunging its cash into media acquisition, for example, while Dish is fixating its resources on wireless.

Moffett said investors should focus on companies that at least have the intention of sticking to the FCF-return program. And, ironically, he believes it’s the company that was hit hardest by the cable flu is the one that most fits that bill.

“To us, the best of these is still Charter,” Moffett wrote. “Yes, what was once a simple free cash flow story has suddenly become rather complicated. Billing system problems resulting in unexpectedly high bad debt levels (and churn), and rising commitments to a wireless launch and high capital spending on finishing their digital set-top box conversion (all coupled with atrocious expectations management) have all combined to blow up near-term free cash flow and share repurchase forecasts, and, well, let’s face it… a cash return story that isn’t returning cash is… well, it’s a problem.

“But Charter hasn’t changed its strategy of returning cash,” Moffett added.