Back in 2009, I was working as an editor for a Hollywood blog operator, who breathlessly charged into the sweltering, smelly Santa Monica hovel she called a newsroom one day to tell us her big scoop: a cable company was about to buy NBCUniversal from General Electric.

I don’t remember that necessarily sounding like a symphony to anyone’s ears. But then again, who could do worse than GE?

NBCU’s motion picture division, Universal Pictures, was dead last among the major studios, hoisting embarrassing box office bombs like “Land of the Lost” and “Funny People,” while controlling less than half of the domestic market share of the No. 1 finisher in 2009, Warner Bros.

The NBC television network, meanwhile, was also in last place among the major broadcasters, with only one scripted show—aging comedy “The Office”—ranking in the top 20 series.

And Universal Studios? You may have passed it on the 101 Freeway on the way out of town to get to Disneyland.

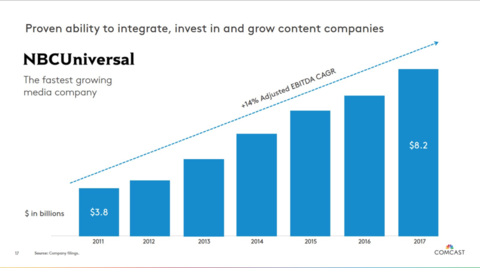

Under Comcast and the corporate synergy strategy it calls “Symphony,” all of these NBCU assets have experienced remarkable turnaround. In 2011, the division generated just $3.8 billion in revenue. By 2017, it had spun off a remarkable $8.2 billion.

RELATED: Comcast makes formal $65B bid for Fox, confidently includes massive breakup fee

Speaking during Comcast’s investor call yesterday, announcing the company’s $65 billion all-cash bid for 21st Century Fox, the man who heads Comcast’s highly successful—so far!—charge into the media business, NBCU CEO Steve Burke, conceded that the prospective Fox assets aren’t in the same “turnaround” shape that NBCU’s were in when Comcast closed on them back in 2011.

“To me Fox is different in its more about complementarity,” Burke said. “It’s about the fact that we’re very strong in distribution and content in the United States and not as strong in places like India or Europe. A lot of it is making the most of that complementarity and looking for opportunities.”

Indeed, the mission objective is much different from the NBCU integration, which involved reinvigorating a lot of foundering U.S. media assets.

Burke will now try to take Fox local language assets that are already performing nicely in regions like Europe, Latin America and India and try to make them play in harmony in a future in which “the best media companies create their own content and distribute it at scale broadly.”

Like AT&T and its newly blessed acquisition of Time Warner Inc., Comcast sees scale and global expansion as the only way to keep pace with Silicon Valley giants Netflix and Amazon, which are now also the biggest media companies.

Notably, Burke said that if Comcast can convince regulators to let it do the Fox deal, the percentage of revenue it gets from overseas will jump from 9% to 27%.

For their part, investors—who had hoped the cable conglomerate would put its recent prosperity towards a nice stock buyback—have been dragged kicking and screaming into Comcast’s latest M&A binge. The company’s shares are now trading around 25% less than they were in February, when Comcast announced it was buying a majority share of Sky.

But Comcast’s share price is up 4% today, suggesting Burke’s presentation yesterday—which essentially hammered home the message that Comcast can do for Fox what it did for NBCU—played a nice tune for some investors.