We’ve said it before, and we’re saying it again—the virtual MVPD business is tough. Going into 2018, we predicted there would be attrition among a flurry of OTT services that deliver largely the same combination of major broadcast and cable channels packaged with a cloud DVR.

No major service has dropped out yet. But just last month, CenturyLink scuttled its beta test of a nationally distributed over-the-top pay TV service. Who could blame the telecom for walking into this brutal class, seeing the grading curve, and deciding just to drop it and major in something else like broadband services. (You can see here we’re going to hammer this school metaphor pretty hard, yes?)

RELATED: Hulu a consensus pick to survive vMVPD’s ultracompetitive race: FOV poll

With Sling TV, DirecTV Now, Hulu Live, YouTube TV, Sony PlayStation Vue and the rest of the vMVPD sector collectively touting around 4.6 million customers, according to research firm MoffettNathanson, it’s an important sector (albeit not exactly a profitable one right now).

And with a round of fresh insight gleaned from the recently completed fourth-quarter earnings reports, Fierce is checking in on the major vMVPD services to see which is making the grade.

Sling TV

Subscribers: Parent Dish Network said during its fourth-quarter earnings report that its three-year-old OTT platform was up to 2.2 million users. Sling added around 711,000 customers in 2017, according to one estimate.

The bundle: Base package still goes for an industry low $20 a month. But holy Danny Trejo, Sling TV’s slogan promise of “a la carte TV” gets complicated once you start picking between the single-stream “orange” and multi-simultaneous-stream “blue” platforms, not to mention all the various add-on modules. If you sacrifice Sling’s core economic advantage, you can spend a little over $40 a month for both platforms, and get most of the basics covered, save for CBS. (Even though Dish renewed its programming deal with CBS Corp. in December, Sling TV still doesn’t have access to the CBS TV Network. Sling is the least distributed among the major vMVPDs in terms of access to local broadcast network affiliates.

Devices: Sling is the most widely proliferated vMVPD, with an app for all major devices, some of them working quite well.

Class notes: Sling TV was first to market, it’s the biggest vMVPD and it’s still growing fast. But unlike AT&T, Dish doesn’t have the kind of wireline and wireless broadband services to help monetize the offering. And as Dish ponders all its spectrum and the broader M&A environment, we wonder where Sling will be in three more years. Why didn’t Dish lock down CBS? And why did ex-CEO Roger Lynch bolt for struggling music service Pandora? Then there’s Sling’s essential offering: Sling’s major advantage is price. But you only get that price advantage if you’re willing to live with only around 40 basic cable channels, including ESPN, Turner Networks and AMC. As TV[R]EV analyst Alan Wolk noted, that’s not necessarily what people are looking for. “Overall it seems that people are flocking to what we’re calling “mesomorph bundles”—around 80 to 100 channels for around $40-50. That seems to deliver everything people want—all the broadcast plus whatever cable channels they might watch. It doesn’t feel like you’re actually giving anything up, but you’re saving as much as $100/month, especially when you factor in set top box fees,” the analyst said.

Grade: B-

DirecTV Now

Subscribers: AT&T said in January that DirecTV Now was up to 1.2 million subscribers 13 months after launch. DirecTV Now added 888,000 users in 2017, according to Leichtman Research Group.

The bundle: Four tiers, with the $35 base bundle including more than 60 channels (major broadcast webs and ESPN included). DirecTV Now is fairly well distributed as far as local broadcast affiliates go—in most of the bigger markets, you’ll be able to receive locals to ABC, CBS, FOX and NBC.

Devices: Every major platform save Android TV, Xbox One and PlayStation 4

Class notes: We’ll leave the general business logic of what AT&T is doing by letting a satellite TV asset it paid nearly $50 million for go to seed while it grows its low-margin vMVPD. We’ll trust that that addressable advertising and synergies with wireless are part of the corporate plan, and grade AT&T on its own merits. The fact is, DirecTV Now is the fastest growing vMVPD (aggressive promotions haven’t hurt its growth), and it seems to have its aces lined up nicely. “The inside track belongs to anyone who has a connection to a broadband provider, because they can offer a double play package of broadband (either traditional wired broadband or the upcoming 5G) and indulge in al the industry’s usual pricing tricks (e.g. deep discounts for the first year of a two year contract),” says Alan Wolk.

Grade: A

PlayStation Vue

Subscribers: Sony announced an official number of around 400,000 a year ago. Analyst speculation now puts the number at around 600,000. This seems small, given that the platform launched back in 2015.

The bundle: While you can get a linear-like package of channels, including regional sports networks, with the $75-a-month “Ultra” tier, the $40-a-month “Access” package covers the basics—the major broadcast webs, ESPN, TNT, CNN, etc. Coverage of locals is decent, too.

Devices: Among the major platforms, Xbox One (for obvious competitive reasons) is the only one Vue seems to be left out from.

Class notes: Again, nobody is getting rich off vMPVDs right now. In fact, according to analyst Craig Moffett, most lose money. Only Sony really knows how much its OTT service is boosting PlayStation console sales. But the platform has been in slow-growth mode for nearly three years. And with so much competition around—remember, T-Mobile is about to get in the vMVPD game, too—we wonder how much longer Sony can throw money at this.

Grade: C

Hulu Live

Subscribers: Hulu says it has 17 million total subscribers, but it hasn’t broken off a figure for its relatively new livestreaming service. CNBC reported in January that the vMVPD platform now has more than 450,000 customers.

The bundle: For $44 a month, you can combine the premium no-commercials version of Hulu’s popular SVOD service with a live-channel package that not only includes the biggest collection of local broadcast affiliate deals of any vMPVD, but also a fairly robust array of cable sports options (not only national channels ESPN and Fox Sports 1, but also regional channels like Fox Sports Net). AMC Networks is missing, but “The Walking Dead” jumped the shark several seasons ago, anyway. Other nice features are multiviewer access (two at once) and a cloud DVR that stores 50 hours of HD programming. “YouTube and DirecTV Now seem to have the broadest array of channels, but Hulu has Hulu and all the content that comes with that,” Wolk said.

Devices: Android TV and PlayStation apps seem to be the only thing missing from Hulu’s live service, which is technically still in beta.

Class notes: For his part, Wolk thinks Hulu also wins on user experience. “Hulu does indeed have a hell of an offering, especially if you are already a Hulu user,” he said. “The one really cool thing they’ve done though, that doesn’t get enough press, is switch to a library-based interface. There’s no grid, it’s all predictive and arrayed by categories (e.g. Sports, News). During the Olympics, they even asked for your favorite sports so they could list those first.”

Grade: A+

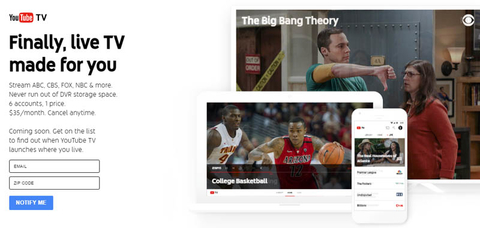

YouTube TV

Subscribers: CNBC estimated in January that Google’s livestreaming service was up to around 350,000 users.

The bundle: YouTube just raised the price by $5 to $40 a week. But from its robust collection of locals for the Big Four, to its proliferation of the basic cable staples (ESPN, TNT, FX, National Geographic, AMC, just to name a few), it falls into the sweet spot of a true linear replacement.

Devices: YouTube TV allows three simultaneous streams, and just debuted apps for Roku and Apple TV. Still missing are Amazon devices and PlayStation 4.

Class notes: Since YouTube doesn’t have a broadband service or programming library to prop up, it’s kind of existentially “screwed,” Wolk said. “Hulu will be okay because the networks and Comcast own it, as will all of the vMVPDs that the traditional MPVDs spin off, plus whatever the telcos come out with. That’s too bad because YouTube’s done a good job getting all the networks on board and their tech is top notch: nowhere near the amount of buffering and glitches as the competition,” the analyst explained.

Grade: B

fuboTV

Subscribers: Start-up backed platform said in October that had over 100,000 subscribers.

The bundle: FuboTV bills itself as a sports specialist. And the conspicuous lack of a Disney and Time Warner Inc. deals (meaning no ESPN, ABC, TNT, etc.) makes fuboTV’s $45-a-month offering seem incomplete. But there are some cool regional sports channels, along with a robust collection of locals. That fact that fuboTV has been able to assemble the competitive package it has in the cutthroat realm of the vertically integrated programming world is worth major credit.

Devices: fuboTV has apps for every major device, save for the big gaming consoles.

Class notes: “I’m a big fan of fubo,” Wolk said. “They’re like the little engine that could. I suspect that they might get bought by someone (Verizon?) who needs a vMVPD play and can supply a broadband connection to go with it.” Notably, fubo has smartly carved out a deal with the National Cable TV Cooperative to vend its platform to smaller operators ditching their video business.