Pay TV pricing is the biggest factor in the consumer decision to cut the cord, and it continues to increase in relevance, according to TiVo’s latest quarterly “Online Video and Pay-TV Trends Report."

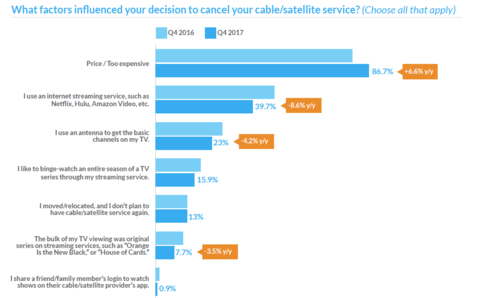

According to the technology company’s research division, 86.7% of pay TV refugees listed price as their top reason for cutting the cord, a 6.6% uptick over TiVo’s Q4 2016 report.

The use of alternative OTT programming sources like Netflix, Hulu and Amazon dropped 8.6% year over year as a primary cord-cutting driver, reaching 39.7% in the new study.

Twenty-three percent of respondents listed use of over-the-air antennas, a 4% decline.

“Price continues to drive respondents to cut pay TV service, making TiVo wonder: what actions can pay-TV providers take to retain this audience?,” the study authors wrote. “Are providers leveraging the necessary subscriber data to identify potential customers at high risk of churn, and are pay TV providers targeting their marketing to this group in effort to combat this action?"

TiVo said nearly half of respondents (49%) pay $51 to $100 a month for linear cable, satellite or telco TV services. Another 20% pay $126 or more a month for these services.

The percentage of respondents paying less than $75 a month dropped 3.4% from the year-ago study. Those paying $75 to $125 a month increased by 3.4%

Of the 16.2% of survey respondents who said they were unsatisfied with their current pay TV service, 83.1% listed increasing monthly prices as their top reason.

According to the study, the average respondent wants an a la carte package of around 22 channels, and is willing to pay $33.09 per month for that.

“Though seasonality likely played a factor in these survey results, it’s worth highlighting that the NHL Network and the SEC Network are new to the top 10 channels respondents will pay the most to watch,” the study authors noted. The NFL Network was on the list in third-quarter 2017. TiVo will continue to monitor whether these sports networks remain among the top 10 channels. Also, the results illustrate that respondents desire a considerably lower price for HBO, Cinemax and Starz than the current subscription price for any of these services.

ABC, CBS, FOX and NBC, as well as cable outlets Discovery Channel, FX, HBO and A&E, once again led TiVo’s list of most essential channels.

TiVo’s study is based on a survey of 3,330 adults in the U.S. and Canada.