Now that the third-quarter earnings season is in the rear view, it's time to assess the damage. FierceCable has assembled a complete look at the results, ranking the top cable, satellite and telco pay TV operators and offering a look at their performance in a number of key metrics, including subscriber growth and average revenue per user (ARPU).

Notably, every major pay TV operator reported video subscriber losses in Q3. But as you can see by comparing to our Q2 carrier report, all of these operators save for Dish grew their ARPU.

How the top 7 U.S. pay-TV operators performed in Q3 in video (ranking by subscribers)

Operator Video subs (mil.) Net adds Q3 ARPU

1. AT&T 25.083 (89K) $123.45

2. Comcast 22.390 (126K) $151.51

3. Charter 16.542 (104K) $110.12

4. Dish Network 13.203 (129K) $87.23

5. Verizon 4.648 (18K) n/a

6. Cox 4.127 (5K) n/a

Source: IDC US Consumer Multiplay and Broadband Services

Once again, cord cutting wasn't as bad as expected... but it's definitely quickening

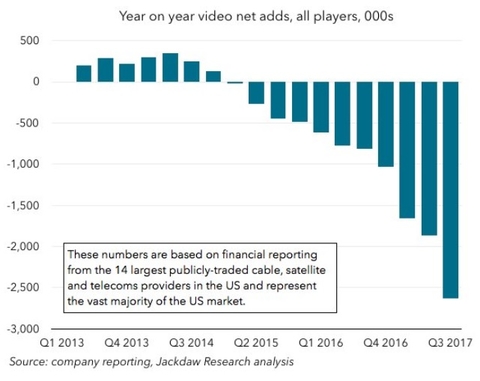

As earnings season has approached in each quarter of 2017, analysts have predicted the watershed moment where linear pay TV losses surpass 1 million customers.

The market came close in the always-volatile second quarter, losing 976,000 subscribers. But even with operators telegraphing potentially huge losses in the third quarter amid hurricane disruption in multiple regions, pay TV once again missed the auspicious 1 million mark.

The top 10 publicly traded operators, which account for about 95% of the market, reported losses of around 398,000 video customers in the third quarter. Discounting gains made by virtual MVPDs DirecTV Now and Sling TV, these operators lost around 820,000 traditional pay TV users.

Factoring in the pay TV business' record-breaking first-quarter subscriber losses of 762,000, the industry has lost around 2.5 million linear customers through the first three quarters of 2017, as illustrated by the IDC charter below.

The leading operators lost less than 800,000 pay TV customers in all of 2016.

Virtual MVPDs added around 900K subs in Q3, but are they helping?

While reporting losses of nearly 400,000 users for DirecTV and U-verse in the third quarter, AT&T also touted a gain of 296,000 customers for its year-old virtual MVPD platform, DirecTV Now.

Analysts also estimate that Dish Network gained about 113,000 users in its three-year-old vMVPD, Sling TV.

Overall, Deutsche Bank analyst Matthew Niknam estimated that vMVPDs added around 900,000 customers in the third quarter, with gains made by Hulu Live, YouTube TV, Sony PlayStation Vue, FuboTV and other virtual players factored in.

Both AT&T and Dish insist that they are not cannibalizing their own services.

At least as far as the business models go for DirecTV and Dish, count MoffettNathanson analyst Craig Moffett as among those who aren't impressed by the margin contributions of virtual MVPDs.

"We've now seen Sling TV contribute to the top and bottom lines long enough to make clear (as if anyone had any doubts anyway) that Sling TV is economically irrelevant," Moffett wrote after Dish's third-quarter report last week. "It is doing nothing to arrest Dish Network's slide."