Now that the second-quarter earnings season is in the rearview, it's time to assess the damage. FierceCable has assembled a complete look at the second-quarter earnings season, ranking the top cable, satellite and telco pay-TV operators and offering a look at their performance in a number of key metrics, including subscriber growth and average revenues per user (ARPU).

To see our full reporting on the first quarter, click here.

First, let's look at the top pay-TV operators, ranked by number of subscribers. This list, from Strategy Analytics, ranks the nation's operators and provides their quarterly net adds/losses and ARPU:

| Top US Pay TV Service Provider Metrics Q2 2016 (ranking by subscribers) | |||||

| Rank by # Subscribers | Service Provider | Platform | Subscribers (millions) | Net Adds | ARPU* |

| 1 | AT&T | IPTV + Satellite | 25.295 | -49,000 | $117.01 |

| 2 | Comcast | Cable | 22.396 | -4,000 | $147.99 |

| 3 | Charter | Cable | 16.934 | -152,000 | $81.55 |

| 4 | Dish Network | Satellite | 13.593 | -281,000 | $89.98 |

| 5 | Verizon1 | IPTV | 4.637 | -1,128,000 | n/a |

| 6 | Cox | Cable | 4.165 | -23,000 | n/a |

| 7 | Altice USA2 | Cable | 3.639 | -25,000 | $116.50 |

|

*Comcast ARPU is Total Blended ARPU, All others are Video ARPU 1 Verizon subscriber data reflects the impact of sale of assets to Frontier

2 The subscriber total for Altice USA represents Suddenlink and Cablevision but the ARPU only represents Suddenlink. Cablevision reported ARPU of $159.90 for its Optimum service during the second quarter. Source: Strategy Analytics' Digital Television Operator Performance Benchmarking: North America |

|||||

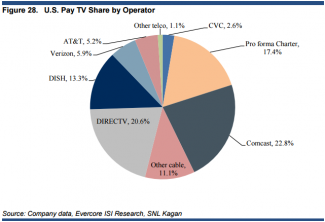

To put these numbers into context, the analysts at investment banking firm Evercore ISI offer a look at how the operators break out in terms of market share:

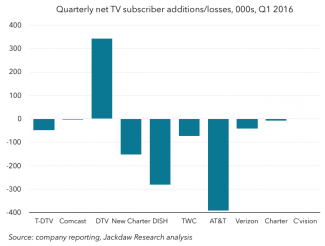

Next, Jackdaw Research analyst Jan Dawson provides an additional look at the performance of the nation's top pay TV operators in the fourth quarter with these key slides:

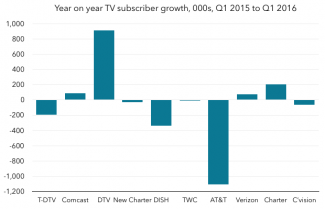

Dawson also ranks the top 11 pay-TV operators in the United States and shows how their subscriber bases have changed during the past year:

| Top 9 | Q2 2015 | Q3 2015 | Q4 2015 | Q1 2016 | Q2 2016 |

| AT&T-DirecTV | 25,490 | 25,424 | 25,398 | 25,344 | 25,295 |

| Comcast | 22,306 | 22,258 | 22,347 | 22,400 | 22,396 |

| DirecTV | 19,544 | 19,570 | 19,784 | 20,112 | 20,454 |

| New Charter | 16,964 | 16,944 | 17,062 | 17,086 | 16,934 |

| DISH | 13,932 | 13,909 | 13,897 | 13,874 | 13,593 |

| Time Warner Cable | 10,774 | 10,767 | 10,821 | 10,842 | 10,769 |

| AT&T | 5,946 | 5,854 | 5,614 | 5,232 | 4,841 |

| Verizon | 5,765 | 5,807 | 5,827 | 5,863 | 4,637 |

| Charter | 4,120 | 4,293 | 4,322 | 4,332 | 4,325 |

| Cablevision | 2,637 | 2,604 | 2,594 | 2,579 | 2,577 |

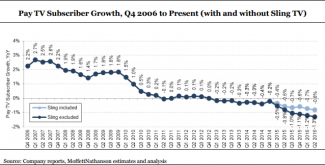

Next MoffettNathanson analyst Craig Moffett checks in with a different look at the overall pay-TV industry, with a chart showing the subscriber growth of the pay TV market from 2006 to the second quarter of 2016:

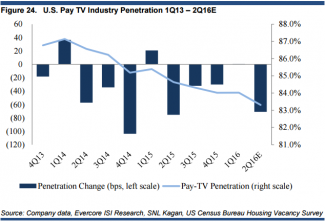

Finally, the analysts at Evercore look at the overall penetration of pay TV from 2013 to the second quarter of this year, according to data from the companies, Evercore itself, SNL Kagan and the U.S. Census Bureau's Housing Vacancy Survey.

This article previously stated that AT&T's pay-TV subscriber total was 26.03 million at the end of the second quarter. The correct total is 25.295 million. This article has also been updated to note that Altice USA's listed second-quarter ARPU only reflects Suddenlink, not Cablevision.