Deciding what to watch among a vast amount of content and platform options is one well-known consumer pain point that doesn’t seem to be abating when it comes to TV viewing, according to LG Ads. And while a new survey highlights this issue it also sheds light on another challenge – with results that show even when viewers do know what they want to watch, a whopping 40% are confused about where to find it because of the number of different streaming TV options available.

The new findings are from LG Ad Solutions, based on a survey of more than 750 U.S. consumers in March 2023, seeking to determine consumer perceptions and behavior related to CTV.

In terms of viewers not knowing where to find content they’re actively seeking LG Ads said it suggests “stronger affinity towards specific content rather than the streaming platform itself.” To that point, the survey found that 59% of respondents are willing to cancel a subscription after watching specific content – lending further numbers to support the trend of subscription cycling (where users jump between platforms to follow desired content) that others, such as Samba TV, have cited as a growing behavior and struggles with differentiation of services.

And as viewers hop between services, more are turning to ad-supported options as cost becomes a bigger factor. LG Ads found 46% of those surveyed reported canceling a streaming service because of economic concerns, while 63% said they prefer to stream free content rather than paying for a subscription. Looking ahead to the next 12 months, LG anticipates changes to streaming services with 32% of respondents saying they will remove certain CTV subscription services, while 21% will add free ad-supported streaming TV (FAST) options.

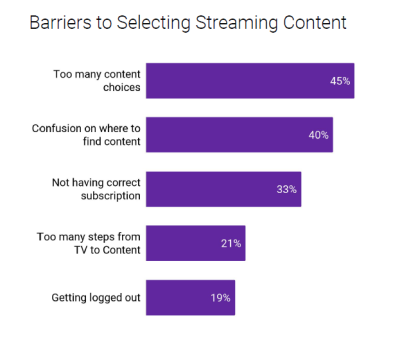

Back to the streaming struggle of deciding what to watch and where to find it, LG Ads found that nearly half (45%) of consumers felt there were simply too many content choices, with that factor cited as the top barrier to picking content – just ahead of confusion about where to find content they already know they want. To that point, in picking content, consumers reported spending an average of 5.7 minutes between the time they turned on the TV and when they started watching content.

To help viewers figure out what to watch and where, LG said “these nearly-six minutes represent a chance to advertise new programming in a contextually relevant environment.”

“As consumers increasingly move to free, ad-supported services, this next phase of TV will be defined by both content and experience," said Tony Marlow, CMO of LG Ad Solutions, in a statement. "This means not only do streamers need to promote their content to lure overwhelmed consumers in, but they also need to have enough to keep them engaged and on the app or channel.

While recommendations from family and friends topped the list (46%) as sources consumers find new content, the next key places for content discovery are the TV home screen and the homepages of a specific app, each with 39%. Rounding out the top five sources for content discovery were TV commercials (21%) and social media ads (21%).

LG noted that “advertising content on the home screen engages consumers while they are actively looking for content to watch.”

Of course, LG is no stranger to the smart TV home screen, as a TV maker that’s also building out an advertising business that benefits from ad-supported streaming and opportunities to collect data and generate revenue from home screen placements and advertising, alongside its own FAST service LG Channels. Other smart TV makers like Vizio have also pointed to opportunities for advertisers to leverage the smart TV interface as the entrance point for many on the home screen.

“Consumers take almost 6 minutes on average to select a piece of content to watch after turning on the TV,” Marlow continued. "This presents a great opportunity for streamers to leverage Smart TV homepages for content discovery. Our data indicates that 39% of viewers have used recommendations from their TV’s homepage when they’re looking for something new to watch–and we anticipate that number to increase as Smart TV adoption continues to climb. The home screen is the new center of the CTV experience where consumers can search for specific content, and find recommendations when they aren’t sure what they want to watch.”

Perhaps unsurprisingly, nearly three-quarters (73%) of consumers say they prefer to see ads that are relevant to their interests, while 63% said they’d prefer to watch ads that are relevant to the content they’re watching.