In the age of reboots, prequels, sequels, adaptations and “based-on” series and movies, new Ampere Analysis data takes a look at just how original leading streaming services’ original content is.

According to the firm’s report, most newly ordered shows and movies ordered by SVODs in the first half of the year have leaned on existing IP. Ampere found that commissioned content (for movies and first-run TV originals) based on adaptations, franchises and other forms of pre-existing intellectual property accounted for 64% of new scripted originals from leading SVOD platforms in the U.S. in the first half of 2022.

That figure doesn’t include unscripted originals, which when accounted for, drops the percentage of IP-based commissions to 42% of SVOD’s new movies and first-run TV originals in the U.S.

Funneling content budgets into series and movies based on IP with name recognition makes sense for SVODs – which are increasingly competing to capture eyeballs with original content – as they look to both attract viewers and lower risks associated with their spending, Ampere analyst Cyrine Amor pointed out.

Amor noted that as streaming has becoming more competitive it has put original content front and center and seen leading services ramp up investments – with spending on original content growing from a quarter of SVODs total content spend in 20219 to over 50% in 2022.

“With such significant budgets available but also at stake, leading global streamers are increasingly turning to pre-existing IP and recognisable franchises and brands to attract and retain subscribers, and reduce the risk associated with commissioning Originals,” Amor stated. “Drawing on pre-existing IP capitalises on established and successful content and is more likely to attract subscriber attention and positive reception than new brand content.”

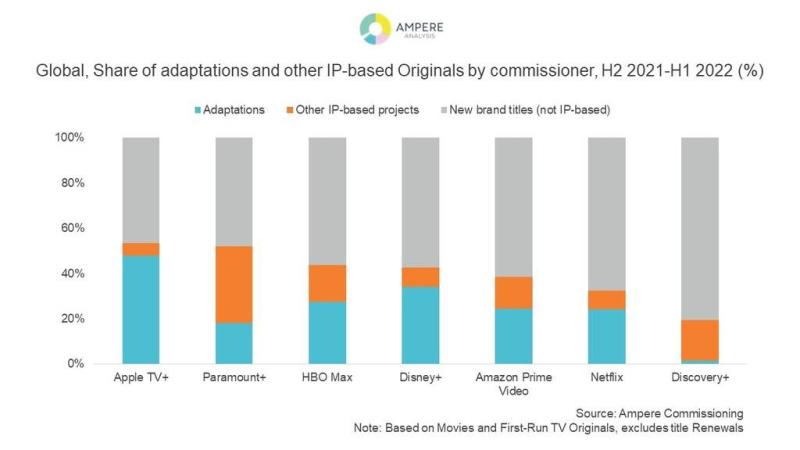

The data shows that Apple TV+ has turned most heavily to pre-existing IP, accounting for 53% of its total new originals for the first half of 2022. That said, in general streamers with studio-backing, such as Paramount+ and Disney+, usually have the highest proportion of IP-based commissions as they look to their internal U.S. based content and franchises for new programming.

Leaning on existing IP is tilted more heavily toward U.S.-audiences, as IP-based content including unscripted accounted for only 28% of SVODs international commissions. According to Ampere, this reflects the competitiveness and maturity of SVODs in the U.S. market, with their collective share of IP-based commissions in North America jumping seven percentage points over the last two years.

And as SVODs expand internationally, specifically Paramount+ and Disney+ their share of new content based on existing IP is gradually decreasing. For example, Disney+ IP-based content accounted for 35% of its global new originals in the first half of 2022 – that’s a marked drop from the over 60% IP-based commissions represented in 2020. In that time Disney+’s international footprint has grown substantially. In June the service expanded to become available in 60 countries across Europe, Middle East and Africa.

During fiscal 2022 Q4 international subscribers accounted for the vast majority of Disney’s Disney+ subscriber gains, adding 7.4 million in the period (excluding Disney+ Hotstar in India). For core Disney+ subscribers, which excludes Hotstar, international users made up more than half of the subscriber base – accounting for 56.5 million of the total 102.9 million Disney+ core subscribers, while U.S. and Canada subscribers accounted for 46.4 million.

It's worth noting that Disney’s undergoing some major internal shifts as the company just ousted CEO Bob Chapek and reinstated his predecessor and long-time chief executive Bob Iger.

Netflix, meanwhile, leads in the original content space both by spending level and commissioning output, according to Ampere. However, its originals up until now have been the “most original” in that it has the lowest share of IP-based titles at 32%, similar to that of Amazon Prime. Still, that percentage is steadily rising though in the U.S. market, where Ampere said the SVOD giant is primary turning to book adaptations as the IP base but also increasingly able to tap its own hit titles such as a “Stranger Things” spin-off. Just last week Netflix released “Glass Onion: A Knives Out Mystery” – the sequel to the hit 2019 “Knives Out” film – for a limited week-long run in around 600 U.S. movie theaters. Netflix hasn’t said how the limited theater run fared, but sources told Variety the theatrical release generated as much as $15 million – with the film set to release on the streaming platform next month.

Netflix’s content budget for 2022 is around $17 billion, which co-CEO and chief content officer Ted Sardanos has said he’s feeling “better and better” about, while also pointing to the need to maximize impact from dollars spent.

“Both the scope and scale, as well as the range and the cadence of hits is improving. So that, I feel better and better about that $17 billion of content spend because what we have to do is be better and better at getting more impact per $1 billion spend than anybody else,” Sardanos said during the company’s Q3 earnings interview in October. “And that's how we're focusing on it. So, I think we're about the right, we're spending at about the right level.”

Perhaps unsurprisingly, when unscripted originals are in play Warner Bros. Discovery’s Discovery+ has the lowest share of IP-based titles at 19% – mainly since the platform primarily offers unscripted original content, according to Ampere.

“Overall, the share of IP-based titles is lower for Unscripted than Scripted commissions, although an increasing proportion of Unscripted Reality and Entertainment content is drawing on pre-existing formats for remakes, spin-offs, or reboots for example,” Ampere concluded.

Warner Bros. Discovery is gearing up to debut a new streaming service that combines the largely unscripted library of Discovery+ with HBO Max (which ranked third for highest share of IP-based original commissions, based on Ampere data). The yet to be named new service is expected to debut in spring of 2023 with both premium ad-free and ad-lite options.