As consumers ramp up their number of streaming services, discussion crops up about how to aggregate those apps into one place. Most consumers would agree video aggregation enhances the viewing experience, according to new data from Hub Entertainment Research.

In fact, 91% of respondents think having access to multiple services via a single device improves the viewing experience – with over half of consumers (52%) saying aggregation makes the experience “a lot” better.

Hub surveyed in June over 1,600 U.S. consumers – age 16-74 – who have broadband at home and watch at least one hour of TV per week.

The survey went on to say a majority of pay TV users (70%) who access streaming services from their set tops feel they’re getting “excellent” or “good” value from their subscription.

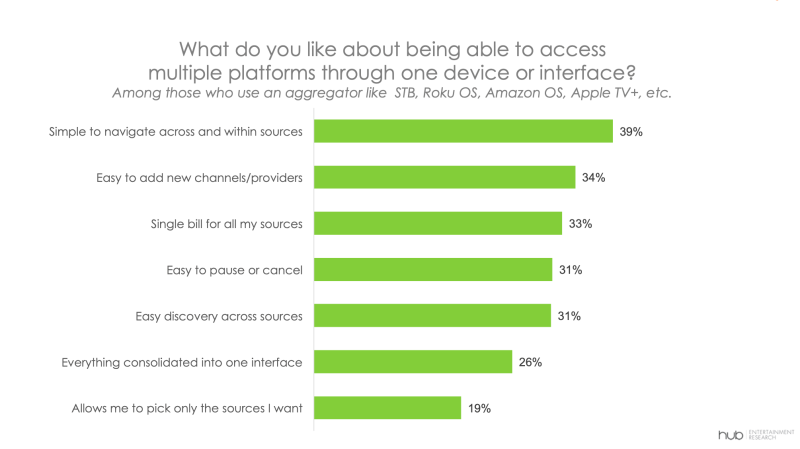

Not only are consumers saying video aggregators are simple to navigate across, but they also value having a single bill for all their apps. OTT bundling is a key source of revenue for pay TV and other home service providers, recent Parks Associates data shows.

The average number of streaming apps seems to be continuously rising. An April Hub study indicated consumers generally need at least four streaming options before they’re satisfied with their TV needs. And recent TiVo data has pegged the number of streaming services to average at around nine apps per user.

“There’s no question that the golden age of streaming has made TV more fun for consumers,” stated Jon Giegengack, principal at Hub and one of the study authors. “But it’s no fun trying to get the most out of that content when it’s spread across so many providers.”

Platforms have been trying to solve the problem of an overly fragmented streaming landscape. Plex in April launched a one-stop navigation tool, allowing users to easily keep track of all their paid and free streaming services. MyBundle.TV last month integrated billing for Sling TV customers onto its platform.

Speaking of Sling TV, Evoca in May unveiled an enhanced programming bundle – combining Evoca’s local content with Sling’s national channels.

“Aggregators enable viewers to get something playing on the screen with as few clicks as possible,” Giegengack continued. “This is a big opportunity for pay TV operators to reclaim their traditional role – only this time instead of bundling networks, they’re bundling platforms.”

Choosing a streaming bundle offers consumers a way to cut costs on services. Hub noted that viewers’ estimate of what they consider a “reasonable” amount to spend on TV has fallen in the past couple of years.

Respondents in 2022, for instance, think spending $68 per year on TV content is “reasonable” (a decrease from $73 annually in 2021). Interestingly, Hub data shows consumers in 2022 are actually spending on average $82 per year on TV.

With such costs, viewers might feel compelled to adopt more ad-supported streaming services, as suggested by Comscore’s 2022 State of Streaming analysis. But Hub found viewers prefer to have a choice between ad-free and ad-supported tiers, as they have similar “value” ratings.

About 76% of HBO Max users, for example, think the platform’s ad-supported version is of “good” or “excellent” value – only slightly higher than user satisfaction for HBO Max’s ad-free plan (75%).

The results for HBO Max fall in line with recent Whip Media data, in which 85% of respondents said they were satisfied with the value the service provides.

Out of the data from five streaming services (HBO Max, Discovery+, Hulu, Peacock and Paramount+), Peacock had the highest discrepancy in value ratings: 69% for ad-supported vs. 76% for its ad-free tier.