In March the price for Amazon Prime’s annual membership increased $20 per year for existing customers, but Parks Associates doesn’t think the hike will deter customers.

New data from the firm’s OTT Video Market Tracker shows that as of Q3 2021, Amazon Prime Video subscriber penetration reached 45% of U.S. internet households. Parks Associates estimates that Amazon Prime members stood at 77.3 million households as of Q1 2021, with around 71% of them watching Prime Video.

In April 2021 Amazon CEO Jeff Bezos claimed more than 175 million Prime members had streamed shows and movies in the past year, shortly after Prime reached the 200 million member mark globally. And a January 2022 Consumer Intelligence Research Partners report estimated that Amazon had 172 million U.S. Prime members as of Q4.

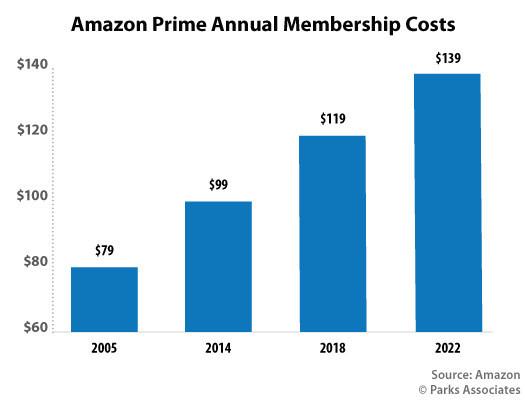

The recent price hike, which saw annual Prime membership costs rise 17% from $119 to $139, went into effect for new customers in February, followed by existing customers last month. It was the first Amazon Prime price raise since 2018 and followed increases by Netflix a month prior in January (making its basic plan $10 per month, Standard plan $15.49 per month; and premium plan $20 per month). Netflix said the $1-$2 increases were to help the streaming service pay for new programming and stay competitive. Hulu in 2021 raised prices starting in December, including a $5 per month increase for its Hulu + Live TV to $70 per month and $75 per month for the ad-free version.

In the virtual live TV streaming space, vMVPD fuboTV just dropped its basic tier, migrating existing customers to a $5 more per month premium tier.

In February, Amazon cited inflation and offsetting pandemic-related disruptions for labor and transportation costs as some of the reason behind the increase.

Video is one of the features of a Prime membership, and Parks Associates senior contributing analyst Eric Sorensen pointed to investments in original content to help keep Amazon customers engaged and entice new subscribers. Prime Video competes against Netflix, Disney+ and Hulu, with the firm calling it “one of the four foundations of the streaming stack.”

"Amazon also debuted its Lord of the Rings trailer during the Super Bowl this year, so the firm obviously hopes the value they are bringing in content will offset any consumer reluctance to pay higher prices,” Sorensen stated. “With inflation and the cost of content on the rise, we will likely see more providers start to slowly raise their subscription prices, trying to find that balance between revenue growth and consumer value."

Also on the content front, Amazon officially closed its acquisition of Hollywood studio MGM last month, making it part of Amazon Prime Video and Amazon Studios. The deal, valued at $8.45 billion, brings a catalog of more than 4,000 films, 17,000 TV episodes and IP such as James Bond into the Amazon fold.

Sports are also part of the picture as Amazon inked a 2021 deal with the NFL to exclusively stream Thursday Night Football. During fourth quarter earnings CFO Brian Olsavsky pointed to the NFL deal as an example of the new content Amazon’s been investing in to make Prime membership more valuable.

“We have been working at getting sports properties that will be beneficial and valuable to Prime,” he said. “We’re still probably early on in that.”

Parks Associates’ Sorensen noted that the Prime price raise is only the fourth in its history.

"These price increases by Amazon have been fully vetted out as part of their long-term strategy to generate more revenue from subscribers over time," Sorensen said. "Supply chain and increasing shipping expenses are being passed down to customers, but it is doubtful that Prime members will object to a twenty-dollar-a-year membership rise, the first in four years."

Still, when Amazon first announced the increase in February, some customers weren’t happy and hopped on social media to express distaste.