Apple on Monday raised the subscription price for its streaming TV service Apple TV+ to $6.99 per month.

It also raised prices for subscriptions to Apple Music and Apple One.

The price hike marks a first for Apple TV+, which debuted in November 2019 and had been competitively priced relative to other streamers at $4.99 per month. Annual subscriptions for Apple TV+ will increase from $49.99 per year to $69 per year, as first reported by 9to5mac.

It’s not the first streaming service to mark increases, as others such as Netflix and Disney raised the cost of their respective SVOD services this year. Disney+’s base plan increased from $7.99 per month to $10.99 per month as it plans to introduce a tier with ads in December, which is taking over the starting price point of about $8 per month. Netflix implemented price increases for U.S. and Canada consumers in January, which saw its least expensive plan go up by around $1 to $9.99 per month. Starting in November, Netflix will be offering a new plan – it’s first with ads - that’s priced at $6.99 per month.

In a statement obtained by CNBC Apple pointed to its growing content slate as contributing to the price increase.

“We introduced Apple TV+ at a very low price because we started with just a few shows and movies. Three years later, Apple TV+ is home to an extensive selection of award-winning and broadly acclaimed series, feature films, documentaries, and kids and family entertainment from the world’s most creative storytellers,” Apple stated.

This year Apple snagged a first for a streaming service when “CODA” won Best Picture Oscar at this year’s Academy Awards. Shows such as “Ted Lasso” have garnered critical acclaim and awards. And Apple is expanding into the world of sports programming, including with rights to MLB’s live “Friday Night Baseball” games, which kicked off in April. Apple also snagged a 10-year deal to serve as the exclusive home of all live Major League Soccer matches starting in 2023.

Apple increases streaming share in Q3, driven by specific content

Based on recent data from Kantar, Apple TV+ (as well as Paramount+) marked strong growth in the third quarter of 2023, largely driven by specific content driving signups.

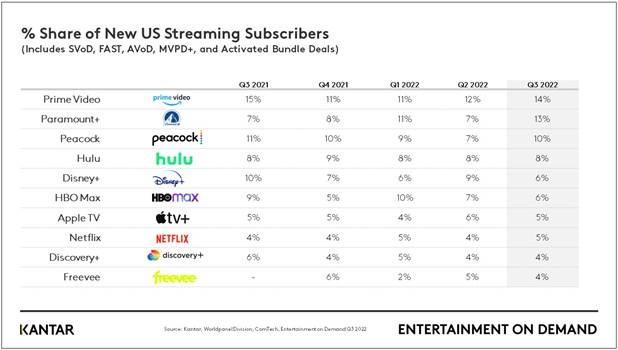

As of Q3 Apple TV+ now has a streaming market share of 10%, reflecting 12% growth quarter over quarter. Competing with other streaming services, Kantar’s Entertainment on Demand report showed Apple TV+ captured a 5% share of new U.S. streaming subscribers in Q3.

Notably, Kantar data found 43% of new Apple TV+ sign ups were driven by specific content (compared to 33% of the total market), but the firm pointed out there are risks for subscribers canceling after they watch the shows they’ve signed up for.

“As Apple TV+ has shown in the past with ‘Ted Lasso’, these new subscribers often cancel their subscription after watching the title they joined for,” wrote Kantar. “Already, cancellation for both platforms [Apple TV+ and Paramount +] in Q3’22 was disproportionately driven by having watched the specific content that drove sign-up.”

The firm also noted cancellations due to technical difficulties, challenges to find content to watch and already high subscription stacking among subscribers.

To minimize risks for churn, Kantar said streaming platforms need to focus more attention on their interface functionality, as that along with recommendations become a key tool for subscriber retention.

“If subscribers can’t easily find a new title to watch, regardless of the quality and quantity of content available, they are more likely to churn from the platform,” the firm noted. “Both Apple TV+ and Paramount+ illustrate that marketing a single title can drive growth, but without a great user experience post-sign up, retention is a challenge.”

While Apple is raising subscription prices, it recently introed a lower-cost version of its streaming Apple TV device. The new version of the Apple TV 4K starts with 64 GB of storage for streaming apps and games for around $130 - a cost that’s about $50 lower than a similar version introduced several years earlier. Apple’s share of the streaming device space shrank 3% year over year in the third quarter, when it captured 9% of the domestic market, according to Parks Associates. Comparatively, Roku and Fire TV largely dominated the space, commanding a 40% share each in Q3.

The higher Apple TV+ subscription prices also come at a time when consumers and businesses are dealing with impacts from inflation and concerns about recession.

Apple reports the Apple TV+ service within its much larger services business but doesn’t break out specific revenue for the SVOD. For the quarter ended June 25, Apple services brought in $19.6 billion in revenue.

Apple reports fiscal year fourth quarter earnings this Thursday.