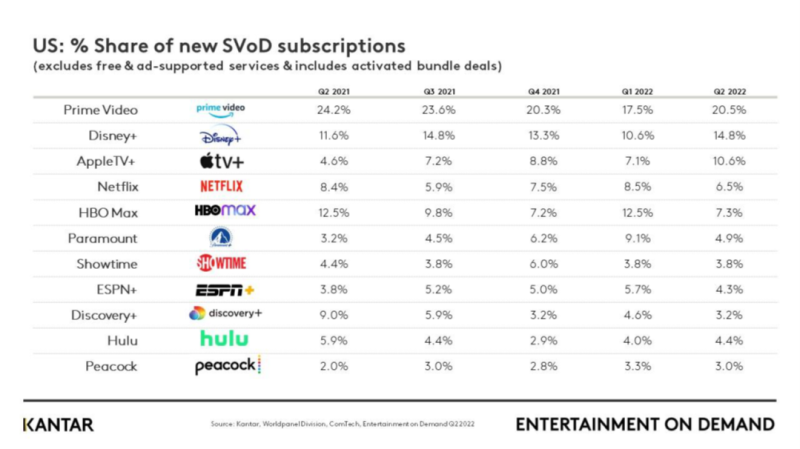

The proportion of U.S. households with streaming services increased in the second quarter, following a flat Q1, according to a new report from Kantar. Disney+ and Apple TV+ showed some competitiveness as each increased their share of new SVOD subscribers and were the only services other than Amazon Prime to nab double-digit percentages.

Overall, streaming service penetration reached 88% - up 2 percentage points on Q1, meaning there are now 113 million U.S. households using streaming services.

Kantar’s U.S. Entertainment on Demand Q2 2022 Barometer showed all three tiers, including SVODs, free ad-supported streaming TV (FAST) and paid ad-supported streaming (AVOD), contributed to growth – but FASTs growth slowed by 2 percentage points quarter over quarter while AVOD ticked up 3% points. Household penetration is still up across all tiers though, with AVOD up 6% quarter on quarter, and FAST up 10%.

For the fifth quarter in a row Amazon Prime Video snagged the top spot for new U.S. SVOD subscriptions, grabbing a 20.5% share (versus 17.5% in Q1). Disney+ also saw share gains in Q2, increasing from 10.6% of new SVOD subscriptions in the first quarter to 14.8% in Q2. Apple TV+ was third with a 10.6% share, up from the 7.1% in the first three months of the year.

It looks as though SVOD leaders Netflix and HBO Max are attracting a smaller share of new subscribers, with both services marking declines in Q2. Netflix nabbed 6.5% of new SVOD subs in Q2, down from 8.5% in Q1. HBO Max garnered slightly more at 7.3% in Q2, down from the 12.5% share it had in Q1.

Still, while HBO Max’s piece of the new SVOD subscription pie dipped, Kantar noted that HBO Max has seen consistent quarter-on-quarter growth, and now has a market share of 20% of U.S. streaming households.

“HBO Max is unique in that its growth is coming from both its SVOD and AVOD tiers,” wrote Kantar. The report said HBO Max service is driving satisfaction with both types of viewers based on Net Promotor Scores – which at 46 in Q2 meant “HBO Max now has the highest NPS score of all streaming platforms.”

Netflix dropping its percentage of new SVOD subscribers may not come as a surprise as the streaming service already has a wide base and just reported losing around 1.3 million U.S. and Canada subscribers in the second quarter. Kantar said Netflix’s reach of 61% of U.S. streaming households in Q2 was down from 67% one year prior. Netflix saw 6% of its subscriber base churn in the second quarter, contributing to its continued loss of market share, according to the report.

With price hikes in the U.S. in January, the report said Netflix (which consistently has one of the highest NPS scores per the report) saw its single largest decline in a quarter for users satisfied with value. Netflix is planning to introduce an AVOD tier in the early part of 2023, hoping to attract a broader range of paying customers with a lower-cost option and bring the opportunity for new ad revenue.

Alongside overall streaming growth, Kantar reported more service stacking – which it correlated to the significant AVOD and FAST growth – with the average streaming household now accessing five different services.

“As stacking reached new heights, consumers were willing to reduce their overall streaming costs for ads,” wrote authors of the Kantar report. “Streaming has gone full circle, once being the destination to avoid Cable TV ads, to increasingly relying on ads to drive growth.”

While consumers are adding more services, they also appear to be leaving platforms at a high rate. Kantar reported that churn remained at a relatively high level from Q1 to Q2, with 8% of subscriptions being canceled in Q2.

“Similar to Q1’22, this high churn coupled with high stacking indicates consumers are switching and boomeranging between platforms,” Kantar stated in the report. “This behavior is largely driven by specific trending content.”