After a slower third quarter for subscriber additions, Disney+ (along with ESPN+ and Hulu) is hoping for a strong end to 2021.

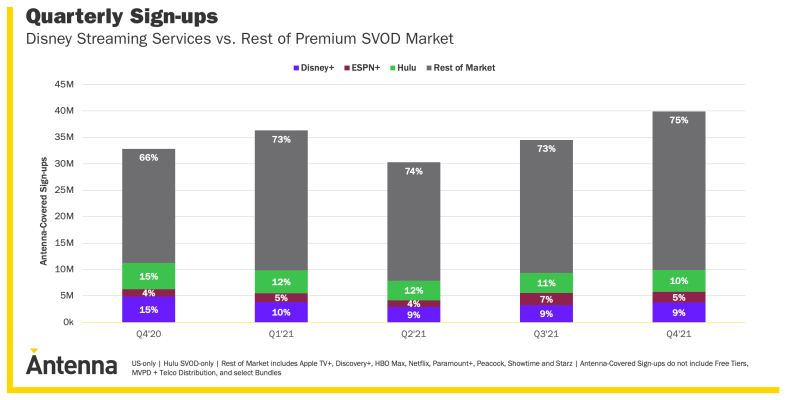

New data from Antenna shows Disney’s stable of streamers grabbed nearly 10 million new sign-ups in the U.S., suggesting some encouraging domestic growth. Disney+, ESPN+ and Hulu (SVOD only) accounted for 25% (or 9.9 million out of 39.9 million) of premium SVOD sign-ups during the fourth quarter of 2021.

Apple TV+, Discovery+, HBO Max, Netflix, Paramount+, Peacock, Showtime and Starz accounted for the other 75% of sign-ups—not including free tiers or MVPD/telco distribution deals. Disney’s streaming services have seen their share of signups fluctuate over the past five quarters, topping out at 34% (11.2 million out of 32.8 million in the fourth quarter of 2020) before dropping to 25% last quarter.

RELATED: Hulu, Sling TV and others get aggressive with Black Friday deals

Antenna found that “The Beatles: Get Back” drew the highest spike in Disney+ sign-ups during its op its opening period (release day and the two following days) with 209,000, close to the 214,000 attributed to “Black Widow.” Hulu’s “The Handmaid’s Tale” also drove a 209,000 spike during the quarter but was outpaced for sign-ups by Hulu’s aggressive Black Friday promotion.

Antenna said that ESPN+ did not have any noticeable spikes around any specific events during the fourth quarter. For a past comparison, UFC 257 + UFC 264 each drove more than 315,000 sign-ups thanks to having Connor McGregor fights on their cards, while week one of NCAA football drove nearly 250,000 sign-ups to the platform.

Disney+ added just 2.1 million new subscribers during the third quarter—taking its total to just over 118 million. It caused some analysts to re-evaluate Disney’s forecast of between 230 million and 260 million subscribers by 2024.

"Disney's focus on franchises led to excellent sign-up rates out of the gate, but we are increasingly convinced that the penetration of this fan base is close to saturated in launched markets," wrote Atlantic Equities analyst Hamilton Faber, according to Seeking Alpha. "While there are new geographies to come, we believe volume growth will disappoint."

Faber said that the Disney+ subscriber guidance for 2024 looks overly aggressive and cut his firm’s forecast to 218 million.