One-stop shopping. Gotta love it. To have everything you need in one place and the ability to plop down your credit card just once for your purchases.

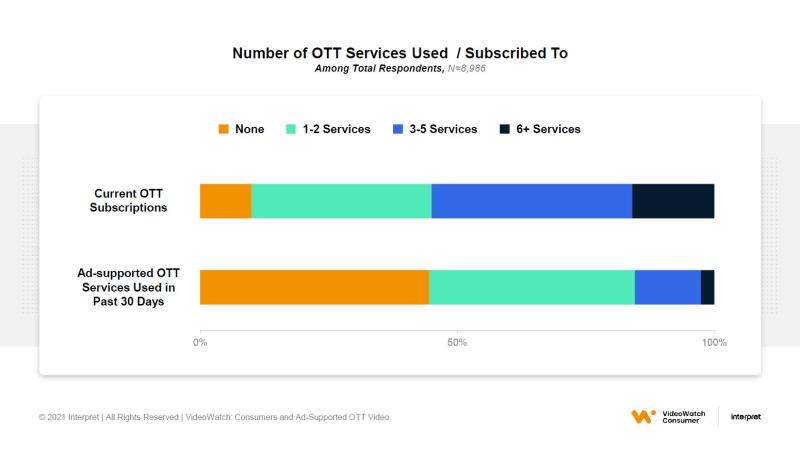

The video space fell away from this ideal a while back, largely with the backing of consumers who wanted options beyond pre-defined pay-TV channel packages…and continued the freefall as new OTT video services and an abundance of original content emerged. Consumers have gobbled up shows and movies from multiple subscription and ad-supported streaming services, each with its own account, library, and experience. Today, over half of U.S. consumers subscribe to three or more streaming services, and a similar number have watched an ad-supported streaming service in the past three months.

Frustration for consumers (and for services trying to attract viewers) largely stems from the consequences of all of this massive choice – with both hamstrung by friction in the experience. Essentially, popularity drives new services and content investment, which drives greater adoption and consumption, which exacerbates the challenge of massive choice.

As we have seen, after a long season of video disaggregation, the pendulum is slowly swinging back. A variety of market participants, from streaming giants to device makers to content discovery apps, are eagerly vying to be the new solution to the fragmentation problem.

Interestingly, while pay TV was the primary video service aggregation option in the past, multiple paths to aggregation have emerged in today’s streaming world. The variety of approaches are based on the core business, content licensing, service offerings, financial resources, market position and partnerships of each competitor. It’s a long list. But the multiplicity of factors explains why so many different types of initiatives are being tested in today’s video service market.

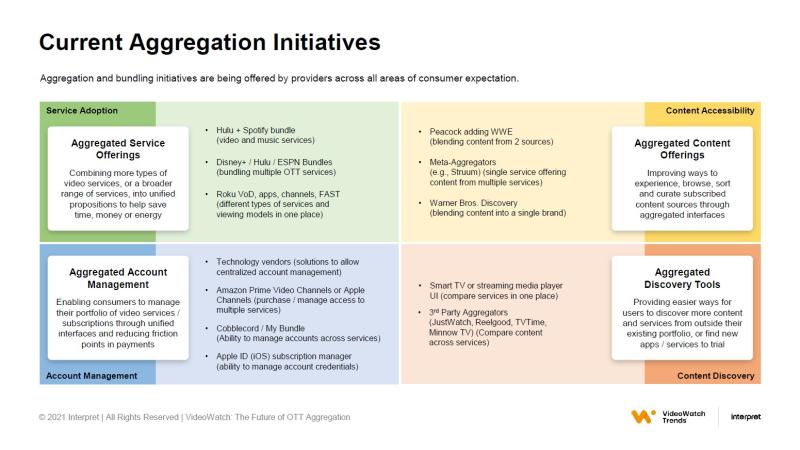

Aggregation initiatives today focus on four key areas, each addressing a unique consumer challenge: content accessibility, service adoption, account management, and content discovery.

Content availability speaks to the fragmentation of desired content across many services. Aggregation initiatives for this area focus or consolidating content under a single streaming brand. Adding content under a single banner, such as WWE content becoming part of Peacock or HBO consolidating WarnerMedia content under HBO Max, increases the potential target audience and offers more content for the same price. Services like Struum and VRV, provide an alternative, with selected content available from differing, independent streaming services.

Service adoption refers to the volume of subscriptions that consumers must accrue to get the content or experiences that they want, which subsequently drives greater switching/churn. Bundling, such as the Disney+/ESPN+/Hulu bundle, provides a single transaction at a lower overall cost and encourages consumers to maintain subscriptions to all three services. The Hulu/Spotify bundle is similar but crosses media types rather than streaming services. Roku, and other streaming devices and some services, offer different streaming formats (VOD, FAST, live content, transactional), providing one source to address differing use cases and viewing models.

Importantly, these two types of initiatives – content availability and service adoption – are the likely paths for consolidation of the industry – either to bundles of services or huge, aggregated libraries under a single brand.

Account management initiatives address the consumer need to manage a large portfolio of services, one of the most frustrating aspects of multi-subscription consumers identified in Interpret’s own qualitative and quantitative consumer research. Streaming marketplaces such as Amazon Prime Video Channels or Apple Channels enable centralized purchasing and some ability to manage accounts in a single interface. Each of these providers also offer their own streaming services and streaming devices. However, third party options are available as well. Technology vendors offer white label marketplaces for pay-TV, broadband, and mobile service providers that centralize OTT purchasing and account management into one interface. Independent services such as Cobblecord also allow consumers to consolidate subscriptions to simplify the experience.

Content discovery is a long-standing challenge for an industry that prioritizes content (and collectively spends tens of billions on streaming-first content each year). Streaming devices have a potential advantage here, primarily due to their common presence in homes and their position as the consumer’s gateway to viewing. While many have added cross-service discovery, getting consumers to prioritize the streaming device interface over individual service experiences is an ongoing battle. Third parties, such as Reelgood, JustWatch, and Minnow TV, also allow cross-service discovery and recommendations but are still growing customer awareness and use.

The various participants in the streaming marketplace are mixing and matching these approaches to find the right alchemy of utility, ease of use, and value that draw the masses. Their success will hinge upon several factors, including the scope/ number of streaming service partners (more is better), their focus on consumer benefits in aggregation, their scalability, and their willingness to share data (which attracts better partners).

Ultimately, aggregation will continue to grow around those ecosystems where consumers enjoy the best experience, users can find the most services, and industry participants can find mutually beneficial opportunities to work together. The pendulum is swinging, and will continue to swing, particularly as consumers frequent more services and seek that one-stop, easy-button content experience that they want.

Brett Sappington is Vice President at Interpret, where he leads the firm’s video entertainment practice for market research and insights. Information on the VideoWatch series of consumer and trend research is available here, along with complementary access to VideoWatch-related data and insights.