Global TV, video subscription and advertising revenue will keep on growing over the next few years and OTT will play a big role in that growth, according to Strategy Analytics.

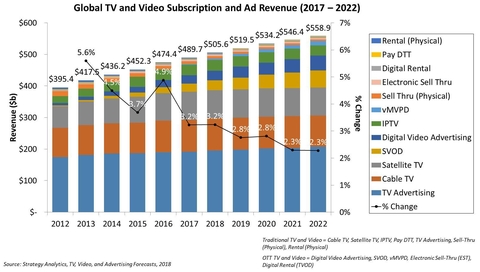

The research firm’s new figures project the total market revenue will hit $559 billion by 2022, up from $490 billion in 2017. Spending on OTT video will account for 90% of that growth. In all, consumer spend and digital video ad revenue from OTT video services will reach $123 billion by 2022.

“OTT TV and video services will be the driving force behind future revenue,” said Michael Goodman, director of television and media strategies for Strategy Analytics, in a statement. “However, traditional TV and video services should not despair too much, as they will continue to account for the majority of consumer and advertising spend for the foreseeable future.”

Indeed, consumer and advertising spend around traditional TV and video products will surpass $435 billion by 2022, and though that’s only a 7% increase over the total in 2017, it will still account for 78% of all TV and video revenue.

Forecasts showing traditional TV growing slower than OTT continue to pop up as U.S. cable and satellite providers keep shedding subscribers quarter after quarter.

RELATED: Editor’s Corner—What Comcast, Charter and others did to keep their customers in Q2

Leichtman Research Group said major pay TV operators lost 415,000 subscribers during the second quarter. The good news was that overall losses were the best they’ve been during a second quarter since 2014. The bad news is the top six cable companies lost about 275,000 video subscribers during the quarter—compared to a loss of about 190,000 subscribers in the second quarter of 2017.

By the time 2022 rolls around, North America will still be the biggest market for TV and video products, accounting for 38.7% of global consumer and advertising spending on TV and video.