Last week the big four U.S. broadcasters—ABC, CBS, Fox and NBC—all held their annual upfronts presentations. From the looks of things, all of them have reason to be confident moving ahead.

UBS recently surveyed 40 television advertising executives (responsible for around $40 billion of ad spending) and they offered a positive outlook on the recent upfronts.

“Panelists expect a very strong upfront. Demand for high quality TV inventory has never been higher. Volumes should be positive and broad based across ad categories (noted [consumer packaged goods], auto, pharma). Demand is benefiting from a general strong economy and tax cuts,” UBS wrote.

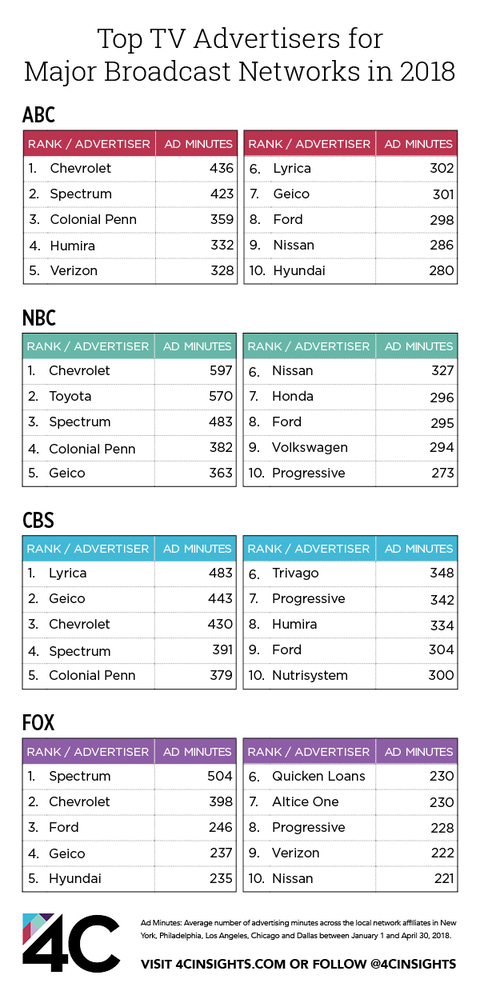

That’s good news because according to 4C Insights, auto and pharma have already been a big ad revenue factor for the big four through the first four months of this year.

According to UBS’ survey, NBC had the most impressive upfront presentation among the major broadcasters.

“Strong pitch focused on their high-quality content and safe environment for brands. NBC continues to benefit from their holistic view to selling advertising, bundling inventory across their entire broadcast and cable network portfolio,” UBS wrote.

Of course, all four big broadcasters showed off their lineups last week so let’s look at how each one did. For the sake of narrowing things down, we’ll pass over looking over how each broadcaster’s studios and cable networks fared and focus only on the broadcast networks.

ABC-Disney

ABC entered this year’s upfronts with a distinction it hasn’t been able to boast about for 24 years: the number one overall new show, thanks to the reboot of “Roseanne.”

Hit shows or no, ABC-Disney is currently under pressure as Comcast plots a competing bid for Fox’s entertainment assets.

“…Despite the runaway success of Disney’s Black Panther and Avenger films, the surprising ABC hit Roseanne, the improvement in sub trends at ESPN and the continued strength in parks and resorts, Disney has lost over $12 billion in equity value due to fears surrounding unknown potential higher costs of closing both the Sky and Fox transactions,” wrote MoffettNathanson analyst Michael Nathanson in a May 9 research note.

But that didn’t dampen the network’s enthusiasm over its new (old) hit.

“If anyone came to play a drinking game based on how many times we mention ‘Roseanne,’ you’re welcome,” Disney-ABC Television Group President Ben Sherwood said, according to Variety.

The network plans to use that show’s success as a lead-in for one of its new comedies, “The Kids are Alright,” and bookend it with the also popular “Black-ish” on Tuesday nights. Both Tuesday and Wednesday feature two new shows, helping to frontload ABC’s weekly fall schedule, which doesn’t include new shows on any other days except Sunday.

During a recent earnings call, Disney CFO Christine McCarthy said that company made another change before heading into upfronts.

“One of the things that is different is about a year ago we consolidated the ad buying or the ad selling through our Disney-ABC Television Group. So this is the upfront that they're up and running as a single sales entity. So we think that's also going to help our upfront sales,” McCarthy said, according to a Seeking Alpha transcript.

The company said earlier in May that quarter-to-date, primetime scatter pricing at the ABC Network is running 27% above upfront levels. So on both sides of the advertising equation, ABC appears to be trending upward.

CBS

CBS can already count on an advertising revenue boost early in 2019 when it airs Super Bowl LIII in February 2019. But the network is also counting on a bit of the same nostalgia kick working right now for ABC: this fall, CBS is bringing back “Murphy Brown” with much of its original cast, and it’s also rebooting “Magnum, P.I.,” with new actors—and a woman playing Higgins but the same red Ferrari.

Despite enthusiasm over its fall schedule including the return of its strong Thursday night comedies and a highly revamped Monday night, CBS is dealing with its own merger-related overhang. Just days before its upfronts, CBS launched all-out war against its majority owner National Amusements to thwart a would-be Viacom remerger and become more independent by diluting NAI’s shares.

“The decision to file a lawsuit indicates to us that CBS management and part of the board has effectively decided either to take control away from the Redstones and chart their own course or to in effect be removed. This is not too dissimilar to the course of action at Viacom sometime back when the board sued the Redstones, but the circumstances were different due to the ground of litigation as well as credibility of the management team at Viacom,” Barclays analyst Kannan Venkateshwar wrote in a research note.

Before the drama ensued, CBS was expecting scatter prices up 20% as it headed into upfronts. And CBS CEO Les Moonves said that having big events like the Super Bowl helps CPMs stay on the rise.

“…The top events, the sporting events, the live events, are still going to produce huge numbers. It's still the hottest thing in town. Even as ratings go down somewhat, or appear to go down because they're watching it on different platforms or different times, network advertising is still the best game in town. That's the reason scatter is up so much, and that's the reason we're looking forward to the upfront very much,” Moonves said, according to a Seeking Alpha transcript.

Fox

Unlike its competitors ABC and CBS, Fox entered upfronts not with a dark cloud over its head but with an intriguing future ahead as “New Fox,” the company that will be formed from what’s left after Disney (or Comcast) buys most of its entertainment assets.

“We want to welcome you to New Fox,” said Fox Television Group co-CEO Dana Walden, according to Variety. “This is an exciting opportunity for our network. We have an opportunity to chart a new course for broadcast television.”

But as the report pointed out, the schedule Fox laid out was very similar to what broadcast networks have traditionally presented: lots of scripted and sports in the fall and unscripted in the midseason and summer. Besides Friday night—where Fox is also reviving a show with former ABC comedy “Last Man Standing” next to new comedy “The Cool Kids”—the network is bringing back a whole lot of its shows. However, Fox could have an ace up its sleeve with its new NFL Thursday Night Football deal, which give the network all the games as opposed to the previous deal in which CBS and NBC split them up.

In the most recent quarter, Fox’s television segment took a revenue and OBIDA hit due to lower NFL postseason ratings and three fewer NFL broadcasts. Thursday Night Football could help plug similar holes like that in the future. And the television could need help keeping pace with Fox’s strong cable networks.

“While domestic cable adv grew 3% in F3Q on the back of higher pricing at FNC, we think TV adv declined mid teens ex. the impact of the SB. However, looking ahead we anticipate improvement in cable as FX has a stronger slate of originals and ratings appear to be strengthening at FNC. At the network, F4Q will be an important quarter as the market remains challenging,” Jefferies analyst John Janedis wrote in a research note.

Fox is predicting flat broadcast ad revenues for the remainder of the year, helped along by sports.

“So while we do have linear declines we are projecting internally and hopefully we'll do far better than this, declines on the linear side. Our sports ratings and revenue coming from sports should cover that. In addition, I would say we are also anticipating that declines in the linear side on entertainment will be captured really for the first time by increases in non-linear advertising. So it's that degree of confidence and that plan we have that leads us to flat on advertising overall,” 21st Century Fox CFO John Nallen said, according to a Seeking Alpha transcript.

NBCUniversal-Comcast

As if NBC would even consider being left out of the reviving canceled old shows revelry, the network jumped in with its own show save when it snatched up “Brooklyn Nine-Nine” just days after it was canceled by Fox. But it’s only holding the show until 2019.

NBC is, however, sprinkling in a few new scripted comedies and dramas over its fall schedule that’s already peppered with many returning series including “This Is Us,” “Blindspot” and “The Good Place.”

According to Variety, NBCUniversal ad-sales chief Linda Yaccarino told the audience during upfronts that her network’s content could be considered “premium,” particularly when stacked against content from digital competitors like Facebook.

But just to be sure that NBC can get a bigger piece of that ad money that’s going toward digital platforms’ more targeted ads, NBC in the months leading up to upfronts joined OpenAP, a cross-audience platform for selling targeted TV advertising formed in 2017 by Fox, Turner and Viacom.

As NBC wrestles with losing Thursday Night Football ad revenues and keeps pace with competitors like ABC that are surging in the entertainment category, targeted advertising could be an important weapon in its arsenal. Brett Hurwitz, business lead for advanced TV at Oath, said on-to-many advertising is limiting broadcast networks’ potential.

“While the recent moves made by networks are going in the right direction, they are still mostly limited to improving the quality of that one-to-many targeting. Instead, the stronger audience opportunity lies in more data-driven approaches,” Hurwitz said.