Redbox executives updated investors on how the newly public company plans to grow its digital revenues while still monetizing its legacy kiosk business, which CEO Galen Smith expects to last seven to 10 more years.

Smith and Redbox CFO Kavita Suthar spoke with Laura Martin, senior media and internet analyst at Needham & Company, highlighting traction in Redbox’s recently launched Advertising-Based Video on Demand (AVOD) and Free Ad-Supported TV (FAST) offerings, which Galen said are well-suited for the company’s existing value-conscious customer base.

Smith explained the company’s plan to launch an aggregated subscription video plan this year, saying Redbox wants to create a single destination where TV viewers can find content. “Our service provides single sign-on, single payment or billing and single app streaming, so it’s all in one place,” he said. Users will sign on to the Redbox app and see options to access traditional streaming services without entering any additional credentials.

The subscription service will launch during the first half of this year, Galen said, adding third party subscription video services will be added during the second quarter.

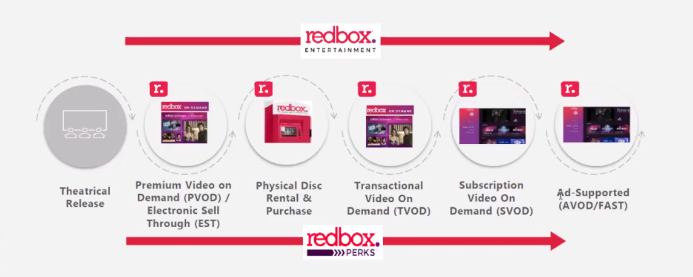

The CEO showed investors how Redbox is trying to capture content consumers at every price point and through every avenue, from Premium Video on Demand (PVOD) to FAST. He conceded the typical Redbox customer does not usually pay $19.99 to rent a new release on-demand, but said Redbox offers that option nonetheless. Redbox also offers the option to rent the DVD of a new release by reserving it through the Redbox app and picking it up at a kiosk.

When movies age out of the premium category, they are available through pay-per-view and through the Redbox kiosks. Soon, they will also be available on the company’s new subscription service.

Smith said the Redbox app has now been downloaded 43 million times. He explained the app started as a way for people to reserve new releases and pick them up at kiosks, and said the company is successfully using the app to transition kiosk users to digital services.

RELATED: Redbox links up with Roku, Walmart to offer streaming credits

The Redbox app also uses loyalty points to drive engagement, and Smith said 40 million people are now enrolled in Redbox Perks. “Redbox has 40 million loyal customers and the opportunity is to help them transition to digital,” he said.

Smith told investors the company’s legacy kiosk business still has legs, noting it remains the cheapest way to watch a new release. He and Suthar explained how Redbox is further monetizing the kiosks with the addition of advertising screens. Partner Velocity installed the screens on 4,000 of Redbox’s 40,000 kiosks, in exchange for a share of the ad revenue the screens can generate. Currently, only a third of the ads are placed by third parties and the rest are promotions for Redbox.

Suthar said Redbox is also leveraging its field service staff to earn extra revenue by servicing other infrastructure in addition to Redbox kiosks. For example, the staff services Amazon lockers, she said.

The CFO also updated investors on the impact of COVID on the movie supply chain, saying there were only 60 new titles in 2021, compared to 140 in a normal year, and that most of the new releases came in the fourth quarter. Suthar expects the cycle to return to normal this year.