The streaming video device market continues to evolve – amid growing consolidation around a handful of devices and platforms.

Amid a slowing economy and the threat of inflation, consumer spending slowed over 2022. Despite this, consumers remained invested in streaming video consumption, with a record-high 23% of internet households subscribed to nine or more services in Q1 2022, according to Parks Associates. The streaming device market is maturing rapidly as a result.

The use of streaming video services continues to rise, and people are viewing streaming video entertainment with the expectation that they can access their content whenever, wherever, and on whatever device they want. The increasing diversity of devices on which streaming video is consumed presents a rising challenge within the streaming video ecosystem. Parks Associates’ research reveals that 55% of US broadband households now own a smart TV. Additionally, 58% of those households use the smart TV as the device they access most frequently to watch streaming video. Further, 49% of US broadband households subscribe to four or more services as of Q3 2021. The research firm reports that companies should maximize their available market in this highly active and competitive business environment by supporting a varied mix of devices.

Both consumers and industry stakeholders are focusing on the smart TV as the entertainment centerpiece of the home. Though other platforms, such as game consoles, are still used to consume video, consumers are moving to the smart TV as their device of choice and secondarily towards streaming players. Similarly, advertisers, measurement companies, and other industry players now consider the smart TV as the key video consumption device in the home.

Competitive evolution today is as much about software and UX as hardware. Consumers are overwhelmed by streaming video choices and looking for devices to simplify their experience. Consumers frequently face a confusing overload of service and content choices, and the industry is competing to deliver evolved user experiences that address this via content-first interfaces, personalized super-aggregation, and more.

The smart TV and streaming media player markets are heavily stratified. Ecosystem giants and platform owners dominate today's streaming device market. Samsung, Roku, Amazon, LG, Vizio, and Google are the main players controlling the point of consumption and are expected to only become more powerful within the streaming industry over time.

As the market progresses in 2023 and beyond in particularly challenging economic conditions, a higher level of competition between major ecosystem and platform vendors is expected to benefit consumers. However, the streaming video device market has become increasingly unattractive for new entrants. Smart TV adoption is rising while streaming media players have plateaued; both remain important.

Game console adoption continues to trend downward, in contrast. Most TV models are now smart TVs, so the natural replacement cycle continues to drive incremental adoption. Smart TVs are the dominant video consumption device. Samsung has the most vital position in the smart TV market by a wide margin, while Amazon now leads the market for streaming media players, with Roku closely behind it.

Content owners and services are concentrating on smart TV and streaming media players as the main video consumption platforms in the home and refining their related strategies over time. Innovators/Early adopters are more likely to stream on a smart TV, while the Late Majority/Laggards are more likely to prefer SMPs.

Smart TVs are marginally better for remote controls and gaming—streaming media players are better for app stores and content searching. At the same time, smart TVs have been gaining ground over streaming media players in terms of performance and consumer perceptions. As smart TVs improve in performance and affordability, they are expected to be increasingly preferred over time. SMPs will inherently remain appealing to Laggards due to their lower relative cost, enabling new smart TV purchases to be inexpensively avoided.

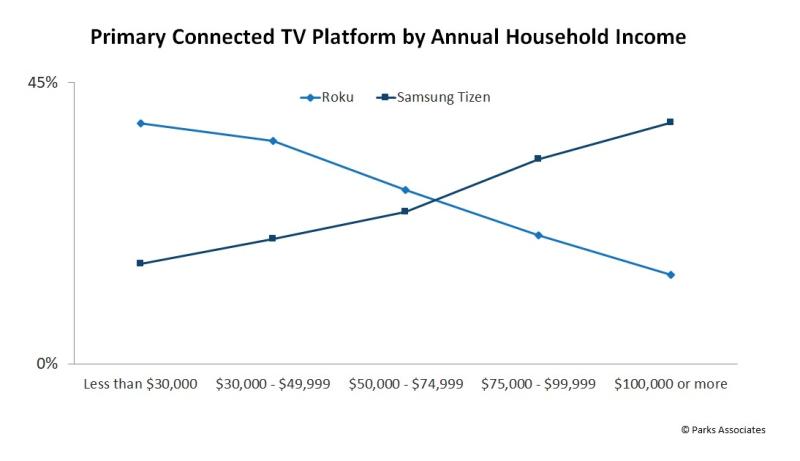

Platform integration and alignment of user bases influence service usage and subscription. Those using the Roku platform are more likely to access ad-supported services, aligning with the budget-based orientation of Roku's products and partners. Those using Apple and Chromecast are likelier to rent/purchase content, indicating the success of integration with iTunes and YouTube / YouTube TV. Those using the Fire TV platform are more likely to subscribe to Amazon Prime, and those using Apple TV are much more likely to subscribe to Apple TV+.

Industry strategy should leverage platform owners' unique advantages in their ability to drive usage and subscription of services, whether on their own or that of others.

Elizabeth Parks is president and CMO of Parks Associates. As President, Elizabeth supports all teams within Parks Associates, a woman- and family-owned market research and consulting firm. She oversees research topics and coverage areas for the company and directs the integrated strategic communications plan for Parks Associates, including advertising, public relations, and marketing. Elizabeth has supported the growth of Parks Associates business and marketing services for 23 years and is the key organizer for all of Parks Associates' events, including Parks Associates signature event CONNECTIONS™. She also drives the overall mission to provide clients with the best consumer and industry research and analysis on the SMB and consumer technology markets to inform strategic market decisions.

Elizabeth joined Parks Associates on a full-time basis after graduating from the University of Texas at Austin with a BA in psychology.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce Video staff. They do not represent the opinions of Fierce Video.