Streaming sports fans are significantly more engaged in livestreaming than viewers tuning in for news, concerts or other live events, according to new data from Parks Associates.

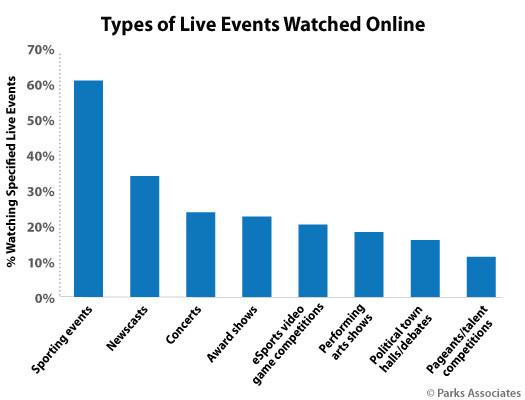

Of the 43% of U.S. households that have streamed live content online in the past three months, a full 61% had recently watched a live sporting event. That comes in well above the second most popular livestreamed category of newscasts, which captured 36% of streamers, followed by concerts at below 30%, according to Parks Associates.

Paul Erickson, director of research at Parks Associates, said in a statement that consumers who subscribe to a premium pay TV sports package or an online sports streaming service are more likely to livestream.

“Right now, sports content is key to drawing and keeping an engaged livestream viewer base. Even with content that benefits from live consumption – such as news and concerts – significantly fewer consumers are livestreaming this content compared to sports,” Erickson stated. “The sports audience is significantly more engaged in livestreaming as a whole."

He also noted that by offering a livestream option for content, service can draw in the highly engaged heavy livestreamer audience and livestream-centric older audiences.

“Consumers in the higher age brackets can be difficult to target, but livestreaming is one option that appeals to them, provided the provider delivers the right content,” Erickson continued.

The report showed that a full 78% of those who subscribe to an OTT sports service have livestreamed, compared to just 25% of those who don’t have an OTT sports service subscription. It also pointed out that livestreaming is the primary way many consume content, estimating that live content makes up close to 50% of total online video consumption for consumers who livestream. For those that are heavy livestream viewers, on-demand content makes up just over 25% of their online video viewing.

Several streaming services are placing a bet on major league sports content as a way to attract new viewers. Apple, for example, kicked off its Friday Night Baseball weekly livestreamed double header last month, and is reported to have nabbed rights for NFL’s Sunday Ticket package (which could cost as much as $2.5 billion per year).

In a recent column for Fierce Video, TVREV co-founder and lead analyst Alan Wolk said Apple should take a bow.

“Going after sports was a very smart move as sports fans are loyal viewers,” he wrote, noting that the NFL win would establish Apple as a key source for sports programming along with its MLB deal.

“More than that, it gives viewers a reason to subscribe to Apple TV+ once they’ve finished watching Ted Lasso and, when combined with the low $5/month price tag, should help to reduce churn,” said Wolk.

Other streaming services are also scoring live sports, like NBCUniveral’s Peacock, which now has exclusive MLB games in a new Sunday morning slot, after broadcasting the Super Bowl and Olympics earlier this year. DirecTV Stream, meanwhile, made recent technical tweaks to improve its sports programming, as it plans to “lean into sports.” Some upgrades include allowing users to record an entire season of their favorite sports teams and updated game tiles so viewers can find games more easily, along with more control over seeing live scores.

There are also sports groups with their own efforts such as FIFA, which last month launched a new free ad-supported service FIFA+, which combines live coverage of some matches and other content. It doesn’t replace existing streaming deals, including Fox Sports UEFA soccer agreement with fuboTV that gives the sports-centric virtual MVPD exclusive U.S. rights as part of a six-year pact.

However, with sports programming fragmented across a variety of platforms, some cord cutters are being pushed back to cable, particularly for access to local and regional sports channels. A recent video trends survey report from TiVo found that 29% of people who switched back to cable or satellite from streaming said they did so because traditional pay TV was the best way to watch live sports.