The sports streaming market is poised for continued growth in 2023, with SVOD services expected to spend $8.5 billion globally on sports rights, per new data from Ampere Analysis.

The rise in spend – a 64% increase from $5.2 billion in 2022 – is indicative of more general entertainment services leveraging live sports to stand out from other streaming competitors. The NFL’s multi-year deals with Amazon and YouTube arguably shifted the tide for sports streaming, Ampere noted, as both agreements represent the largest signed sports streaming deals to-date.

The NFL is far from the only league involved in sports streaming, as Major League Soccer plans to kick off its regular season this week on Apple TV, which is home to the new MLS streaming service. The NBA is also reportedly looking into streaming options for its games.

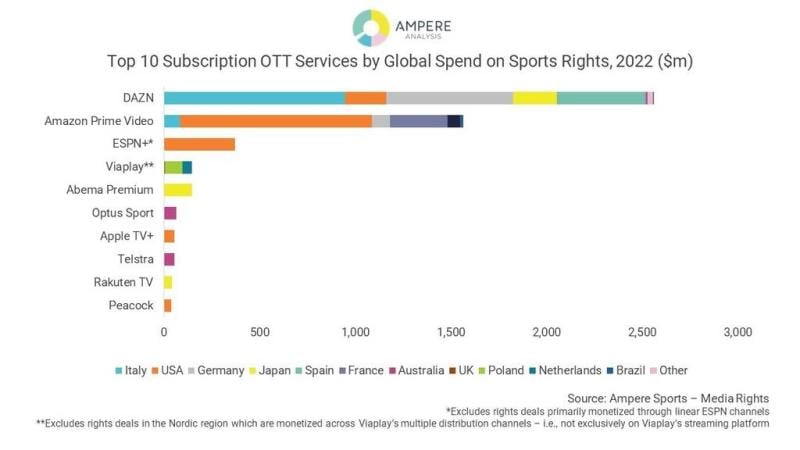

Sports streaming service DAZN accounted for more than half (54%) of what all OTT subscription services spent on sports rights in 2022. In its 2022 annual review, DAZN disclosed it added over 75 sports rights to its platform last year and is now the largest digital sports broadcaster in Europe. Most of DAZN’s sports rights spend was concentrated in Italy, according to Ampere.

Amazon Prime Video nabbed second place in sports rights spend for 2022, with the bulk of its spend targeted in the U.S. Of the nearly $17 billion the e-commerce giant allocated last year towards video and music content, $7 billion went to original content, live sports and third-party video content.

All told, general entertainment services made up six of the top ten services in Ampere’s ranking.

The firm added while streamers’ investment in sports has typically lagged original content spending, technology advancements have bolstered demand for sports streaming.

However, it will take time before sports will fully transition to streaming, said Ampere Analysis Research Manager Jack Genovese. That’s partly due to the nature of sports rights deals, which typically span multiple years.

“It is also due to the sheer value of sports rights, and the sensitivities characterizing the distribution and consumption of sport,” stated Genovese. “The need for high quality, low latency feeds will continue to favor risk-averse behavior among broadcasters and rights owners alike.”

Live streaming has plenty of kinks that need to be worked out, as Applause CTO Rob Mason recently explained to Fierce, as streamers must ensure latency and video quality are up to par. Streaming lag time is particularly prevalent for large-scale events like the Super Bowl.

“However, streaming will offer opportunities for sports to experiment with content, distribution and monetization, which will revolutionize the way in which sports rights are sold and bought in the future,” Genovese added.

While sports rights spending picks up, original content will continue to thrive. Nearly one-third (28%) of original content spending in 2022 came from streamers like Netflix, Prime Video, Disney+ and Apple TV+, Ampere said. And as it turns out, most streaming originals are based on pre-existing IP or franchises to attract more consumers.

For 2023, Ampere has predicted Disney and Warner Bros. Discovery will lead the race in original content spend, investing $10.5 billion and $9.5 billion, respectively.