Streaming services led by Netflix are helping to push total global content spend past $220 billion in 2021, up 14% year over year, according to Ampere Analysis.

The research firm said that content spending by commercial and public service broadcasters rebounded in 2021 after taking a hit in 2020 due to advertising spend decreases and production halts during the earlier phases of the COVID-19 pandemic. However, content spend by among broadcasters still remains below 2019 levels due to viewing shifts to online video and lingering economic effects.

At the same time, subscription OTT services grew overall investment in content by 20% in 2021 to nearly $50 billion. Ampere said that Apple TV+, Disney+, HBO Max, Peacock and Paramount+ have expanded rapidly and together through their original content strategies contributed more than $8 billion to content spend in 2021.

"In 2022, we expect content investment to exceed $230 billion, primarily driven by subscription streaming services, as the battle in the original content arena intensifies – both in the US, but also in the global markets which are increasingly key for growth,” said Hannah Walsh, research manager at Ampere Analysis, in a statement.

RELATED: Disney plans to raise its content spending by $8 billion in 2022

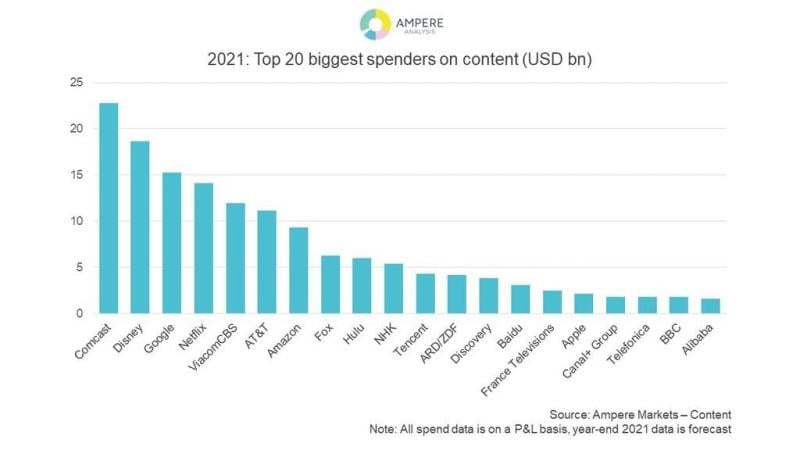

Despite the growth among its competition, Netflix keeps on dominating the SVOD content spending market, accounting for 30% of total SVOD content spend and 6% of total global content investment in 2021, according to Ampere. That makes Netflix the third largest content investor with $14 billion in total spend behind Comcast and its subsidiaries ($22.7 billion) and Disney ($18.6 billion).

“Comcast and Disney invest heavily in sports rights, which —alongside their hefty investments in original content — contributed to their leading positions in the table. Sports rights made up of over a third of both Comcast and Disney’s spend in 2021,” said Walsh.

Disney revealed earlier this year in a regulatory filing that it intends to expand its content budget by $8 billion in 2022. That projected figure covers produced and licensed content including sports rights but Disney said the increase is also driven by higher spending to support its direct-to-consumers services including Disney+, Hulu and ESPN+.