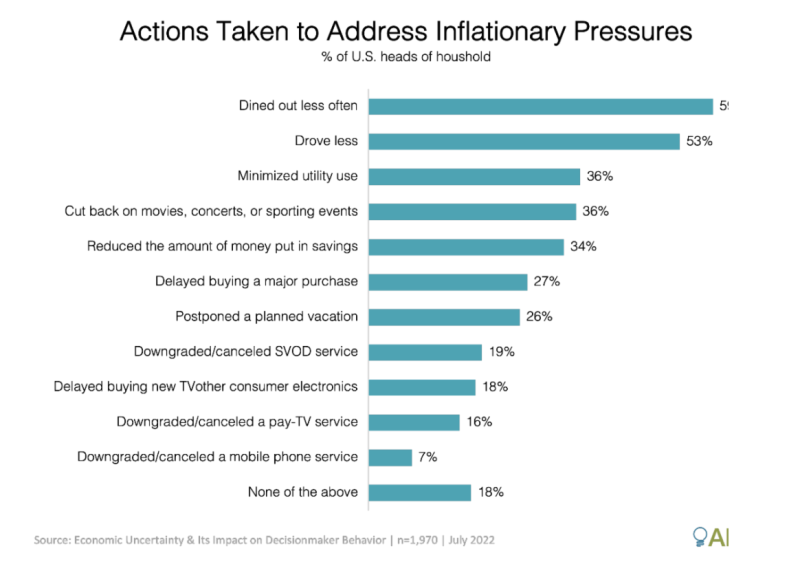

More than one in four American households (26%) has responded to inflation by taking a scalpel or a scissors to their TV budget in the last six months, according a new survey released Thursday by Aluma Insights.

The Fort Collins, Colorado, media consultancy found that 19% of respondents had downgraded or canceled a subscription video on demand (SVOD) service in the last six months, while 16% had downgraded or canceled a pay-TV service.

“Domestic TV and video subscription growth was slowing before the recent wave of inflation,” Michael Greeson, Aluma’s founder and principal analyst, said in its press release. “But the rising costs of consumer goods and services, as well as housing, added fuel to the fire, putting even more pressure on consumers to reduce these expenses.”

In an email, Greeson said he expects that most of these household budget-cutting exercises involved trimming a service.

“I believe the majority of the 26% that reduced SVOD or pay-TV expenses were downgrades, not cancellations, though cancellations during this time were validated by not only continued pay-TV losses but Netflix shedding several hundred thousand domestic subscribers,” he wrote.

Aluma’s research found that the 25-44-year-old demographic was most likely to cut or curtail a video subscription, with 28% doing so for SVOD and 19% for pay TV. Households with incomes under $30,000 a year were about as likely to cut their video budgets: 27% downgraded or canceled an SVOD service and 23% did so with a pay-TV service.

Greeson said in the release that if inflation continues at its July 2022 rate (in an Aug. 15 update, the Bureau of Labor Statistics found it hovering at an annual rate of 8.5%), video services could expect more of the same.

Both pay-TV and SVOD services have had their own inflationary spiral in recent years, with increases in programming costs leading to rounds of rate hikes at such services as Comcast and Netflix.

But with inflation higher than average in food and energy, Aluma’s survey found the biggest cutbacks in activities most closely tied to those industries: 59% of households reported dining out less often, while 53% said they drove less.

Aluma’s release said these figures were “drawn from a July 2022 survey of 1,970 U.S. heads of household.” Greeson explained via email that the survey was conducted online over 10 days based on a double opt-in panel of consumers, adjusted to match Census Bureau data on the age, income, education, gender and race/ethnicity of heads of households.