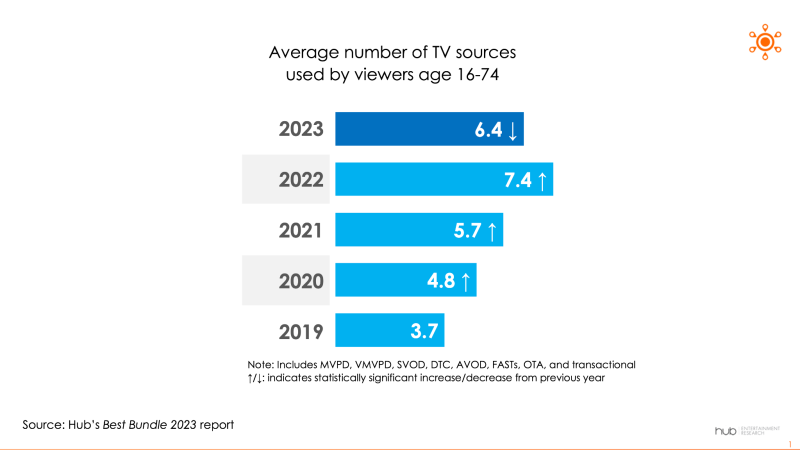

Over the past five years the number of TV sources consumers use has been on an upward trajectory, but data from Hub Entertainment Research shows a new reversal in that trend – with viewers now stacking fewer video services than they did in 2022.

Hub’s annual “Best Bundle” survey found the number of video sources viewers use has dropped from 7.4 to 6.4, reflecting a relative decline of 14% from 2022. The drop comes after a couple of years of strong growth for subscription stacking, with viewers doubling their amount of TV sources between 2019 and 2022 from 3.7 to 7.4.

According to Hub, reasons for the decline are varied but the firm cited inflation and perceptions about the economy as the likely primary reasons. One key question that remains is whether it’s a short-term or long-term trend, Hub noted.

The survey found similar 7% declines in both traditional TV and streaming contributed to a drop in video stacking. Compared to 2022, viewers that reported having an SVOD service dropped from 89% to 82%, while those citing a traditional MVPD TV subscription declined from 62% of viewers to 55%. Virtual MVPDs didn’t show any statistically significant change.

Bolstering Hub’s findings of a subscription stacking trend reversal for subscription video on-demand (SVODs) is that a smaller share of viewers now say they subscribe to three or more of the top five – meaning Netflix, Hulu, Amazon, HBO Max or Disney+. Last year, half (50%) of consumers cited three or more subscriptions to the “Big 5,” a figure that’s dropped to 42% in 2023.

Some in that group are gearing up to combine separate services into one offering or app. That includes Warner Bros. Discovery, which later this month will launch its Max service – pulling together content from Discovery+ and HBO Max into a single platform. WBD has already said it won’t raise prices on ad-lite and ad-free versions of the Max service compared to HBO Max today, but will introduce a premium tier priced at $20 per month.

Disney, meanwhile, on Wednesday disclosed plans to integrate Hulu content within a single Disney+ app before year-end. It’s also planning another price bump for Disney+ in 2023 – to boost subscription revenue but also to drive some customers to the cheaper ad-supported plan on Disney+, which helps generate advertising revenue. Discovery+ and Hulu will continue to be offered by WBD and Disney, respectively, as standalone services.

As consumers start to limit the number of TV subscriptions they pay for, the share of viewers using free ad-supported streaming TV (FAST) services, perhaps unsurprisingly, has remained steady since last year at around 57%. Hub noted that free services are rising in importance to consumers who are more wallet conscious amid inflation concerns and economic uncertainty.

“Booms don’t last forever, and inflation and economic worries may have finally slowed the roll of consumers looking to stack traditional and streaming subscription TV services,” said David Tice, senior consultant to Hub and co-author of the study, in a statement. “However, FASTs have maintained their momentum this year; in a time of economic uncertainty, ‘free’ is a powerful differentiator.”

Other recent findings from LG Ads also pointed to consumers tightening belts around streaming subscriptions and turning to free ad-supported options as cost becomes a bigger factor. The survey, released in April, from LG found 46% of respondents reported canceling a streaming service because of economic concerns, while 63% said they prefer to stream free content rather than paying for a subscription. And over the next 12 months 32% said they plan to remove certain CTV subscription services, and 21% said they plan to add FAST options.