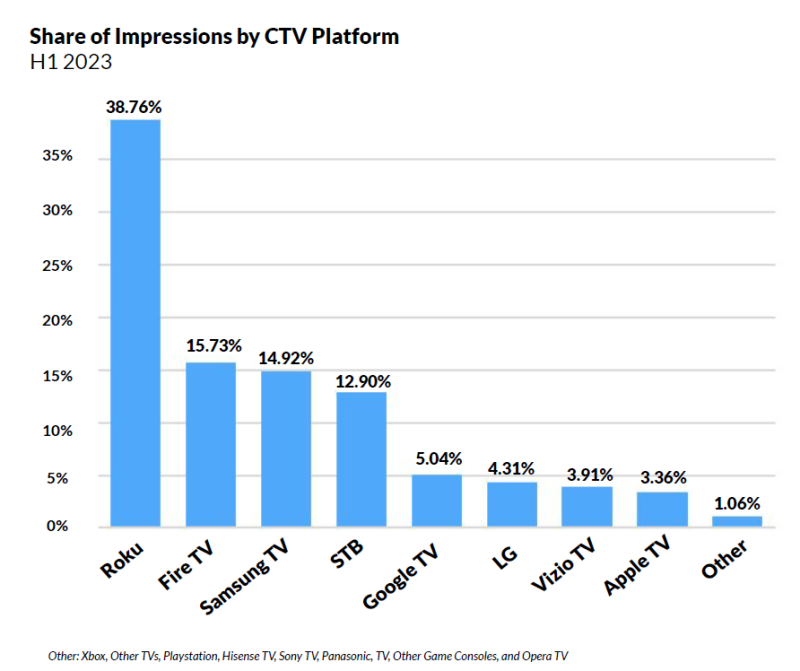

Roku in the first half of 2023 continued to dominate as the platform leader by far in terms of share of connected TV ad impressions facilitated by sell-side ad platform Beachfront.

In its H1 2023 Insights report, Beachfront disclosed Roku accounted for a nearly 40% share of CTV ad impressions, similar to its performance in the second half of 2022. While still the dominant platform player by share of CTV ad impressions, Roku just last week disclosed plans to slash 10% of its workforce as it looks to curb rises in year over year operating expenses. In addition it’s pulling certain content from its company-operated services, specifically at least 37 original shows from its free ad-supported streaming TV (FAST) service The Roku Channel as part of cost cutting efforts.

As for CTV ad impression share, Roku was followed by Fire TV, which had close to 16% share of ad deliveries in the first half of the year. Rounding out the top three platforms and a leader among smart TV makers was Samsung TV, with a nearly 15% share of CTV ad deliveries. Google TV, LG, Vizio and Apple TV also landed among the rankings all with 5% or less share of CTV ad impressions. Samsung, LG and Vizio continued to see their share of ad deliveries rise compared to the second half of 2022, consistent with a trend for standalone devices and smart TVs seen in Beachfront’s previous half-year CTV report.

According to Beachfront, the most notable insight from the dataset was a downtick in ad impression share for set-top boxes, which at fourth garnered just under 13% share. That’s a decrease from the 19% share STBs held in the second half of 2022. While set-top boxes’ share dipped Beachfront noted that the number of impressions Beachfront delivered within STB environments increased overall, reflecting growth within the programmatic and CTV ecosystem broadly. Google TV also climbed notably (up from the 2% share in 2H 2022), but bolstered as a result of Beachfront now combining Chromecast and Google TV into one category.

Beachfront said its CTV marketplace “saw a considerable surge in CTV inventory scale” at the start of 2023 “driven by the addition of new, high-volume premium supply sources.” Beachfront noted that the influx of premium CTV supply within its platform in the first six months of 2023 contributed in part to the shifts in share compared to the last six months of 2022.

Although the start of the year saw the advertising industry impacted by economic uncertainty, Beachfront found CTV advertising continued to build on growth, with the number of advertisers investing in CTV rising by early 4% in 1H 2023 compared to the back end of 2022. Some brand categories are leaning more heavily into CTV, including CPG (consumer package goods) activity, including Food & Drink and Style & Fashion brands, where Beachfront saw strong increases on the back of retail media growth.

Contextual content transparency improves

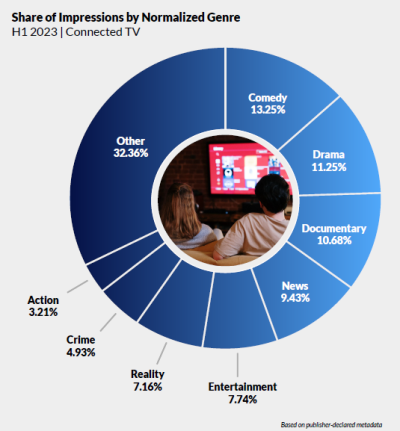

As more brands look to invest in CTV, Beachfront also highlighted improvements to challenges that have created friction for buyers – including more transparency and context around content including genres.

The sell-side ad platform said its CTV marketplace captured a genre signal on more than 80% of delivered impressions in the first half of 2023, representing “meaningful growth” compared to prior half-year periods. Beachfront delivered impressions across more than 70 normalized genres, with Comedy surpassing Entertainment as the top genre in terms of share, with more than 13%. Drama came in second at above an 11% share, outpacing Documentary and News categories.

Additionally, there were also lifts in CPMs – on average 27% - for impressions that included a genre in the bid request, compared to those that did not. The largest CPM increases were seen in the categories of Documentary (30%), Drama (28%) and Comedy (22%).