National TV ad impressions dropped 3.5% in 2022 to 8 trillion across linear, streaming and local programming, according to a year-end report from iSpot.tv.

The 8 trillion impressions measured by iSpot came alongside an estimated $45.36 billion in national TV ad spend, up 6.1% year over year.

Although 2022 saw some advertiser pullback amid concerns over inflation and macroeconomic downturn, iSpot said viewership and investment in TV continued.

“Traditional linear TV still delivered a massive amount of reach and engagement to advertisers: trillions of ad impressions, hundreds of thousands of new commercials, thousands of brands and hundreds of industries all found their way into the homes of viewers,” iSpot.tv noted in the report.

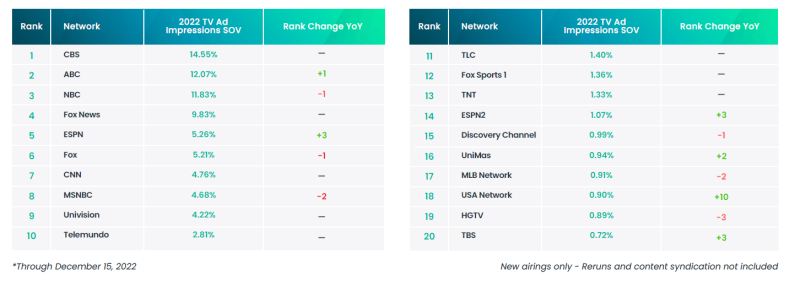

In 2022 ad completion rates for all of the Big 4 broadcast networks stayed above 98% for another year. CBS led as the top network by ad impressions SOV at 14.55%, followed by ABC (12.07%) and NBC (11.83%). Fox News and ESPN also made it into the top five, with the latter climbing three spots to beat out Fox network. Fox, which was the only Big 4 broadcast network to not make it into the top five, declined one spot to land in sixth with 5.21% of TV ad impressions in 2022.

Figures are through December 15, 2022, and include new airings only, not reruns or syndicated content.

iSpot said that USA Network got the biggest boost from live sports, as the network jumped 10 spots to land in the top 20 at number 18. iSpot cited the Olympics as helping to drive the year over year gains for USA Network.

Sports continued to dominate and drive the top national ad deliveries, with the NFL leading the pack at 6.55% - more than double that of the next closest - college football at 3.11%. NBA was third at 2.17%.

The NFL’s TV presence continued to grow in 2022, per iSpot, with the NFL Playoffs accounting for over 18% of TV ad impressions in January and live games making up 11.82% of TV ad impressions during September.

“With a longer regular season and expanded playoffs recently, the league increased its share of TV ad impressions 12% vs Jan. 2021 and 25% vs. Jan. 2020. That trend should continue for 2023 as well given increases seen during the 2022 regular season to-date,” iSpot noted.

Last year saw key NFL games shift to streaming, most notably Thursday Night Football, which kicked off its run on Amazon Prime Video last fall under a deal that runs through 2033. However, viewership hasn’t necessarily followed, with the Sports Business Journal reporting the service averaged 9.5 million viewers for its first season as the exclusive home of the sports package. According to SBJ, that’s a 41% audience decline from the 16.2 million viewers TNF garnered on average in 2021 when Fox, the NFL Network, Amazon and local broadcast channels shared rights. Still, Amazon says it’s pulling in younger viewers, with its lowest median age for a full season since 2013 and around seven years younger than the average audience on the NFL’s other sports packages.

This year more NFL coverage is moving to streaming. Just ahead of the New Year, YouTube secured exclusive rights to the league’s coveted Sunday Ticket package. Starting with the 2023 season live, out-of-market Sunday afternoon games will be available as an add-on and a la carte option on virtual MVPD YouTube TV and YouTube Primetime Channels, respectively.

As for 2022 ad impressions, SportsCenter also saw gains as the program climbed four spots to land at number seven, per iSpot, as ad impressions grew 38% year over year, due in large part to a 70% increase in ad minutes.

Also making their way into the top 10 for programs by share of ad impressions, per iSpot, were Good Morning America, Men’s College Basketball, Today, MLB, The Young and the Restless, and ABC World News Tonight.

Although MLB remained among the top 10, iSpot data found TV ad impressions for the MLB playoffs dropped 7% year over year during first-airing games. The report noted that the postseason audience can rely more on teams with the biggest fan bases advancing in competition, which didn’t happen in 2022.

CBS held as the network with greatest share of ad impressions and its CBS Mornings program also saw a huge year over year boost. The morning program didn’t make it into the top 10 but propelled 54 spots to number 14, capturing a 0.94% share of TV ad impressions.

Domino’s was the brand with the most TV ad reach, and the sixth biggest spender. Other brands with the largest reach by ad impression in 2022 were Liberty Mutual, Progressive, Geico and Subway.

And animals remained a fan favorite among viewers last year, with the most likeable ad of 2022 coming from Chewy.com. It’s “Chatty Pets: Lenny & Leroy” spot garnered 2.3 billion ad impressions and snagged the highest likeability score. A heartfelt spot from PetSmart was the second most-liked creative of the year, with Dawn in third for an eco-focused spot.

“Looking ahead to 2023, CTV is bound to reach new heights as ad inventory grows and brands turn to the channel to drive greater efficiency in TV budgets. The most successful TV advertisers will be those that lean into ad-first, cross-platform measurement for verification of audience reach, creative effectiveness and the business impact of ad investments,” iSpot concluded.