Now that the second-quarter earnings season is in the rear view, it's time to assess the damage. FierceCable has assembled a complete look at the results, ranking the top cable, satellite and telco pay-TV operators and offering a look at their performance in a number of key metrics, including subscriber growth and average revenue per user (ARPU).

How the top 7 U.S. pay-TV operators performed in Q2 in video (ranking by subscribers)

Operator Video subs (mil.) Net adds Q1 ARPU

1. AT&T 25.172 (199K) $121.16

2. Comcast 22.516 (33K) $151.19

3. Charter 16.646 (90K) $82.58

4. Dish Network 13.332 (196K) $87.25

5. Verizon 4.666 (15K) n/a

6. Cox 4.132 (8K) n/a

Source: IDC US Consumer Multiplay and Broadband Services

Cord cutting was bad … but not as bad as expected

Cord cutting achieved record level in the first quarter, but the final tally didn’t come in as bad as some analysts had predicted.

According to SNL Kagan’s definitive tally, linear pay-TV operators lost 976,000 customers in the second quarter.

Analysts had pegged the second-quarter attrition to exceed 1 million, with Wells Fargo’s Marci Ryvicker suggesting it could go as high as 1.28 million.

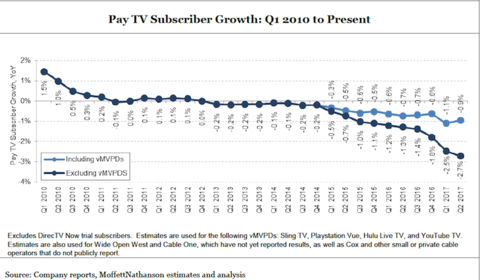

The rate of decline for linear pay-TV services reached 2.7%, close to the predicted 2.8%, said Moffett Nathanson analyst Craig Moffett. The rate worsened from 2.5% in the first quarter. However, the acceleration of decline slowed, with the first quarter’s 2.5% rate having quickened from 1.8% in the fourth quarter of 2016.

Losses were clouded by a number of factors, not the least of which was the emerging virtual MVPD market, with operators like Dish Network not disclosing how many customers its traditional satellite business is losing and how many subscribers its virtual service, Sling TV, is gaining.

“To put it politely, the data sucks,” Moffett said in his note to investors. “Some vMVPDs report data, some don’t. Some include free subscribers still in their promotional windows, and some don’t. Some are included in recent periods but not in older ones. So take the vMVPD data with a grain of salt.”

Cable operators gathered more wireline broadband share, but growth slowed

The top six cable companies added 461,997 high-speed internet customers in the second quarter, while the top seven telcos lost 233,260 HSI users over the three-month span. The top cable operators now control 63.6% of the residential wireline broadband market, according to Leichtman Research Group.

The pace of cable's HSI customer acquisition, however, slowed 17% year over year in Q2.

"Cable companies added about 3.1 million broadband subscribers over the past year, while Telcos had net losses of about 550,000 broadband subscribers," said Bruce Leichtman president and principal analyst for Leichtman Research Group, in a statement. "At the end 2Q 2017, cable had a 64% market share vs. 36% for Telcos. The broadband market share for cable is now at the highest level it has been since the first quarter of 2004."

Here's how the top cable operators fared in wireline broadband in Q2, according to LRG:

Net HSI adds in Q2

Comcast 175K

Charter 267K

Cox 15K*

Altice USA 2K

Mediacom 6K

WideOpenWest (1.4K)

Cable One (1.6K)