Now that the fourth-quarter earnings season is in the rear view, it's time to assess the damage. FierceCable has assembled a complete look at the results, ranking the top cable, satellite and telco pay TV operators and offering a look at their performance in a number of key metrics, including subscriber growth and average revenue per user (ARPU).

Notably, the video business seems to be a little less profitable than it used to be, and not just because there are less customers to go around due to cord cutting. AT&T, for example, produced an average revenue per video customer of $128.06 in the fourth quarter of 2016, but saw that figure fall to $126.65 in the fourth-quarter 2017. Dish Network, meanwhile, saw its ARPU fall from $88.66 to $86.43 over the same span.

Both operators are aggressively growing lower-margin virtual MVPD services at the expense of their satellite TV platforms, which are both in steep decline. In fact, both AT&T and Dish reported customer gains in the fourth quarter, driven by the growth of vMVPD services.

How the top 7 U.S. pay-TV operators performed in Q4 in video (ranking by subscribers)

Operator Video subs (mil.) Net adds Q3 ARPU

1. AT&T 25.244 161K $126.65

2. Comcast 22.357 (33K) $151.49*

3. Charter 16.544 2K $85.13

4. Dish Network 13.242 39K $86.43

5. Verizon 4.619 (29K) n/a

6. Cox 4.115 (12K) n/a

7. Altice USA 3.406 (24K) $140.20*

Source: IDC US Consumer Multiplay and Broadband Services

The U.S. satellite TV business has suddenly collapsed

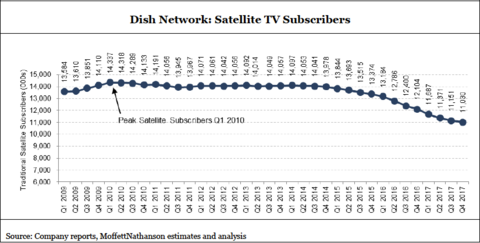

One of the more interesting stories from the fourth quarter was the quickening collapse of the U.S. satellite TV business.

Dish Network broke out subscriber metrics for its three-year-old Sling TV platform for the first time, revealing growth of 161,000 customers in the fourth quarter, bringing its total to 2.2 million.

But Dish lost more than 1 million satellite TV customers in 2017, with its base falling to 11.030 million users vs. a peak of 14.357 million back in 2010.

For its part, though it has been growing vMVPD DirecTV Now, AT&T lost 1.159 million linear pay TV customers in 2017, the bulk of them coming from the satellite side. DirecTV satellite losses approached 150,000 in the fourth quarter.

Overall, Dish and DirecTV lost around 268,000 satellite TV subscribers in the final three months of 2017, Evercore ISI analyst Vijay Jayant estimated.

Cord cutting actually improved in Q4 ... thanks to vMVPDs

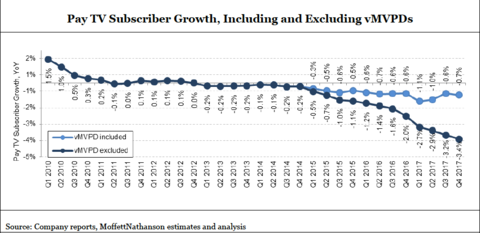

While the blood loss to linear pay TV services approached 3 million in 2017 and was never worse, the rate of decline actually slowed in the fourth quarter.

Linear pay TV services lost 560,000 customers in the fourth quarter, a 23% blood-loss increase over the fourth quarter of 2016, according to estimates published by Jayant. But it was a marked improvement over the hurricane-impacted third quarter, which saw U.S. cable, satellite and IPTV platforms lose 943,000 customers, a 40% year-over-year uptick.

Meanwhile, virtual MVPD services continued to grow, adding 773,000 users in the fourth quarter and largely masking the continued losses of traditional services. According to MoffettNathanson analyst Craig Moffett, OTT subscribers are "padding the totals" for satellite TV carriers, in terms of subscribers and revenue.

"What's growing is the number of vMVPDs," he said. "By our admittedly rough estimates, the number of vMVPD subs in the U.S. has jumped by 2.6M over the past year, and by nearly 800K over just past quarter, to about 4.6 million.

Dish and DirecTV, he said, aren't seeing a benefit to their bottom lines because of this growth.

"Dish Network and AT&T's Entertainment Group (which includes DirecTV Now) announced Q4 revenue growth of ... well, OK, their revenue growth wasn't very good, coming in at -5.4% and -3.5%, respectively. But at least they're making money! Well, come to think of it, their EBITDA growth was pretty bad, too, coming in at -21.5% and -11.2%, respectively."