Ampere Analysis predicts direct-to-consumer streaming businesses of all major U.S. media companies – sans any sports streaming operations – will achieve consistent profitability within 18 months.

In analysis released Wednesday, the firm pegs Disney as poised to get there first (as early as calendar Q1 2024) but followed in short order by Warner Bros. Discovery (predicted profitability by Q3 2024), with Paramount and NBCUniversal close on others’ heels (both projected to reach the goal by Q1 2025). It should be noted analysis of NBCU only takes into account U.S.-based Peacock streaming operations and not Comcast’s traditional pay TV-led services or Sky Showtime. And taking sports out of the equation is another significant caveat.

The firm noted some streaming businesses have already posted modest profits (for example, Warner Bros. Discovery’s DTC segment, which includes Max and Discovery+ generated $50 million profit during the first quarter of 2023) but Ampere’s analysis is focused on consistent profitability. The analysis considered subscription and advertising income against content costs, staff and marketing costs, depreciation and amortization, to predict when business will reach consistently positive EBIT (earnings before interest and taxes).

Ampere highlighted that as investor sentiment towards direct-to-consumer streaming soured, media companies turned greater attention on profitability, including implementing cost cutting measures – primarily related to content spend rationalization and staff reductions.

“A confluence of factors as varied as the end of Covid-19 lockdowns, geopolitics and the cost-of-living crisis created the environment that forced the studios to reassess the return on investment of the streaming direct model,” said Guy Bisson, executive director at Ampere, in a statement. “The cost rationalization of the last 12 months has now positioned the industry for genuine streaming profitability in relatively short order.”

Disney, for example, in its most recent earnings report grew DTC revenue 12% year over year to $5.04 billion, while narrowing DTC operating losses substantially to $420 million (compared to $1.4 billion DTC losses in the same period a year prior.) Disney’s DTC operations include Disney+, Hulu and ESPN+. The company in 2023 implemented a broader cost-cutting initiative that included cutting 7,000 jobs globally and put it on track to slash costs by roughly $7.5 billion.

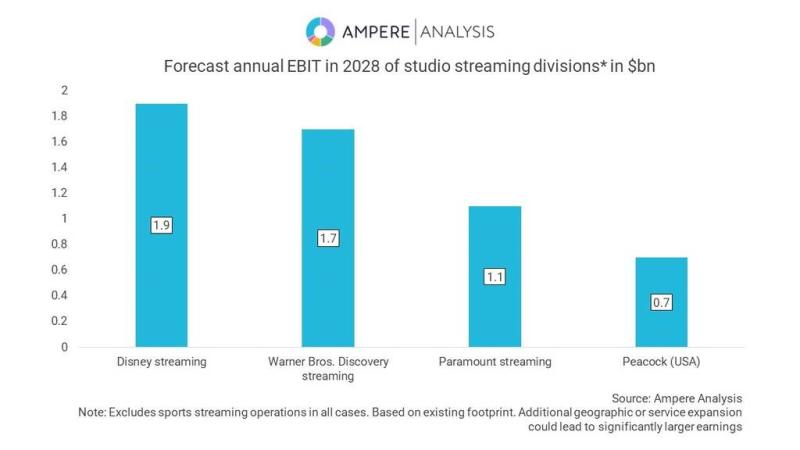

“Not only have all the major studio streamers now laid the groundwork for profitability…but they all also look likely to turn streaming direct into significant sources of profit,” wrote Ampere in its report. By 2028, Ampere expects studios will generate between $1 billion and $2 billion in annual EBIT from streaming businesses, based on their current market footprint – with further geographic expansion leading to even greater potential upside.

Alongside cost-cutting measures and spending pullbacks Ampere pointed to the embrace of ad-supported products as the second key factor in driving a shift toward profitability. It pegged advertising as a “wild card opportunity” that could generate significantly more growth than currently modeled.

As DTC streaming businesses don’t bleed money, Bisson also expects that media companies will be able to position them as complementary to theatrical releases and transactional and free TV – with those sectors, as a result, seeing a boost as well.

“The rationalization of streaming is already seeing renewed support among studios for the theatrical window and revisiting of the content licensing model,” wrote Bisson.

Major studios have made a more recent return to licensing content to Netflix as they look to generate cash, such as Disney and others, rather than keeping it only for their own platforms. Although as a recent New York Times article pointed out, media companies are still holding back from licensing their most popular content.

Still, not all analysts have positive projections for legacy media’s streaming ambitions.

LightShed says media companies streaming strategies need overhaul

Analysts at LightShed Partners put out a post this week that strongly questions the four companies’ approaches on the streaming front, saying “we are even more convinced today than 2018 that legacy media companies are making a mistake and all need to radically alter their streaming strategies.”

The firm noted that going into 2024, all four companies are taking the route of cutting content and marketing spending, raising prices, and extending the life of linear assets “for as long as possible and simply hope for the best.”

“All four are laser focused on eliminating streaming losses and shoring up balance sheets rather than growing the most robust and profitable long-term streaming business,” wrote analysts led by Richard Greenfield in a December 19 post.

LightShed shared prescriptions for streaming businesses of each media company, some of which it thinks should be shut down altogether – including Peacock. The firm noted operating losses for Peacock since launch will come in at more than $7.5 billion at the end of 2023, “with NO obvious path to Peacock ever paying back Comcast’s investment.” LightShed suggested Comcast could shift away from a focus on sports to make Peacock look more like Starz – or possibly merge it with both Starz and Showtime. They also advised the ad-supported version of Peacock could be revamped as a FAST service leaning on NBCU’s TV and film catalog.

For Disney, one piece of advice from the firm is to abandon plans for a flagship ESPN direct-to-consumer product and move prime ESPN+ content to a combined Hulu-Disney+ app.

“We believe Disney has to pick one streaming business to focus ALL of the company’s energy and resources; in turn, Disney should focus their efforts on the streaming platform where they have full control of the IP/content versus licensing sports rights from third-parties,” wrote the analysts.

As for Paramount, LightShed doesn’t see “how Paramount+ can earn a compelling payback on the billions of dollars that have already been invested” and would scale back the SVOD right away and reverse course on the integration of Showtime, among other steps. Ultimately the firm expects Paramount will be sold.

LightShed also doesn’t have a rosy view of WBD.

“With the accelerating collapse of linear TV, we simply do not believe Warner Bros. Discovery has the ability to become a leading global streaming competitor with enough scale to drive profitable growth,” the firm stated.

The analysts said WBD should rebrand the Max SVOD service as HBO and get rid of content that doesn’t fit the brand (meaning newly integrated assets such as Discovery content and CNN), while keeping Discovery+ as a standalone niche streaming service.

Finally, the firm doesn’t see M&A as the answer to media companies’ streaming struggles, as LightShed said it’s too late and companies are “not equipped talent-wise or strategy-wise” to build global streaming services on top of linear TV businesses facing growing headwinds. It also sees regulatory approval as a challenge.

“Legacy media companies simply do not have time to wait and hope for M&A as a strategy,” wrote Greenfield. “They must take action to alter their streaming strategies immediately or their stocks will continue to suffer.”