TiVo’s latest Video Trends Report shows that consumers are spending more time watching content but now tapping slightly fewer video sources to do so, alongside decreases in average spending on video services.

In TiVo’s report, respondents to a Q2 2023 survey of 4,518 adults in the U.S. and Canada reported using an average of 10.9 video services – up from 9.9 in Q2 2022 but down from 11.6 in Q4. TiVo found the average number of non-paid services was up slightly from Q4 to four while the number of paid services declined to 6.9.

When breaking out U.S. and Canadian consumers, Americans reported a significantly higher number of video services at an average of 12, compared to 7.1 on average for Canadians. The drop in video sources comes as consumers are also spending less on video. Average video spending declined almost $20 from last fall to $170.86 as of spring of 2023.

However, that doesn’t mean consumers are watching less content, as time spent viewing increased to 4.7 hours per day – up from 4.4 hours in Q4. TiVo noted considerable gains in AVOD/FAST and social video consumption, which was up 6% from Q4 and accounted for around 28% of viewing time. TiVo attributed the bump in part to major SVODs (such as Netflix and Disney+) introducing lower-cost ad-supported tiers that also drive advertising revenue. The AVOD/FAST category still followed behind SVOD, which accounted for nearly 31% - an increase of 4% since TiVo’s fourth quarter trends report. Those gains were largely at the expense of pay TV, which saw its share of viewing time spent decrease 7% since Q4 to account for just over 28%.

When it comes to the FAST category, Fox-owned Tubi outpaced Roku in Q2 to become the most commonly used service in North America, with those two followed by Paramount-owned Pluto TV and Amazon’s Freevee as other top services. According to TiVo, free live streaming TV or FAST channels now reach almost 50% viewership. And among the 27% of respondents with pay TV service that plan to cut the cord in the next six months over 21% said AVOD/FAST would be their alternate method for watching live TV (up 5% year over year), behind virtual MVPDs at 60% (a 2% yoy decline).

As for SVODs, more consumers reported having at least one SVOD service (88%), but churn continues to be an issue as 23% canceled an SVOD in the last six months. Netflix, Prime Video, Disney+ and Hulu still top the list as most commonly used SVODs, but TiVo noted NBCUniversal’s Peacock saw a significant jump from Q4, up 20% in Q2 2023.

Still 41% of respondents said there’s no room in their budget for additional services, which could drive consumers to free services or lower-cost ad-supported tiers.

Content still king, but discovery still a challenge

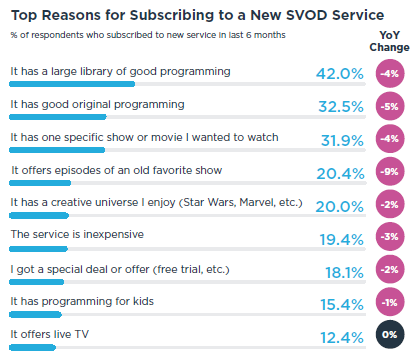

As SVODs look to attract subscribers that may have less wiggle room in their wallets, content remains the top reason consumers cited for subscribing to a new SVOD service, though ticked down since a year ago.

A large library of good programming was the top reason for subscribing to a new SVOD at 42% (though declined 4% year over year), followed by good original programming (32.5%) and one specific show or movie respondents wanted to watch (31.9%). Episodes of older favorite shows and creative universes or franchises were also in the top five.

However, finding content remains a struggle for consumers as only 18% of people said they always know what they want to watch when turning on the TV – meaning 82% browse before picking a show or movie. And there’s usually a decent amount of app switching to find something to watch, with 60% of respondents saying they go into more than one app in a typical viewing session and 46% using two or three apps. Less than a quarter of consumers reported using just one app in a typical viewing session.

This lends itself to earlier results from Nielsen’s Gracenote on the issue of choice fatigue among a wide range of content options. That study found consumers typically spend more than 10 minutes on average to try to find something to watch - with discovery challenges prompting 20% of viewers to ditch their TV session altogether when they weren’t sure what to watch and couldn’t find something from browsing.

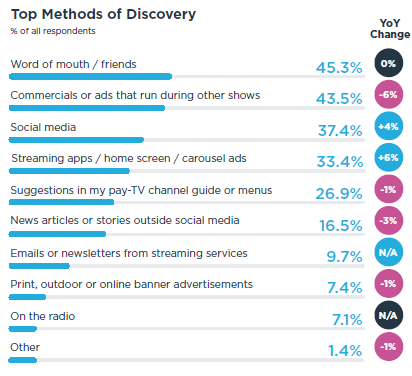

And although streaming services are working to make content discoverable on their respective platforms, word of mouth from friends remained the strongest method of finding new TV shows or movies, according to TiVo, at over 45% in Q2 2023. That outpaced commercials as a top content discovery method, which declined 6% year over year. Notably, streaming apps, home screen and carousel ads saw the biggest increase, getting a 6% boost yoy to 33.4% in Q2 2023. Smart TV makers such as Vizio are among those leveraging their device home screen as opportunities both for advertising and to promote content discovery.

“Consumers know what they want in a video service and are adjusting their entertainment habits to fit their needs – whether that be cancelling their SVOD subscriptions or reviving their cable,” said Scott Maddux, VP of global content strategy and business at TiVo-parent Xperi, in a statement. “As we continue to see this shift in consumer behavior it’s essential that entertainment providers focus on solving consumer content discovery issues to help consumers who are juggling their entertainment needs get back to what’s important, enjoying entertainment.”