Disney’s ESPN network is going direct-to-consumer, and CEO Bob Iger reaffirmed Wednesday that it’s “not a matter of if, but when,” as the company explores various potential strategic partners.

Disney and ESPN made headlines earlier this week when it inked an exclusive 10-year licensing deal with casino company Penn Entertainment, allowing it to use the ESPN branding to launch online sports betting brand ESPN Bet. Penn is operating the sports book and paying $1.5 billion to use ESPN’s name, marketing and talent, along with the option for ESPN to buy Penn stock. Disney believes there’s an opportunity to significantly grow engagement with ESPN viewers, via the Penn partnerships, particularly young consumers, Iger said this week.

On Disney’s quarterly earnings call Wednesday Iger also reiterated the inevitability of ESPN’s flagship linear channels going to DTC, saying “the team is hard at work looking at all components of this decision, including pricing and timing.”

There have been several earlier reports on the linear ESPN channels DTC move and how it could be approached, with Iger previously telling CNBC that the company was searching for a strategic partner in the shift to streaming, potentially offering an ownership stake. That includes reported early talks with leagues themselves as well as potential interest from tech and telecom players. It’s also been reported that ESPN wants to create a streaming sports hub as a destination for all live sports.

This week as Disney reported fiscal year 2023 Q3 results, Iger confirmed that the company is looking for strategic partnerships across distribution, technology, marketing, and content opportunities “where we retain control of ESPN,” citing notable interest “from many different entities.”

The chief executive also pointed out that ratings continue to climb on the main linear ESPN channel even with accelerated cord-cutting.

“This rating strength creates tremendous advertising potential across the board,” Iger said. “Our total domestic sports advertising revenue for linear and addressable is up 10% versus the prior year adjusted for comparability, which speaks to the fact that the sports business stands tall and remains a good value proposition.”

In Disney’s latest quarterly results domestic linear advertising was down year over year though ESPN-specific ad revenue grew by 4%. ESPN ad sales for the current quarter to date are pacing down, which executives attributed in part to the absence of Big Ten programming.

Overall Disney’s linear networks marked revenue declines in the quarter, dropping 7% year over year to $6.7 billion. Operating income also decreased by $580 million (or 23%) year over year to $1.9 billion, including declines in both cable and broadcast domestically.

However, it’s worth noting that streaming doesn’t bring the lucrative carriage fees that Disney receives from traditional distributors per subscriber for including ESPN in their cable or satellite lineup, even if those pay TV customers don’t watch the channel. But as cord-cutting continues that also means fewer linear subscribers and related revenue.

Iger during the call acknowledged that Disney “benefited greatly from the distribution support in the old business model from cable and satellite,” whereas DTC can be more of a go-it-alone play, but noting there could be opportunity for another party to help to that front. The company is “extremely encouraged” by the interest it’s had already, he said.

According to Iger, the strategic partnerships that Disney is looking to build and is in discussions over are aimed at: One, increasing the content ESPN offers, and two, potential distribution and marketing support.

“This is all being done with an eye toward the inevitability of taking the ESPN flagship over the top,” he said, keeping in mind how much content it needs to make the business successful, which will be tied to the pricing and how much distribution support it needs.

And while he thinks Disney already has the best hand in terms of content on ESPN, as it ultimately becomes a streaming business, “we believe that adding more content in under economical circumstances might be a wise thing,” Iger said.

On the streaming front ESPN+ (which offers only some of the live sports programming found on the linear network) saw subscribers remain relatively flat in the quarter, losing 100,000 subscribers for a base of 25.2 million. In the fiscal Q3 average revenue per user (ARPU) on ESPN+ declined 3% to $5.45, which Disney attributed to lower per-subscriber ad revenue and a higher mix of subscribers taking bundled offers.

Sports fans may come flocking – analyst

In an August 7 blog post ahead of Disney’s earnings analysts from Interpret Research noted that Disney is facing a challenge to bring ESPN back to profitability, with a strategic partnership and DTC streaming platform it hopes will address the issue.

“At the right price, sports fans may come flocking,” wrote the research firm.

Interpret thinks Disney’s approach to make the ESPN+ the hub for live sports would be welcomed for fans that have seen their teams and games become fragmented across services and platforms as various streamers pick up different rights.

The firm highlighted various strategic partners and potential suitors, such as Apple, Amazon, Google, Verizon, or potentially sports leagues themselves to have a hand or ownership stake – with different avenues offering benefits.

“With a tech or telecom partner, Disney hopes to boost its distribution and reach, while partnering with a sports league would help boost its content and perhaps keep its licensing fees down, leading to better profitability for its sports broadcasts,” wrote Interpret analysts.

With Apple TV+ adding live sports to its roster and Google’s YouTube TV scoring key NFL Sunday Ticket rights, Interpret said a partnership or even partial ownership of ESPN “would push Apple to the forefront of sports programming,” while a partnership would further establish YouTube’s position in sports.

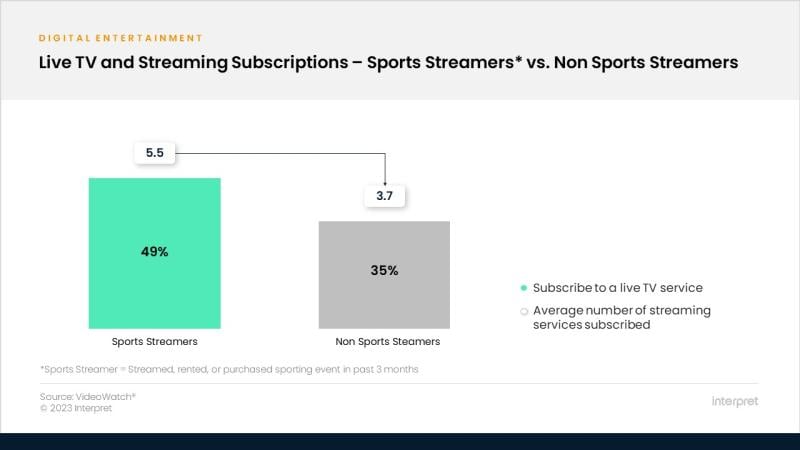

And sports fans are already leaning into streaming more heavily than others. Interpret’s VideoWatch data finds that sports fans streamers are more likely to subscribe to a live TV service (46%) than non-sports streamers (35%). Sports streamers also average more streaming subscriptions than their non-fan counterparts, at 5.5 and 3.7 services, respectively.