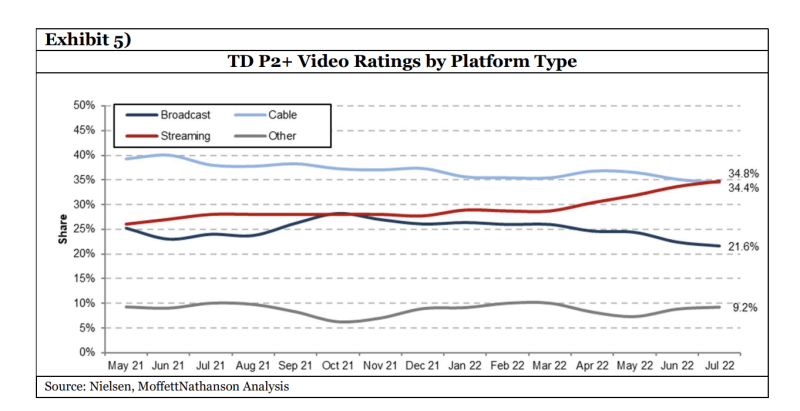

In July, streaming video consumption surpassed cable viewing for the first time, and the analysts at MoffettNathanson said today, “the Rubicon has been crossed.”

Cable views in July dropped from a 35.1% share of total TV views in June to 34.4% in July; whereas streaming jumped from 33.7% to 34.8% month to month.

“For years, conventional wisdom in media has held the opinion that the future belonged to streaming, wrote the analysts led by Michael Nathanson and Robert Fishman. “In July, that future finally arrived with streaming surpassing cable networks for the first time in Nielsen’s measurements of time spent by platform.”

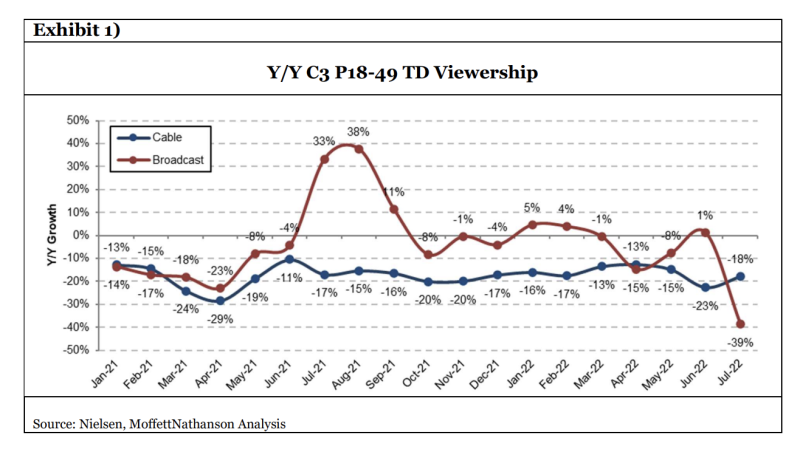

Aside from numbers that show cord-cutting reached new highs in the second quarter of 2022, the analysts said, “We believe that the market may be underestimating the structural declines in linear cable and broadcast network viewership which will pressure near-term advertising revenues.”

They noted that the July 2022 figures were up against tough comparisons from the previous year when the Tokyo Olympics aired and the NBA and NHL seasons ended later in the summer than usual because of Covid delays.

“More troubling to us is the fact that broadcast’s loss of key events wasn’t cable networks' gain, as viewers did not return to cable,” they said. “To wit, cable ratings in July 2022 fell -18% Y/Y, a continuation of the steady though rapid erosion of its viewership with no recovery in sight.”

Based on Nielsen data, the shares of the top streaming platforms remained relatively consistent from May 2021 to July 2022. Netflix commanded with a 23% share of streaming time; YouTube clocked in at 21%; Hulu at 10%; and Prime Video at 9%.

While cable viewership has been declining for a long time, Comcast and Charter are hedging their bets with streaming.

They’re gearing up to jointly launch a national streaming platform for smart TVs. For the JV, the companies will use Comcast’s Flex aggregated streaming platform and hardware. Customers of the new platform don’t need to be Charter or Comcast broadband subscribers.

Rick Howe, host of The Friday Fireside webcast, told Fierce Video earlier this summer that the JV could aggregate various streaming services and put them on Comcast’s Flex and “essentially, by doing that, create something that feels to the consumer a lot like cable TV with its multi-channel selections.”