NBC, FOX and Disney have the most desirable network families according to new research from The Diffusion Group (TDG).

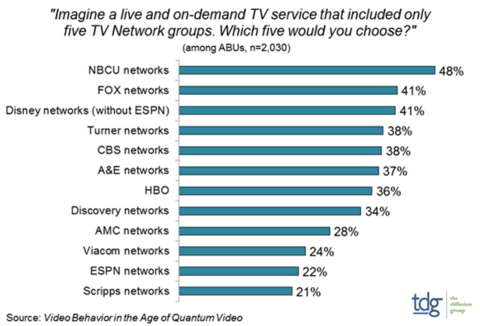

For its new national study, Video Viewing Behavior in the Age of Quantum Video, TDG surveyed 2,030 connected consumers about the five network families they most want in a five-group skinny TV plan. During the survey, TDG allowed respondents to see which channels were included in each network group before selecting. The Big Four broadcasters grabbed four of the top five spots, led by NCBU (selected by 48%), followed by Fox (41%), Disney/ABC (41%), and CBS (38%).

"Live Big Four broadcast viewing is diminishing, as with virtually every major network. This should not imply, however, that their death as brands or as major forces in consumer video is inevitable," said Michael Greeson, director of research at TDG, in a statement. "The value of their content is immense; top of mind for many viewers."

Turner tied CBS with 38%. And importantly, ESPN was not included with Disney but rather offered as a standalone family of networks. The fact that ESPN’s family of networks didn’t make the top ten in the survey led TDG to hypothesize that Disney made a wise decision in making the upcoming ESPN streaming service complementary to linear ESPN, and not overlapping.

"Many expected ESPN Plus to be the online equivalent of ESPN, but Disney decided that the risk of cannibalizing high-value linear pay TV subscriptions would create substantial channel conflict and hasten the declines in pay TV subscriptions. This risk is inherent in the DTC model and must be addressed group by group, even channel by channel,” Greeson said.

RELATED: ABC, CBS, Discovery most desirable a la carte channels, TiVo study says

TDG also said the survey results offer insight into the viability of a new vMVPD entrant Philo, which is populated by the channels of A&E, AMC, Discovery, and Viacom. A&E was selected by 37% of connected consumers, AMC by 28%, Viacom by 24%, and Scripps by 21%.

"The potential is there, but having to pay $16-$20/month for a TV service without the Big Four broadcasters and live sports may prove a bitter pill to swallow," Greeson said.