Paramount Global will again raise the price of its general entertainment streaming service, Paramount+, as it seeks to further capitalize on Paramount's vast content library and live sports deals, the company's top executive affirmed on Wednesday.

Speaking at the Goldman Sachs Communacopia & Technology Conference on Wednesday, Paramount CEO Bob Bakish said a recent price increase that followed the integration of Showtime content into Paramount+ resulted in lower subscriber churn than anticipated, which gave the company confidence that it has price elasticity in what has become a saturated streaming TV marketplace.

"The whole industry has been raising prices, and we just effectuated our first price increase, and it is very much performing according to plan," Bakish affirmed. "There was some question as to whether it would adversely affect churn in a significant way, in bringing down subscriber acquisition. And the fact of the matter is, we're not seeing that. So, that proves we have pricing power in the marketplace."

The price increase that went into effect in June saw the cost of the Paramount+ Essential tier increase by $1, with streamers paying $6 a month for shows and films from CBS, Paramount Pictures, MTV Networks and other Paramount-owned brands interspersed with a slate of original content that is exclusive to the service. Content from Paramount's multiplex movie network Showtime was incorporated into the streamer's commercial-free tier, which was renamed Paramount+ with Showtime, with the price of that plan going up by $2 to $12 a month (though some streamers who were paying for Showtime content through an earlier Paramount+ bundle deal actually saw their monthly price decrease as a result of the integration).

In addition to the streaming refresh and price increase, Paramount outlined plans to rebrand Showtime on cable and satellite to reflect the Paramount+ integration. That has yet to fully happen, though some Paramount+ content has been broadcast on Showtime since the streaming rebrand.

Bakish says there are still plans in place to bring the Paramount+ brand name to the Showtime channels on cable and satellite in the near future. On Wednesday, Bakish also revealed that subscribers to Showtime will eventually be able to use the cable or satellite credentials to log in to Paramount+, though he didn't say when this will happen and whether those credentials will get subscribers access to all Paramount+ content. Paramount stopped offering an online-only version of Showtime this past summer.

Bakish says company supports Charter’s push to modify pay TV model

Throughout the duration of his 45-minute appearance, Bakish emphasized the point that Paramount wants to reach TV consumers on whatever platform they use — whether that is traditional cable or streaming platforms, or some combination of the two.

The affirmation comes at a time when some cable platforms are resisting efforts from TV programmers to charge more for linear channels, while those same programmers increasingly move their premium content offerings to their own direct-to-consumer streaming platforms.

Such is the case with Charter Communications, which recently dropped around a dozen channels owned by the Walt Disney Company. The dispute has left around 15 million Spectrum TV subscribers unable to watch ESPN, FX, the Disney Channel, Freeform and some Disney-owned ABC stations for nearly a week.

As is typically the case, the dispute started when Disney asked for higher fees in exchange for its linear TV channels. Surprisingly, executives at Charter affirmed last Friday they were willing to pay Disney's "market rates" for programming, as long as Disney sweetened the deal by including free access to its ad-supported streaming services for Spectrum TV customers and the flexibility of moving certain channels to various low-cost TV packages.

Industry experts — and at least one Charter executive — say the dispute opens up a new front in the ongoing battle between cable and satellite distributors and the programmers who own the networks. During a conference call last week with shareholders and the media, Charter CEO Chris Winfrey said its negotiations with Disney will be reflected in future carriage deals with other programmers, including Comcast's NBC Universal, Paramount Global and Fox Corporation.

Asked for his thoughts on the situation, Bakish said on Wednesday that Paramount began to see the writing on the wall several years ago, and already embraces some of the ideas that Charter touts in its new approach to carriage deals.

Bakish affirmed Paramount's broadcast and cable channels are well-reflected in two new low-cost programming tiers introduced by Charter for its Spectrum TV customers, including one plan that lowers the price of service by dropping regional sports networks.

"We like that business," Bakish said. "That is a growing sector of the video ecosystem — the more-attractively-priced, skinnier entertainment bundle. It's really an entertainment-only bundle, and that's good."

Paramount was also one of the first companies to embrace the packaging of traditional pay television with streaming-only apps, something Bakish referred to as a "hard bundle," though Paramount has mostly employed the tactic overseas in order to spur Paramount+ adoptions. In Europe, Paramount has several deals with traditional cable and satellite platforms, including Comcast's Sky in the United Kingdom and France's Canal+.

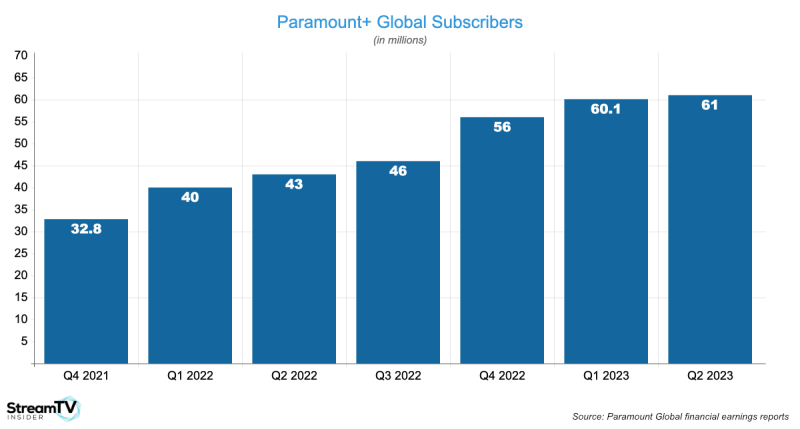

Those partnerships have helped grow the global subscriber base at Paramount+ to over 61 million, and while the average revenue per user (ARPU) can be lower in markets where Paramount focuses on hard bundles with cable providers in order to spur adoption, Bakish said some of the company's improved ARPU growth is in Western Europe, where such bundles are popular with providers and streamers alike, when compared to Paramount's direct-to-consumer businesses in Latin America, where the company is mostly growing its streaming business on its own.

"When we look at expansion beyond that, I believe partnerships will figure more prominently," Bakish said. "It enables a more-attractive economic expression, it reduces the need for local content, it reduces the need for local marketing, it reduces the need for custom platform expenses, and it really gets a powerful local partner engaged in driving the business."

In the domestic market, Paramount is looking toward partnerships of another kind — one where Paramount+ can serve as an added value to an existing offering that does not necessarily involve streaming. The company currently has partnerships with Walmart and T-Mobile, where customers receive free access (either through trials or complementary subscriptions) to the ad-supported tier of Paramount+. Earlier this year, Paramount announced a partnership with Delta Airlines that integrates Paramount+ into Delta's loyalty program, which allows passengers to stream content on most domestic flights.

While Paramount isn't necessarily moving toward hard bundles with cable TV partners, Bakish says the company still offers value to cable companies who are focusing more on their broadband Internet services. Paramount+ and Paramount's free streaming service, Pluto TV, are distributed on Internet-connected set-top boxes on most major cable providers. That includes Flex, a streaming TV device developed by Xumo, a joint venture between Comcast and Charter.

"It gives [cable providers] an incentive to transition and ride that migration of consumer behavior from a traditional set-top box linear [product] to broadband," Bakish said, implying cable customers who switch to broadband-only offerings from their service provider won't necessarily lose access to Paramount content, because it is offered over-the-top as well.

That content includes live sports, which some broadcasters are choosing to relegate to their linear channels on a near-exclusive basis. Bakish said Paramount doesn't see things the same way, with its live sports distributed across broadcast TV channels like CBS and streaming platforms like Paramount+ pretty evenly.

Sports rights

When asked if Paramount would pursue some of the major sports deals that are up for renewal, Bakish said he felt the company had a robust offering of sports programming with rights secured through 2030.

"We're actually at the point where our sports balance is right — we don't need to play in any more auctions, because they will continue to be frothy," Bakish said. "We're at the point where our sports properties are driving our linear business, driving our streaming business, and it's really more about driving entertainment and leveraging that."

Having a well-rounded product that incorporates live content, general entertainment and movies across traditional linear television, free streaming and premium over-the-top products helps differentiate Paramount from the rest, Bakish affirmed.

"It all starts with, do you have a compelling offer for consumers?" Bakish said. "And, the answer is, with Paramount Plus with Showtime, we do."