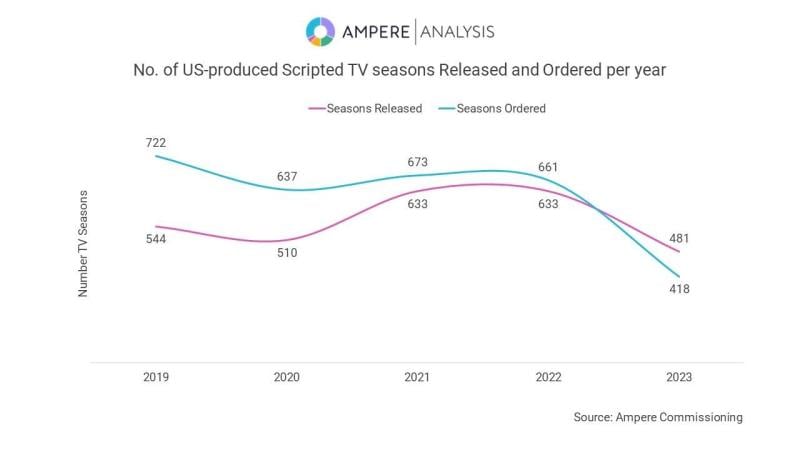

The era of Peak TV has ended, according to recent research from Ampere Analysis, as scripted series in 2023 — both released and ordered — took a steep tumble.

The published findings revealed that scripted US series releases fell to 481 in 2023 from a 633 crest point in both 2021 and 2022. The Hollywood writers’ and actors' strikes and a dip in the original content boom played a hand in the downswing, which still fell below the releases in 2020 (510) — a year plagued by a global pandemic. And the drop in releases was paired with an even sharper decline in ordered series — from 661 (2022) to 418 (2023).

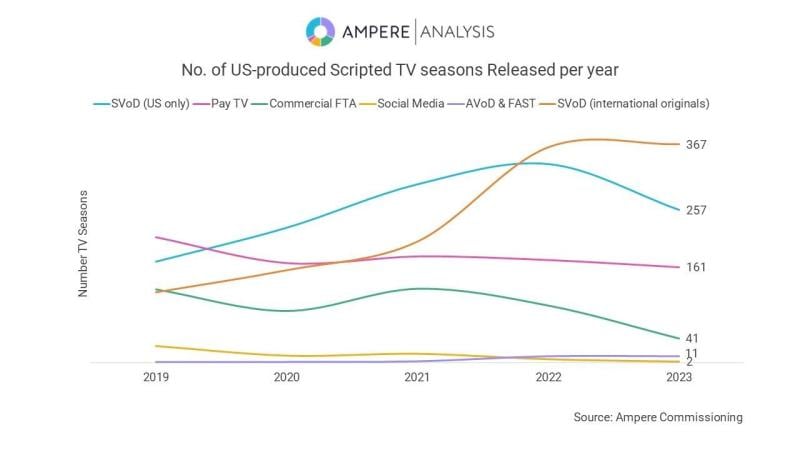

SVOD services represented the “more terminal decline,” as the firm stated. Netflix, for instance, dropped releases from 107 in 2022 to 68 in 2023 – with the drop starting before the strikes began. Peacock also dropped by 20 titles, followed by Hulu (-11), Max (-9) and Paramount+ (-4). Services from Apple, Disney+ and Amazon maintained the number of series released, but only Amazon maintained ordered series in 2023. Ampere Principal Analyst Fred Black noted to StreamTV Insider (STV) that Amazon maintaining output and orders was likely because the e-commerce giant doesn’t rely on its streaming service revenue the way many of its competitors do.

In addition, Black contended that the dwindling releases “has actually been a long time coming,” and the strikes were ultimately an accelerant to an already existing trend.

Sub-surface of the strike-tipped iceberg, one of the deeper root causes of these falling numbers was streamers’ switch away from pursuing subscriber growth to instead focus on profitability, Black said — a sentiment shared by another analyst at Aluma Insights.

“When you're trying to attract new subscribers, you need lots of fresh, exciting new content. And so you commission a lot of content hoping that you're going to get a hit,” Black explained. “But when you start to focus on profitability, then you start to question some of the checks that you're cutting.” He noted this shift is further reflected in Ampere’s finding that the volume of renewal content fell a lot less than first-run TV series.

Localizing of content

The firm’s research also found that US TV series commissions were outpaced by international commissions. At the top eight SVODs, there were 202 new US commissions (down from 349) and 295 international (down from 429) after the 2023 cutbacks — a relative disparity of 46%.

“The strikes are partly the cause but also conceal the broader story of internationalisation and the decentering of Hollywood as the core of the world’s TV industry.” stated Ampere in its analysis.

Black explained that viewers, both in the US and internationally continue to grow more receptive to non-US produced shows, encouraging localization of original content.

“Additionally to that, streaming services can also pursue increasing their original content in markets where subscriber numbers are still going up,” he said, adding that while subscriber numbers in the US have plateaued, in markets like South Korea or Poland, the numbers continue to rise.

Preparing for post-peak TV

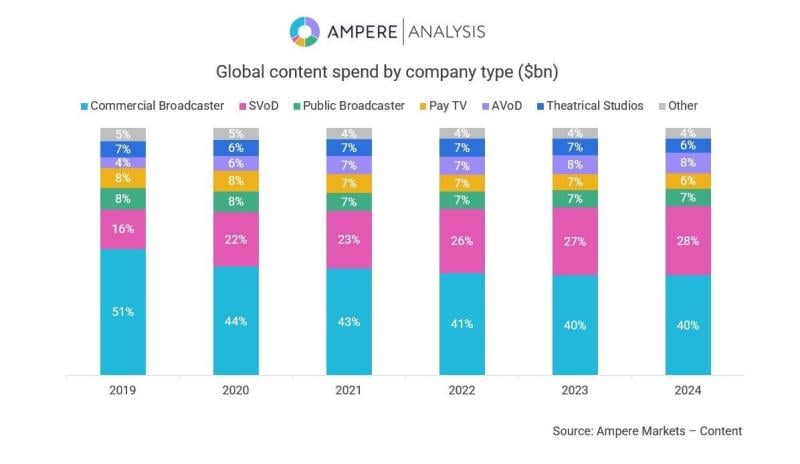

Ampere noted some possibility for a “temporary bounce” in seasons released on broadcast, and it predicts “a small recovery of 2%” for global content spend growth in 2024 to reach a total of $247 billion this year (aided by a 7% content spend increase from global streaming services). But ultimately, the firm foresees little release rebound this year.

And with Peak TV seemingly at an end, Black claimed that the year’s focus — particularly in the US — will be “subscriber retention while improving revenue.”

Many of the ways in which that will happen have already started, he observed. Some of these include rising subscription prices, more streaming services turning to ad-tiers and the subscriber growth of those tiers. Streamers have pushed this aspect of their services because they can make as much, if not more money when adding advertising subscription revenue compared to subscription revenue alone, he continued.

However, advertising can also add a layer of creative complexity to content production as well, as noted by a lead analyst at TVREV, Alan Wolk, in a column on STV. “When you’re making shows for subscribers, you have a lot of freedom as to where you can go creatively. When you need to convince brands to run ads against those shows, there’s a whole new set of criteria you have to be aware of,” wrote Wolk.

Along with advertising, streamers have also increasingly opened up to bundling, licensing content to other platforms, and integrating their libraries with platforms like Roku — all patterns Black believes will solidify over the next few years.

“Being content exclusive is becoming less of a key to your subscription services,” he said.

With the fatigue of content choices and discoverability challenges, cross-platform searchability continues to be a strong consumer priority. Black predicts that the industry will heed that demand and collaborate for better functionality across platforms, calling “the remaining barrier” a tech-based one.