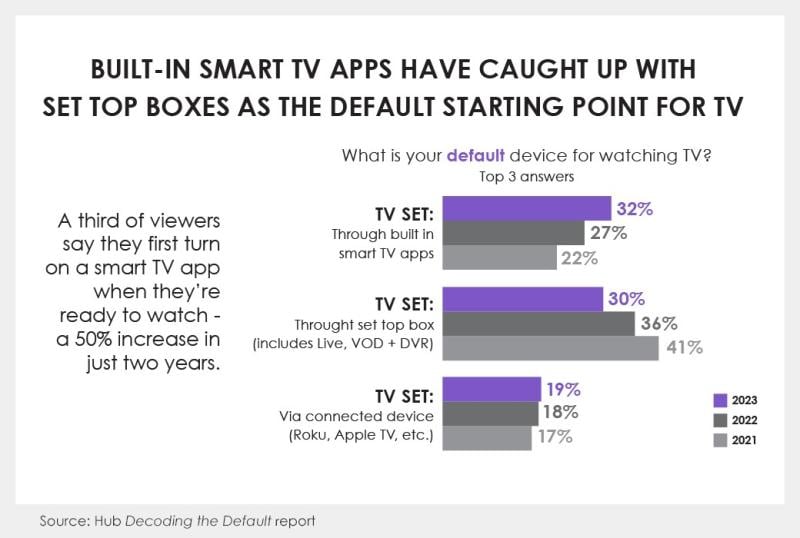

How consumers kickstart their TV viewing has changed quickly in the past two years, according to new data from Hub Entertainment Research. Built-in smart TV apps have rapidly gained favor as the default entry point for watching TV and now pace slightly above that of declining set-top boxes that are tied to traditional pay TV services.

According to Hub’s annual “Decoding the Default” study, around a third (32%) of viewers say they first turn on a smart TV app when they’re ready to watch video content – jumping 10 percentage points from the 22% that did so in 2021. The set-top box (including live, VOD and DVR) is still a jumping off point for many at 30%, but it represents a strong downtick from the 41% in 2021.

“Just two years ago, nearly twice as many viewers began at the set top box as those who started with a smart TV app. But now, they are essentially equal as default viewing options,” wrote Hub Entertainment in its analysis.

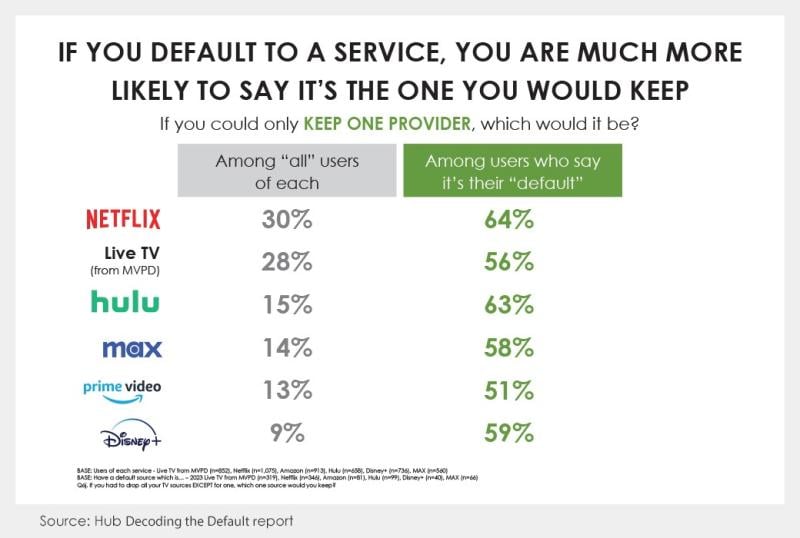

Hub’s analysis and findings also suggest that securing the spot as users’ default TV source is key, particularly when it comes to retention. When asked if they could only keep one provider or service, those that default to a particular source are significantly more likely to say it’s the one they would keep.

Separate research from GlobalData, released Wednesday, also finds that U.S. cable and satellite pay TV services are poised to see continued subscriber declines amid a continued shift to streaming services, further complicated by of a generation of younger viewers who may never take up traditional pay TV services in the first place.

According to the firm’s latest report, U.S. pay TV household penetration is expected to be 42% in 2023 – and while that’s still quite sizable, it reflects a stark decline from 2009-2010 when penetration was above 85% – and is anticipated to decline further to 32% in 2028. By 2025 total linear U.S. pay TV subscriptions are expected to fall below 50 million, per GlobalData, as AVOD, FAST, virtual MVPDs and SVODs win viewers’ attention. (It’s worth noting that GlobalData doesn’t include virtual MVPDs such as YouTube TV, Hulu Live TV, and Sling TV – which offer cable-like channel lineups in their live TV subscriptions but are delivered over the internet - in its pay TV figures.)

Impact of live TV and sports

Another factor to consider is the impact of live news and sports on viewers’ default TV source. According to Hub’s data, live programming, sports and news are the primary draws (45%) for those that opt to start TV from their MVPD set-top box.

And as Tammy Parker, principal analyst at GlobalData, noted separately, sports has been seen as a stalwart underpinning of traditional pay TV services, but that too is changing.

“Sports programming has been the chief redeeming feature for traditional pay-TV services, which is still true to a point, but streaming video providers are increasingly encroaching on that sacrosanct relationship, with certain live sports events having already migrated to streaming platforms,” Parker commented. “For example, viewers who want to watch NFL Thursday Night Football or Major League Soccer’s MLS Season Pass need to turn to Amazon Prime or Apple TV+, respectively. Disney’s expected launch of a standalone ESPN streaming service will further encourage a viewer exodus from traditional linear TV providers.”

Hub Entertainment Senior Consultant Mark Loughney also pointed to the shift of live TV and sports to streaming.

“With the trend toward more live news feeds and major sports offerings on streaming services, two of the primary drivers for viewers who default to the MVPD set-top box are being eroded,” Loughney commented in Hub’s recent findings.

However, in separate findings, despite projected global pay TV declines, Ampere Analysis sees cable and satellite platforms as remaining “a powerful force in the TV world, and important distribution partners for streaming products,” citing the recent Charter and Disney deal that includes DTC streaming services bundled with Charter TV packages.

“This package structure, already increasingly common in Europe and parts of Asia, offers a framework for traditional cable TV companies to transition their business into a streaming aggregation play, and stabilize subscriber trajectories,” said Ampere senior analyst Rory Gooderick in a statement.

Some, such as Charter and Comcast’s Xumo joint venture, are looking to bridge traditional linear and streaming viewing. This fall the JV introduced the Xumo Stream Box device that offers integrated search and discovery functionalities across pay TV and streaming apps and is the cable operator’s main video product going forward (earlier this year Charter execs said two-thirds of its video sales were already set-top box-less, as customers tap its Spectrum TV app instead).

And with set-top box favor and pay TV subscriptions both on the decline, it could also bode well for smart TV makers’ TVOS that house the built-in apps, where they can leverage those interfaces that are increasingly serving as the gateway to TV viewing to offer not only content options but lean into opportunities for advertising as well.

“As the smart TV menu becomes a primary destination for more viewers, the importance for providers to have their apps installed on TVs cannot be overstated,” Loughney commented.