New survey results from Hub Entertainment Research show that not only are more consumers tapping ad-supported streaming options, but those using streaming services with ads feel they get just as much value as those who subscribe to ad-free versions.

Hub’s TV Advertising: Fact vs. Fiction study found in Q2 2022 more than half (55%) of consumers said they use at least one free ad-supported streaming TV service (FAST) such as Pluto TV, The Roku Channel, Tubi, Amazon’s Freevee or the free version of Peacock. That’s an increase of nearly 10 percentage points compared to the fourth quarter of 2021 when it stood at 46%.

Consumers seeing value in FASTs was fairly high among all five services tested. The Roku Channel stood out with 84% saying they got “excellent” or “good” value from the service, followed by CBS (80%), Freevee (78%), Paramount’s Pluto TV (78%), Fox’s Tubi TV (77%), and Crackle rounding out the bunch with 67%.

Additionally, four in 10 subscribe to the lower cost tier of on an SVOD service with ads among Hulu, Discovery+, Paramount+, Peacock or HBO Max. The percentage, according to Hub, increased from 38% at the end of 2021 to 42% as of Q2 2022.

Meanwhile, the proportion of consumers that would prefer to pay around $4-$5 less per month for the tradeoff of watching ads has stayed relatively steady, according to Hub. In the latest study, 56% preferred cheaper subscriptions with ads, versus 44% who said they’d almost always pick an ad-free option even if it costs more.

Importantly, survey respondents subscribing to ad-supported tiers on those five services were largely in line with ad-free subscribers in feeling like they get “excellent” or “good” value from the service. Standouts were Warner Bros. Discovery’s Discovery+ and Paramount Global’s Paramount+, where subscribers with ads were 5 percentage points more likely (87% and 81% respectively) than ad-free subscribers (82% for Discovery + and 76% for Paramount+) to feel the services offered good or excellent value.

On the other hand, Hulu’s ad-free subscribers were 7 percentage points more likely (85%) than its ad-supported subscribers (78%) to feel that way. Disney will be launching an ad-supported tier of its Disney+ service on December 8, which executives have said will lean on learnings from success at Hulu. During second quarter earnings last week, Disney executives said they planned to take a conservative approach for ad load and frequency for the AVOD option.

Netflix is another major player preparing to launch a lower-cost subscription tier with ads. Netflix plans to launch in early 2023, and selected Microsoft as its technology and ad sales partner.

Interestingly, while Hulu and Discovery+ users were most likely to agree that they saw “a lot more” or “some more” ads on the service than others – but despite feeling there were more ads 63% (for each Hulu and Discovery+) felt the number of ads was reasonable. Around a quarter of respondents for each Discovery+ and Hulu felt the number of ads was unreasonable or too many – only slightly higher than those that felt the same for Paramount+ (24%) or Peacock (21%).

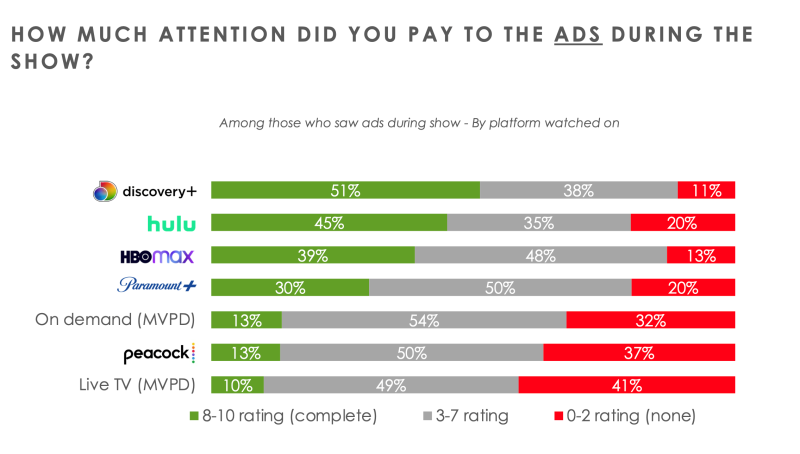

Also of note, Hub survey data found Discovery+ and Hulu subscribers were most likely to give a higher score in paying attention and completing an ad. Over half (51%) of recent Discovery+ viewers gave an 8-10 (on a scale of 0-10) rating for attention to ads, as did 45% of recent Hulu viewers. That compares just 13% giving top ad attention ratings on Peacock, less than a third (30%) on Paramount+ and 39% on HBO Max.

HBO Max just released a user interface revamp for desktop and mobile apps of the streaming service, which is set to combine with Discovery+ into one larger SVOD service. Warner Bros. Discovery has cited plans to launch the new offering in the summer of 2023.

And although viewers are paying more attention to ads on some platforms, Hub found there’s a threshold when it comes to ad load and length of commercial breaks. Once the number of ads in a 30-minute period reaches six, the proportion that feel the ad load was unreasonable starts to climb – going from 25% for five ads or fewer to 36% for 6-10 ads, and 46% feeling it was too much at 11 or more. A similar trend was seen for the length of a commercial break. Around half of consumers felt less than 30 seconds for an ad break was reasonable, but once they hit one minute, perceived unreasonableness climbs from 33%, to 41% for 90 seconds or more, and 48% for two minutes or more. Less than a quarter of survey respondents felt that two minutes or more of commercials is reasonable.

“Flashback to the late 2000s: take the rapid success of ad-free streaming services like Netflix, add in the gradual erosion of traditional pay TV subscribers, and many industry experts began to predict that ad-supported TV would go the way of the dinosaur,” said Peter Fondulas, principal at Hub and co-author of the study, in a statement.

“It turns out the issue consumers had with ad-supported platforms was not the fact that they included ads at all, but how the ads were delivered. With reasonable ad loads, more relevant targeting, and a quid-pro quo agreement (watch ads, pay less), the industry seems finally to have an answer to the question that has dogged it for years: how to get consumers to accept TV advertising,” he continued.