We can all agree that in the last decade plus streaming has completely changed the way viewers watch TV and the way advertisers reach those viewers. But even in the last 12 months, significant changes to the way subscription models of streaming TV and viewer access to more apps has further upended very entrenched advertising programs. With Disney+ and Netflix now in the advertising game, and with FAST apps proliferating, Connected TV (CTV) advertising is on an exponential growth track.

The TVision State of CTV report, which is produced every six months, gives us an opportunity to take a more holistic view of what is happening among streaming apps and CTV advertising. First let’s take a look at some high-level take-aways on the CTV landscape.

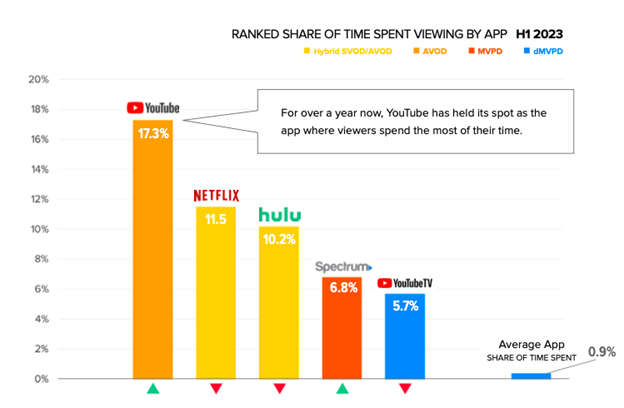

- Three major apps - Youtube, Netflix and Hulu - still lead share of time spent viewing. Among the first movers in delivering advanced video content, these three apps have been the leaders on this list for several years. These are the apps that viewers spend the most time watching.

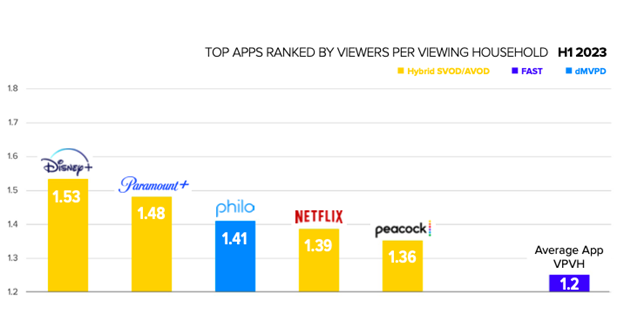

- Families still watch TV together - The apps with the highest Viewers per Viewing Household (VPVH) include Disney+ and Paramount+, which both lean heavily towards family-friendly content.

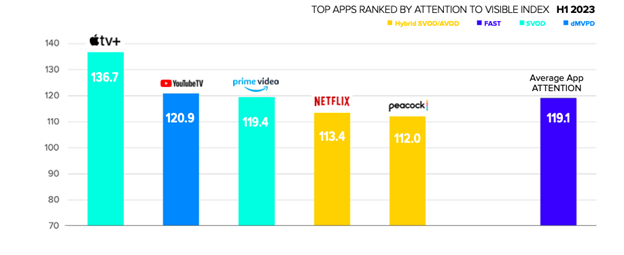

- High quality content captures more attention - AppleTV+ which is known for its high quality programming and investments in content leads the Attention Index in H1 2023, at 136.7. The subscription-only app also landed the top show on the TVision Power Score for the first half of the year - Ted Lasso, Season 3. The TVision Power Score factors in four key metrics: the amount of time viewers pay attention to the program, the amount of program time available for the season, the program’s reach, as well as the application’s reach. This combination of metrics was chosen to enable a neutral look at the quality of programming and its unique, inherent ability to draw in viewers — regardless of the scale of the platform, or the program’s release schedule.

Advertisers are increasing investments in CTV

Opportunities for CTV ad investments continue to increase, and advertisers are taking advantage. CTV ad spending still lags linear TV advertising more than it should, but brands have dramatically increased their CTV ad spending. Disney+ and Netflix are reporting increasing traction within their ad supported tiers, which delivers more opportunity to reach highly engaged audiences, and FAST apps continue to proliferate (even Ryan Reynolds has his own FAST channel). But there are challenges for advertisers to be aware of:

- CTV apps per household is down - While the number of available apps continues to proliferate panel data suggests that households are again getting choosy about which apps are on their TV screens. After pandemic-era vacillation, the number of streaming apps has stabilized at 6.7 apps per household.

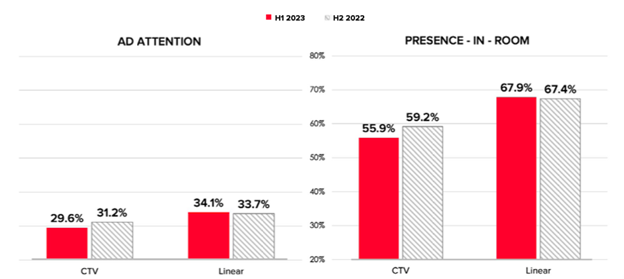

- With the increase in CTV advertising investment, viewer attention to CTV ads has fallen - A potentially troubling trend for advertisers is the fact that CTV ads historically deliver lower ad attention than linear. Moreso, CTV ad attention fell from 31.2% in H2 2022 to 29.6% in H1 2023. Presence-in-room, which measures if someone is in the room with the opportunity to pay attention to the ad, also fell in the same time period for CTV. This may be because many CTV apps give viewers a counter to know exactly how long an ad will run and therefore when they should return to the room.

What does this mean for the future of CTV?

As CTV advertising initially took off, buyers and sellers found an environment that was not quite linear TV and not exactly digital advertising either. To some degree initial CTV advertising had the limitations of both. Walled gardens created challenges to understanding household reach, and initial programmatic buying options made it hard to know where ads were running, and when. This lack of transparency increased the risk of wasted impressions.

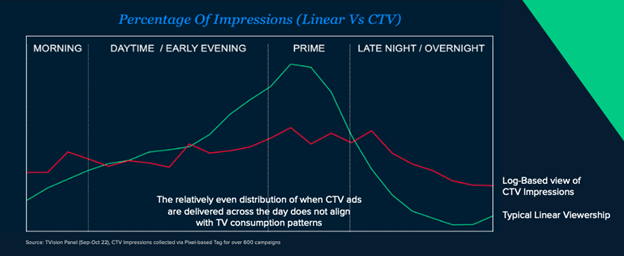

TVision data shows that CTV ads are generally delivered evenly across a 24-hour day and do not align with how viewers tune-in to CTV programming. In fact, 40% of CTV ads are delivered in lower value late-night, overnight, and morning dayparts, whereas only 20% of linear TV ads are delivered in these less-attentive time periods.

To combat the low attention numbers that advertisers are experiencing across CTV its necessary to incorporate attention measurement into CTV campaigns. When advertisers optimize for attention by focusing their investments towards apps and contents that deliver engaged audiences they are able to eliminate wasted CTV impressions and increase reach.

Yan is the CEO and Co-founder of TVision, the only company which measures how people really watch TV and CTV via a passive in home panel. TVision helps brands, their agencies, TV networks, and OTT platforms better understand how people really watch CTV so they can make more effective media decisions.

Yan founded TVision while earning his MBA at MIT. Prior to TVision, Yan started and managed Yo-ren, a leading digital marketing agency in China, and also worked at McKinsey in Tokyo. He has an MBA from the Massachusetts Institute of Technology (MIT), and a Bachelor of Industrial Engineering from the Tokyo Institute of Technology. He is an in-demand speaker, having appeared on stage at numerous industry events including Advertising Week, TV of Tomorrow, TV Week, as well as IAB, ANA and ARF events. Yan grew up in both Japan and China and currently resides with his family in New York.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by StreamTV Insider staff. They do not represent the opinions of StreamTV Inisder.