The number of free ad-supported streaming TV (FAST) channels and services has risen rapidly in the past few years, and FASTs are outpacing other modes of viewing when it comes to keeping consumers attentive, findings from separate Samsung and Vizio studies show.

Samsung Ads’ new industry report, Decoding FAST: A comprehensive guide to the Free Ad-Supported Streaming Landscape, found that the number of FAST services like Fox’s Tubi, Vizio’s WatchFree+, The Roku Channel, Paramount’s Pluto TV, and Samsung’s own Samsung TV Plus have tripled over the past four years. There were only six FAST players in the market in 2019 versus 18 by 2023. Samsung TV Plus alone saw consumption on the free ad-supported streaming TV service internally grow by 60% in the last year due to societal factors like economic pressures, the rising costs of streaming services, and market frustration with too many options.

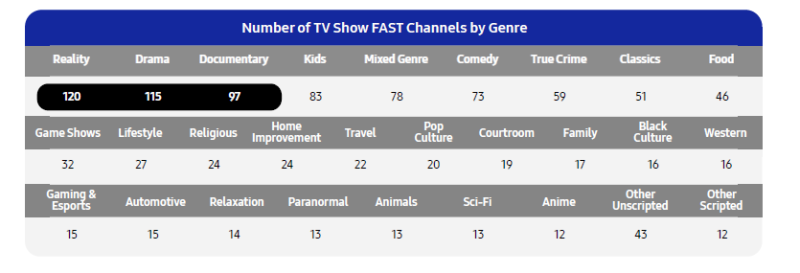

In fact, average users lounging on their sofa after work have a wide range of FAST channel options to wind down to, with local news or beloved reality TV shows proving to be especially popular. At least that’s what the numbers are saying. Over half of all U.S. FAST channels serve scripted and reality TV programming, with News & Opinion channels in second place for top genres. Within TV Show programming on FASTs, Reality TV is the most available offering with 120 channels exclusively dedicated to the genre across services, according to Samsung.

Separately, yesterday attention metrics provider Adelaide released additional research, commissioned by Vizio (which has its own FAST service) that FAST apps outperform the firm’s overall CTV attention benchmark scores by up to 25%, which means that FAST viewers are engaged and paying more attention to its content. Compared to traditional linear cable TV, that FAST outperformance figure climbs to 40%.

The report also acknowledged that CTV and linear TV tend to have stronger-than-average attention metrics when compared to other digital formats. The Adelaide CTV AU metric is built with opt-in eye tracking data from TVision, processed alongside attributed upper and lower-funnel outcomes.

“These findings disprove the narrative of inattention or lesser value in FAST environments,” said Devin Fallon, senior director of Media Insights & Analytics at Vizio, the owner of the WatchFree+ FAST, in a statement on Adelaide’s FAST audience attention scores in comparison to CTV and linear TV.

“As subscription fatigue sets in, viewers are increasingly augmenting their streaming bundles with free services, and this ensures advertisers that FAST environments can drive both upper and lower funnel ROI,” Fallon continued.

More and more, consumers are opting for content with ads that is free or low-cost as a tradeoff to save on subscription prices, with a few preferences.

TV shows dominate FAST channels, where reality reigns

According to Samsung’s report, in 2020 there were only 614 FAST channels across the overall market versus 1,926 in 2023. Of those channels, the top two formats are scripted and reality TV programming, and news. TV shows take the cake, with the format accounting for approximately 57% of U.S. FAST channels. And of that lion’s share, FAST channels are splitting legacy programming with modern shows.

Part of what’s tinted consumer openness to FAST content is the preconception that free channels only offer content that is too dated to be of interest. However, Samsung found that as of September 2023 more than one-third of the 340 single-IP FAST channels (or about 114) were based on shows or franchises that are still making new content and nearly 50% of all FAST channels with single-seires content are offering programming that originally aired in 2020.

That’s where comfort programming, like reality TV, steps in as a reigning category. According to Samsung, Reality TV is the top TV show genre with 120 channels, though closely followed by dramas with 115 channels.

Samsung also found that while kids content slides into fourth place for TV shows on FAST with 83 respective channels, there is still plenty of room to grow. On the movie side, there are only two FAST channels devoted to kids content.

Local news takes flights on FAST

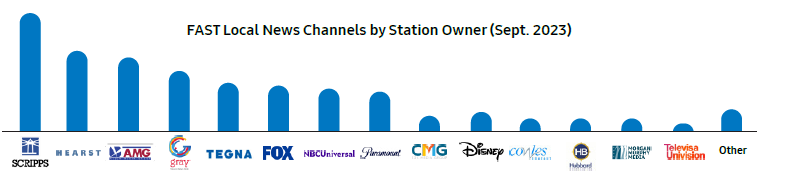

Though behind TV shows, News & Opinions channels have the second-most FAST offerings, making up 18% of the U.S. channel marketplace, or 333 individual channels, according to Samsung. Across the segment, local news is top-of-mind for users and there are 231 FAST channels devoted to live feeds across specific national markets. The closest segment behind local is International News with 51 channels.

suggesting that there’s still growth to come in FAST local news," stated Samsung in the report. (Source: FASTMaster/CRG Global Analysis for Samsung Ads)

Samsung’s Takashi Nakano, content & business development lead for Samsung TV Plus, previously told StreamTV insider that news, with both local and national stories, continues to do well on the FAST.

“It’s a high engagement vehicle for news programming, so FAST is definitely a place where people get their news,” he said last October.

Consumption of news content could be slated to increase dramatically in 2024 with elections occurring in dozens of countries around the world, including Mexico, Venezuela, Ukraine, and the U.K., along with a presidential election cycle in the United States.

Multilingual capabilities

FAST channels are proving to have more flexibility to tap into markets whose primary language isn’t English. One out of every five FAST channels are available in a foreign language—a massive jump in access to non-English language content for free.

According to Samsung, approximately 14.5% of FAST channels are in Spanish, or around 280 channels of Spanish-language content alone. Another 6.5% of channels are in a language besides Spanish, or about 125 channels.

There is even more room for multilingual expansion in coming years because of the consumer thirst for local news content, the Samsung report found.

Movies lag slightly behind

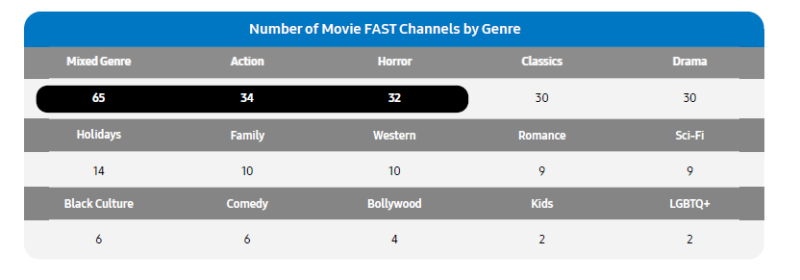

Behind the dominance of TV shows and news, Samsung found the third largest vertical for FAST channel formats was movies.

Research showed the most successful movie FAST channels are those that mix a variety of genres into one channel. Of blended movie channels, there are 65 in the FAST market. Beyond blended channels, genres like action, classic movies, drama, and horror are the most popular with users.

Still, while the growth of FAST has been rapid in the last several years, at least one analyst predicts content and user expansion could be poised to slow in 2024.

In a January 7 post, ScreenMedia analyst Colin Dixon wrote, “the FAST gold rush could be over as signs suggest viewers will slow adoption and content providers rationalize their investment.” Read more on Dixon’s view here.