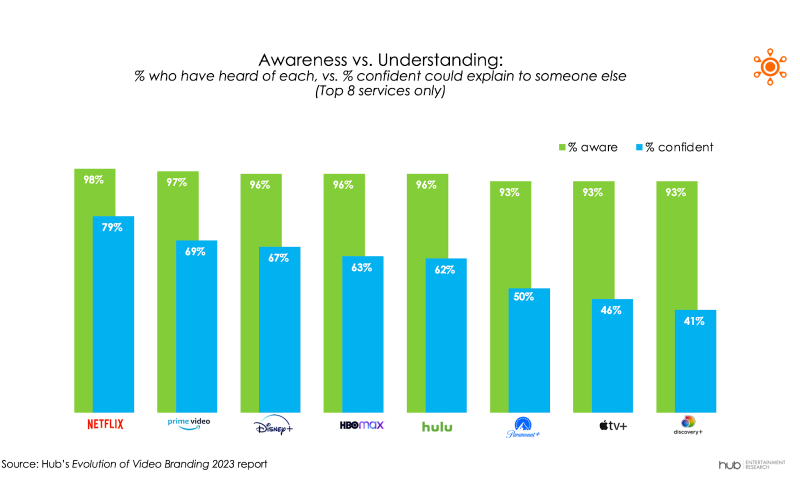

Given how crowded the streaming space has become, it’s unsurprising consumers are having a hard time telling apart one service from another, an issue highlighted by new data from Hub Entertainment Research.

Hub’s annual Evolution of Video Branding survey found while most consumers were aware of major streaming services, far fewer felt confident that they understood what each streamer is known for, or how it differs from other services.

Netflix had the lowest discrepancy between brand awareness and brand understanding, as nearly 80% of respondents felt they could explain how Netflix is different from other apps. Prime Video and Disney+ weren’t far behind, with brand understanding levels of 69% and 67%, respectively.

Awareness levels were high among all the major streamers, which Hub noted is “no small feat with such a crowded ecosystem.”

Interestingly, Apple TV+ (46%) fell on the lower end of the brand understanding spectrum. Though almost all respondents know about AppleTV+, Hub said fewer than half felt they understood the service’s value proposition. The firm's survey spanned 2,400 U.S. consumers – ages 16-74 – who watch at least one hour of TV per week.

Programming is one way consumers are differentiating streaming platforms, with 41% of viewers saying they signed up for a service to watch a particular show – up from 36% in 2022.

Consumers are especially drawn to franchises and existing IP. Asked which franchise-based show they were most likely to start watching, 40% of respondents said they would prefer a Marvel show. Other popular franchise choices included procedural crime dramas like “Law and Order” (39%), “CSI” (33%) and “NCIS” (33%).

Streamers are harnessing the value of franchises. Ampere Analysis found 64% of new scripted SVOD originals last year were based on adaptations, franchises and other forms of pre-existing IP.

“Viewers have not lacked in choice of services and content over the past few years. But this can be a two-edged sword for content providers, as the immense volume just makes it hard for viewers to remember what is different about each service,” said David Tice, Hub senior consultant and co-author of the study, in a statement. “But at the end of the day, content is king, and unique content will drive viewers even if the service itself isn’t unique to consumers.”

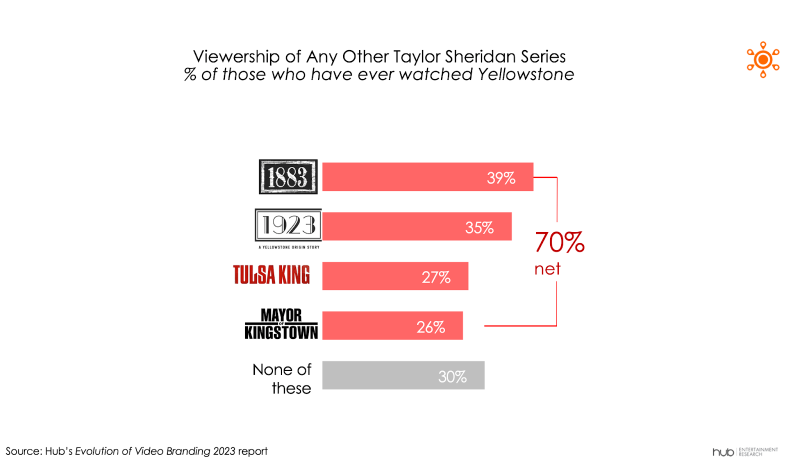

Hub’s study went on to say successful IP can form a discovery “chain” that generates new viewers, referring to the “Yellowstone” series as an example. Among the respondents who said they watched “Yellowstone” (29%), almost 70% watched at least one of Taylor Sheridan’s other shows, with “1883” being the most popular pick.

Perhaps the availability of these shows impacted the results, Hub commented. Due to existing streaming rights, “Yellowstone” is only available on Paramount’s cable network and Peacock. Whereas the remainder of Sheridan’s shows are all on Paramount+.