Oh, the wonderful world of FAST-live channels.

The acronym denoting free advertising-supported TV used to describe a bottom-feeding school of fish swimming quietly below much larger creatures in the media sea. Not anymore. FAST has since evolved into a growing pod of whales that number more than 1,700 channels through major platforms in the U.S. alone, according to the evolving count by One Touch Intelligence’s StreamTRAK service. With major studios and streamers launching FAST channels left and right, it’s clear this still chaotic but maturing part of the content industry has weaved its way permanently into the ecosystem. For better or worse. After all, one person’s symbiotic friend is another’s harmful parasite. And FAST channels, while largely complementary to the wider streaming industry, also disrupt an ecosystem already under assault from cord cutting, exploding streaming competition, and a persistent advertising slowdown.

Around this time last year, we looked at the then-burgeoning FAST marketplace that we cutely called “Fast & Curious” in homage to the movie franchise. And so, it’s fitting that our new “2 Fast 2 Curious” special report remains firmly on brand. Some highlights:

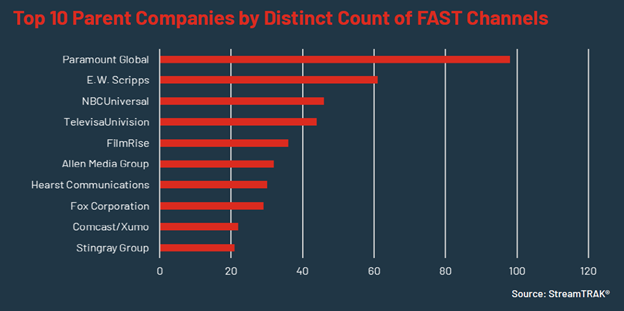

- Pluto TV owner Paramount Global touts the greatest number of FAST channels of the U.S.-based providers we track.

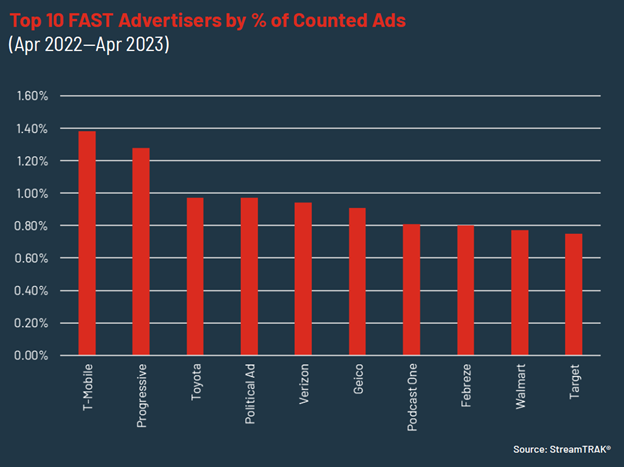

- T-Mobile, Progressive, and Toyota were the three top FAST channel advertisers from April 2022-April 2023, based on our representative audits.

- The most distributed FAST channels include an eclectic mix of Scripps News, Cheddar News, The Pet Collective, The Bob Ross Channel, and Nosey.

By analyzing OTI’s comprehensive FAST Channel Lineup table, we can see that the top 10 producers of FAST channels are a mix of major studios, broadcasters, and independents.

You’ll notice that not all major studios make the top 10, with Warner Bros. Discovery only recently pulling some titles from HBO Max (now Max) to test out FAST distribution through Amazon’s Freevee, The Roku Channel, and Fox’s Tubi. But it seems certain that WBD will soon exploit increasing amounts of IP either through licensing deals like the one it just inked with Netflix for HBO original “Insecure” (and probably soon others such as “The Pacific”) - or perhaps solely through FAST channels when it comes to much of its library, either exclusively as it rips titles off of Max or in non-exclusive fashion as it did with Netflix.

In another indication that the FAST space is maturing, major brands ranging from T-Mobile to Progressive to Toyota now rank among the biggest FAST advertisers. Political advertising is also gaining in strength, suggesting that the upcoming election cycle could bode well for FAST as campaigns fight for inventory with major brands that have already put more money than usual on reserve for the scatter market following this season’s more muted haul from the Upfronts and Newfronts.

Also interesting is the genre diversity across FAST channels, with many programmed around specific shows or iconic brands. StreamTRAK monitors eight FAST platforms: LG Channels, Peacock, Pluto TV, Samsung TV Plus, The Roku Channel, Tubi, Vizio WatchFree+, and Xumo Play. And we continue to find some surprising trends, including the strange mix of channels that represent the most distributed FASTs across platforms. So, while news content (Scripps News and Cheddar News) tops that list, others near the top include The Pet Collective featuring pet videos, The Bob Ross Channel (yes, the big-haired, big-hearted painter from PBS), and crime-themed Nosey. There’s no discernable pattern. And that’s apparently just how FAST likes it.

Despite a sometimes-choppy consumer experience, FAST remains a persistently vibrant media sector as consumers seek out free alternatives as inflation squeezes their pocketbooks. Meanwhile, FAST growth continues despite new ad-supported tiers saturating the marketplace from SVODs like Netflix, Disney+, and BET+, as well as AMC+ later this year. NBCUniversal’s recent announcement that it will launch nearly 50 new channels on Amazon’s Freevee and on Comcast’s own Xumo Play is just more evidence that the FAST train won’t be slowing down any time soon.

Of course, risks remain for FAST providers: Plex, which touts 425 channels, according to StreamTRAK, last month announced it would lay off 20% of its staff, with CEO Keith Valory acknowledging in a staff memo that “unfortunately, we cannot know how long ad markets and pricing will continue to be depressed and volatile." Will fractured audiences and more AVOD competition drive FAST CPMs so low that media companies start losing interest? Perhaps someday, but the supplemental revenue that studios and streamers can still make on FAST represents an alluring and steady temptation. At least for now.

(Click here to download a complimentary copy of our comprehensive 2 Fast 2 Curious report).

Michael Grebb is Vice President and Lead Analyst for One Touch Intelligence, which provides market intelligence and industry analysis services for leading companies in the media and telecommunications space. The One Touch Intelligence STREAMTRAK series is a complimentary service offering industry professionals insights and context around developments in the digital media sphere.

Industry Voices are opinion columns written by outside contributors — often industry experts or analysts — who are invited to the conversation by StreamTV Insider staff. They do not necessarily represent the opinions of StreamTV Insider.