Streaming providers worldwide saw video on demand (VOD) consumption decrease by an average of 9% in 2021, according to video intelligence company NPAW’s latest report. The downward trend signals an increase in competition among streaming services, as overall VOD content grows.

NPAW surveyed 110 industry members across six global regions. The data sample also compared streaming usage across different devices, with insights divided between VOD and linear TV content.

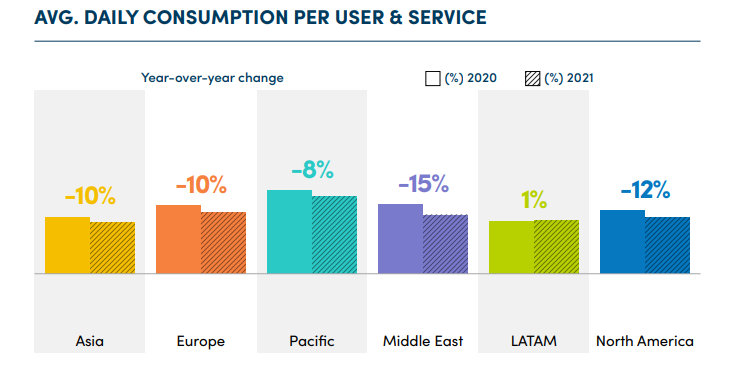

Viewer engagement, measured in average daily playtime per user, was down for all devices across almost all regions in 2021. Only Latin America saw a slight increase in daily consumption from 2020.

Individual services saw an overall decrease in their average effective playtime, as consumers divide their attention among different streaming providers. The average U.S. household uses an average of five different streaming devices.

Smartphones, despite having a global reach of 5.31 billion unique users, saw an 8% drop in VOD consumption. NPAW attributes that number to the competition streaming services face with other forms of mobile entertainment.

TVs and computers saw a higher average daily consumption per user, compared to that of handheld devices. TVs made up 41% of VOD device share in hours in Q4 2021, while ending with a 45% share in the same quarter for Linear TV.

Linear TV saw a 3% global increase in average effective playtime, mainly driven by Asia and North America. Average daily consumption per user went up in every region except Europe and the Middle East. Consumption of linear TV depends more on local preferences than VOD does, NPAW noted.

Average effective playtime per play, for VOD and linear TV, went up 12.3% and 23% respectively. Sports streaming played a key role in raising consumption and is likely to drive competition among providers in 2022. Amazon and Apple, for instance, are currently in a bidding war for the NFL Sunday Ticket, the winner will likely pay $2 billion annually for exclusive streaming access.