Under the traditional linear TV model, regional sports networks (RSNs) that deliver sports content to local markets were once the darling of the media industry. By their nature, sports fit the pacing and structure of live-linear video delivery, and RSNs provided MVPDs and advertisers the coveted demographic of 18-34-year-old males with disposable income. Even as consumers began shifting their viewing time and dollars away from traditional pay-TV to online viewing options, sports acted as a bulwark for MVPDs.

Parks Associates consumer survey reveals 40% of US pay-TV subscribers said sports content would be "very difficult" to give up, second only to local broadcast content. For that reason, MVPDs were willing to pay high carriage fees to carry these networks, sometimes over $6.00 per subscriber. However, several factors make the traditional RSN model increasingly untenable such as shifting demographics, high carriage prices, and declining advertising dollars.

There are four leading players in today's landscape and a handful of regional players in the RSN space. Sinclair Broadcast Group owns and operates 21 RSNs, acquired from Disney and Fox. Sinclair recently rebranded them in partnership with Bally Sports, a sports wagering service. Other players include NBC Sports, AT&T Sports Networks, Charter Communication, and several independent RSNs.

Sinclair Broadcast Group, the largest RSN operator, bet on RSN's in 2019, and it has been in the red ever since. RSNs pay enormous rights fees to teams and need to charge MVPDs high carriage fees to recoup those costs. Many MVPDs are not willing to pay the high price to carry the niche RSNs. In 2022 THE YES NETWORK is expected to boost its average monthly subscription fee to $7.27 per household, a 12% hike from the $6.49 the network booked in 2019. It is yet to be seen if traditional cable operators will protest the high cost or give in to satisfy their customers.

Sinclair is actively evaluating strategies to solve its cash flow problem. In a recent internal presentation, the Sinclair executive team plans to launch a streaming effort called "' Project Active,' built around 'gamification,' 'sports betting,' and 'community engagement.' The offering would have multiple tiers, from a free, ad-supported tier featuring highlights to a full-suite offering with live games untethered from the pay-tv ecosystem.'" Sinclair's President and Chief Executive Officer, Chris Ripley, in a Reuters article, said, "If you're interested in gaming, we're going to add on extra stats, the ability to do prop bets in the game, pitch by pitch, play by play…You can play along and wager while you watch." A direct-to-consumer streaming service with betting and highlights could be a path to turn a profit for Sinclair.

Yet, Sinclair's ability to offer such features is in dispute. MLB Commissioner Rob Manfred said he does not believe Sinclair has secured the appropriate digital rights from the 14 MLB clubs it has licensing agreements with to pull off such an enterprise. "The other set of rights they've talked a lot about is gambling rights; they don't have those either," Manfred said, speaking at the CAA World Congress of Sports event in New York, an event covered by Sports Business Journal John Ourand.

Ripley addressed the recent chatter regarding the direct-to-consumer initiative during the company's third-quarter earnings call on November 3, 2021. “On the MLB front, Sinclair has renewed its exclusive local rights agreement with the Detroit Tigers, which includes direct-to-consumer and other digital rights.” He went on to mention that the “discussions continue with other leagues including NBA and NHL regarding the structure of a direct-to-consumer product.” Chris Ripley noted that “the evolution of viewing habits makes it imperative that our current product be extended so that it is attractive to all viewers in a team's territory who can subscribe to it, through traditional MVPDs or through direct to consumers.” He also mentioned they will continue to negotiate in good faith with all interested parties to make a direct-to-consumer business a reality. Furthermore, adding they continue to engage in discussions with stakeholders around funding the direct-to-consumer business. Sinclair noted that the plan is to roll out a direct-to-consumer streaming service by opening day in Major League Baseball 2022, a mere 5 months away in April.

For Sinclair, a path to survival will require renegotiating all of its current rights deals to include streaming. Sinclair has the content and the sports wagering component that fans want in its partnership with Ballys. However, it appears what Sinclair lacks is the right to stream the product to where its target demo is consuming sports content. This is a poor position for a broadcaster that owns most of the regional sports networks. Unfortunately, Sinclair is not the only RSN facing this profitability dilemma, but it stands to lose the most without a streaming path forward with the most skin in the game.

Recent moves from Fanatics point to an alternative model forward for RSNs. Fanatics is an $18 billion American e-commerce retailer of licensed sportswear, sports equipment, and merchandise. The company has raised more than $325 million in capital from investors like JAY-Z, Silver Lake, and Major League Baseball. According to the Wall Street Journal, the company plans to use the new capital to transform itself into a digital platform. Fanatics hopes to create multiple related businesses, including ticketing, sports betting, and media. For an e-commerce business, that is a lot of expansion initiatives. Fanatics has a solid customer base and creates and sells personalized team fandom. It owns data on anyone who has ever bought a hat, a t-shirt, or a bumper sticker from its site. Plus, a percentage of the recent 325-million-dollar investment in its business is from sports rights holders interested in the success of their team's RSNs.

If Fanatics were to own RSNs and offer a digital subscription direct to consumers, fans could watch their team, place bets, buy tickets and buy a championship pennant to hang in their office all in one place. Still, for Fanatics to succeed in the RSN media space, it needs to build the other businesses first. Selling sports tickets, offering sports betting, and negotiating streaming rights with Fanatics' current investors may be the secret sauce that the RSNs are missing to gain profitability.

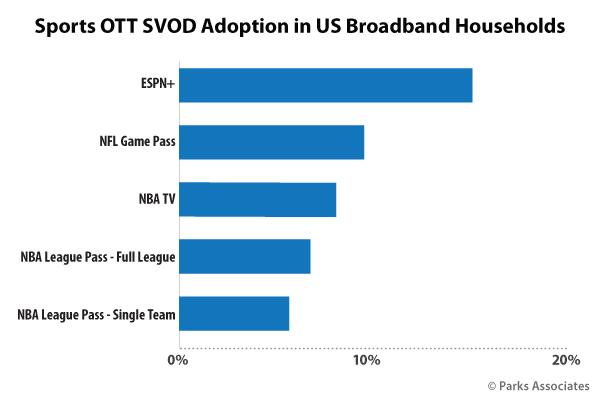

Ultimately, any path forward for RSNs will likely require streaming rights and multiple revenue streams. For the RSN ecosystem to survive, the rights holders (leagues and teams) and rights distributors (RSNs) will need to see a financial benefit to their bottom lines via multiple streaming services. RSNs need to keep their existing partnerships with traditional pay-TV providers, add direct-to-consumer streaming (SVOD), and maximize as much Virtual Multichannel Video Programming Distributors (vMVPD) revenue as possible. Merchandise, ticket sales, and sports betting are all enhancements to the product. Still, they will not keep the RSNs in business if the target demographic are streamers and they are stuck in a traditional pay-TV business model.

This research is part of Parks Associates OTT Market Tracker Services. If you would like to track market trends and in-depth analysis of OTT video service providers in the US and Canada, please contact [email protected] or visit www.parksassocates.com

Eric Sorensen is an accomplished sports and news media executive with extensive knowledge in developing live streaming and D\digital Media strategies. Diverse background includes; business management, product development, digital ad sales, videogame development, social content strategies, sponsorship development, and TV production. Eric spent over 15 years at ESPN helping pioneer the launch of WatchESPN, The Longhorn Network, and SEC digital network. Prior to joining Parks Associates, Eric served as director of advertising and digital and social content for the Houston Astros.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce Video staff. They do not represent the opinions of Fierce Video.