As smart TVs become the default platform through which consumers access video content, the number of standalone streaming devices will decrease. Consumers are increasingly interested in having all of their entertainment available on a single device, as seen by the data on device sales. Revenue from Roku's hardware (players) division fell by 26% year on year to $97.4 million in the third quarter of 2021, according to the company. Smart TVs have become more affordable in recent years, have vastly improved their user interfaces, and do not require additional peripheral setup. A smart TV is an easier, more accessible streaming solution than a separate device for many consumers, if for no other reason that it eliminates the consumer's burden of navigating HDMI ports, inputs, and wires. Smart TVs have become the streaming device of choice for most consumers. As a result, Roku, Google, Amazon, and Comcast are all competing in the smart TV platform market, and Amazon and Comcast also entered the smart TV market in late 2021.

Smart TVs are viewed as must-have devices by an increasing number of US homes, and they are the only streaming video product category to have risen in adoption continuously throughout the pandemic. Households in the United States today possess a broad range of connected devices capable of showing video, but there is a clear pattern of devices preferred for video consumption. According to Parks Associates, smart TV adoption in broadband homes remained consistent in 2021 at around 55 to 56%, while streaming media players lost ground in the third quarter of 2021. We will continue to see this trend in 2022 and beyond.

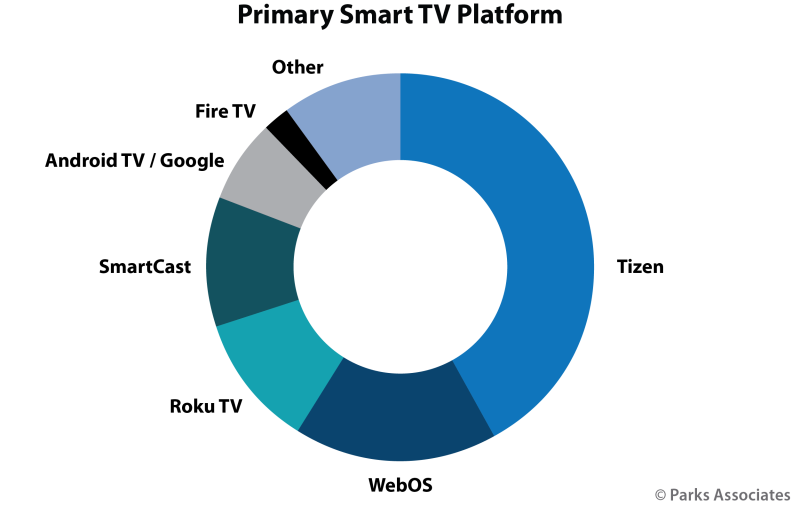

Due to the company's strong position in the smart television market, Samsung's Tizen smart TV platform is among the most widely used connected entertainment platform in broadband households in the United States, at par with Roku. In Q3 of 2021, 27% of broadband subscribers reported that Samsung Tizen Smart TV was their primary device for consuming video content. Amazon has expanded into the smart television market as well with two product lines: the Fire TV Omni Series and the Fire TV 4-Series. Amazon’s performance in the highly competitive TV market will be a major competitive factor to watch in 2022.

Consumers’ preferred usage of devices to consume different types of OTT services, confirms the significant role that smart TVs have taken in household content consumption. Parks Associates research finds that smart TVs are the top device in terms of usage and are also the platform with the most balanced jack-of-all-trades usage of the top devices. Between service provider viewing, SVOD and AVOD, smart TVs are seeing broader universal acceptance as a viable consumption device for all mainstream OTT service types, compared to other streaming video devices in the home.

From the industry perspective, the intersection of the smart TV with advertising and measurement capabilities is the topic of the day. This comes at a time when the TV advertising and measurement landscape is at a crossroads and undergoing significant change. Underscored by traditional decades-dominant heavyweight Nielsen’s significant challenges of late and recent rumors of its potential sale, the transition of TV viewership towards streaming has upended the former status quo. This transition has rapidly created opportunities for newer streaming-savvy advertising and measurement players – including smart TV platform owners.

Smart TVs have become the main device in households where linear and streaming video consumption are taking place, along with gaming. They are thus the single point of interaction for all of the major types of visual home entertainment consumption. This convergence of different forms of entertainment content consumption, the capability to collect valuable user data, and IP-based addressability has not been lost on either TV manufacturers or advertisers. Many major smart TV platforms have integrated Automatic Content Recognition (ACR) technology to support their own advertising and measurement businesses, and the technology can track various types of video usage - including broadcast, OTT, gaming, and advertising.

Today, all the companies behind the major US smart TV platforms have advertising and/or measurement businesses that utilize their smart TV platform footprint. This data-driven revenue stream is now a fixture of the total smart TV revenue model for platform owners. For the advertising industry and marketers, spending on smart TV advertising is growing quickly. When it comes to advertising and audience measurement on smart TVs, the balance of power today has shifted towards the platform owners. Those that control the hardware and/or platform are best placed to implement per-device-level data collection, analytics, audience measurement, and ad insertion.

In summary, the smart TV is now the most important video consumption device in US households for a variety of reasons. Not only is it consumers’ most-adopted video device and their most favored as the primary device for watching video, it’s also the device best able to collect data on consumers’ combined entertainment consumption behavior and serve them targeted advertising. The companies controlling the smart TV platforms in use today are thus in control of the most significant point of entertainment aggregation in the home, and one that that they can also leverage as a significant source of long-term recurring revenue via the value of the data collected.

Visit www.parksassociates.com to learn more about changing consumer preferences for streaming devices, as well as the implications for streaming video services and advertisers and the use and competitiveness of streaming video platforms.

Join us at our upcoming executive conference, CONNECTIONS: The Premier Connected Home Conference. This in-person event will take place at the Omni Hotel in Frisco, Texas May 17-19, 2022 and will cover smart home devices, home systems, privacy and security, broadband services and so much more.

Paul Erickson is a senior analyst at Parks Associates with more than 20 years of technology industry experience. Erickson’s coverage has spanned connected consumer electronics, pay & broadcast TV, digital & physical media, streaming devices and services, home and pro AV, smart home, user interface technologies and digital rights management.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce Video staff. They do not represent the opinions of Fierce Video.